Daily Finance and Company News

Celebrating 30 Years of Financial Education

I decided to buy a home because I wanted to settle down with my family.

In order for me to get a new house, I needed to pay off all my debt.

Where we were renting, it kept increasing.

It was challenging to get an organization to lend you the money.

We still had this mortgage payment that was going up and up.

Our appointment was really low, so my goals were piling up on top of each other.

All roads led eventually to Consolidated Credit.

One of my neighbors told me about Consolidated Credit.

I heard about Consolidated Credit through email.

First time home buyers, this is a very important support that you can get in this process. You know, it can be traumatizing sometimes.

I really like that they had different people coming in from different areas.

Every time I called, I felt the warmness over the phone, that they were my personal team.

Without the class, I don’t know if we have this house right now.

After I finished my debt management program and the house counseling, my credit score went up to 790.

I know this is ours, and that is a great and wonderful comfort.

I would definitely recommend Consolidated Credit.

I want to thank Consolidated Credit and the team for everything. They reached out and did for me.

We come to work every day because nothing feels better than helping people lead better lives. But we couldn’t do any of that without our partners. Simply put, they help us help millions.

Consolidated Credit is one of our great partners who comes in and not only teaches financial education and literacy to our students, but also to their parents.

Everybody is very appreciative and found this boot camp to be worth their time. And it’s certainly worth our effort and we’re just so eager to have them.

It’s great to have a partner in the community that we can refer them to.

Consolidated Credit has been a long time supporter and partner of Junior Achievement of South Florida.

We look for someone who has a great reputation in the community and is actively involved in financial education that we can partner with all of our similar programs.

We’re so incredibly grateful to Consolidated Credit for their assistance and support; not just financially, but every year they come and bring toiletries and food, and just so many things that help us respond to the challenges that people in our community are facing.

This partnership with Consolidated Credit Solutions: we’re changing lives, we are building intergenerational wealth, and we are building financial independence for the families that we serve. Thank you Consolidated Credit Solutions for this amazing partnership with Habitat for Humanity.

You folks do a phenomenal job, and it’s so important to educate everybody, plus our men and women that serve our country.

The more financial literacy you have among a city, the better your city is going to be, so we appreciate having Consolidated Credit in our city.

KOFE is a financial wellness program that has different features. The online website features a portal that we give to a corporation to put on their internet. Employees will have access to a lot of different tools, as well as a dedicated toll-free line so the employees will have access throughout the year to unlimited and free financial coaching.

Employers are noticing that nowadays employees are not only finding themselves with health issues but also having a lot of problems with their personal finances. They’re also finding that personal finances are affecting the bottom line of the company, so employers are reaching out to Consolidated Credit more and more looking for that corporate financial wellness program that it can add to the mix of offerings they have in their wellness initiatives.

We’re here to educate, and inspire, and meet you where you are.

Estamos aquí para educar e inspirar. Y llegar hasta donde tú estas.

We’re counselors, and we’re committed to helping people who need it the most and to make the debt-free journey as easy as possible.

Somos consejeros.Comprometidas a ayudar a quien más lo necesite. Y para que el camino para liberarse de las deudas sea lo más fácil posible.

We get people on the road to financial stability and on the road to home ownership. We’re even there at an eviction foreclosure and during overwhelming debt.

Guiamos a la comunidad para alcanzar la estabilidad financiera. Y a lograr obtener vivienda propia, lejos de deudas asfixiantes, embargos o desalojos.

We’re the guiding light to financial freedom. We’re here to be a good partner to solve problems and do what’s best for our mutual clients.

Somos una guía para la libertad financiera. Estamos aquí para hacer un mejor equipo. Para solucionar los problemas y hacer lo mejor por nuestros clientes.

[Speech in multiple languages]

We’ve been doing this for 30 years. We’re committed to providing financial literacy education across the country. We will keep advocating for those who need help and working with financial institutions to provide the best possible outcomes.

We stand ready for the challenges that the next 30 years will bring.

We are Consolidated Credit!

-

Now PlayingCelebrating 30 Years of Financial Education

-

Up NextConsolidated Credit Leads Successful Homebuyer Course with Habitat for Humanity

-

Homeownership: Your Path to Security & Stability

-

Advocating Financial Education: Consolidated Credit’s Annual Financial Literacy Breakfast

-

Consolidated Credit’s 4th Annual Business $ense Seminar

-

Feels Like the First Time HOMEBUYER FAIR

-

Hear from Consolidated Credit's Partners in Financial Education

-

Our History of Credit Counseling and Financial Education

Spring Clean Your Finances for Financial Literacy Month

Money management is a skill — and like any other skill, it requires learning, training, and practice. “Now more than…

March is National Credit Education Month

1 in 10 Americans don't know their credit score and twice as many people don't know how to find it.…

Valentine’s Day Spending 2024

How much does the average American spend on Valentine’s Day? Only about 1 out of every 2 Americans plan on…

Data Privacy Day: A Reminder to Protect Your Personal Data

Sunday, January 28th, 2024 is Data Privacy Day, an annual international event created to raise awareness about online privacy and…

Set the Right Plan to Pay Off Holiday Debt

How to start the New Year on the right financial foot. It’s all too easy to overspend during the holidays.…

Kickstart Your New Year’s Money Resolutions!

