How high-interest credit cards impact a student’s ability to graduate debt-free.