If you’re like most people, this time of year probably has you considering your New Year’s resolutions. One of the…

The Biggest Holiday Spenders Have a Surprising Amount of Credit Card Debt

English speakers 4x more likely to spend over $1,000 on the holidays than Spanish speakers. English and Spanish-speaking Americans have…

Habitat for Humanity and Consolidated Credit: Building Homes and Wealth

In a first-time partnership, Consolidated Credit works with Habitat for Humanity to provide financial education to 25 soon-to-be homeowners.

The Student Loan Crisis Is Worse than You Think

Payments resume in October, but Consolidated Credit warns: “Student loans are part of a bigger problem.” In a few days,…

It’s Time for Your 2023 Fall Financial Checkup

8 Financial things to do before the end of the year The weather is getting cooler but prices on consumer…

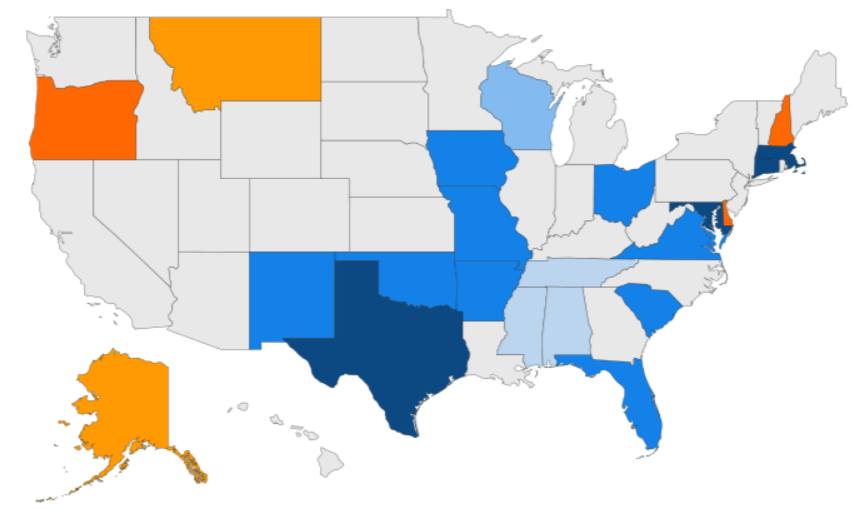

Find Your State’s Tax-Free Weekend for Back to School Savings

Tax-free weekends for back-to-school can help you save. Attention all parents and students who are looking to save— back-to-school tax-free…

Consolidated Credit Partners with Nova Southeastern University for First-Ever “Housing Summit”

On May 20, Floridians can learn the homebuying process for free from industry specialists. Consolidated Credit’s annual housing fair has…

America Saves Week 2023

America Saves encourages you to save money with a goal in mind. It’s America Saves Week—a week dedicated to helping…

4 Tips to Prevent Tax ID Theft

Take these four steps to help protect your tax refund this year. What is tax ID theft? Tax identity theft…

Consolidated Credit Celebrates 30 Years of Financial Literacy

Financial Literacy Month may be ending, but you should never stop learning! Each year, companies like Consolidated Credit mark April…

Buying a Home: Consolidated Credit Clears Up the Complex Process

The home-buying process isn’t easy for anyone. It’s even harder when coming to a new country. Elia Orellana started saving…

A New Place for Veterans

Consolidated Credit partner Mission United celebrates its 10th anniversary by opening a new location for Veteran financial services. Mission United…

You Could Win $500 in Our Thankful Photo Contest

It pays to be thankful as you work to get out of debt. Calling all Consolidated Credit clients and alumni!…

Consolidated Credit’s Homebuying Fair Makes Homeownership Possible – Even in Today’s Market

After a brief hiatus during the pandemic, the annual homebuying fairs are back. Buying a home is confusing in the…

American Financial Well-Being in 2022

The CFPB has released their new report, which details how people deal with their financial obligations. You’ve heard of credit…

Seniors Lose More Than $1.7 Billion to Elder Fraud Every Year

Telemarketers, online scammers, even family members steal from the elderly. And most of it goes unreported. A recent study on…

100 Days, 100 Ways

With 100 days before Christmas, it’s time to start planning! September 16th marks the official start of the winter holiday…

Does the Convenience of Online Shopping Make It Harder to Budget?

A new survey finds Spanish-speaking Americans may have a harder time when it comes to shopping online. There’s little question…

CFPB Investigating Credit Card Late Fees and Penalties

If you’ve ever been late with a credit card payment and thought that late fee you got popped with was…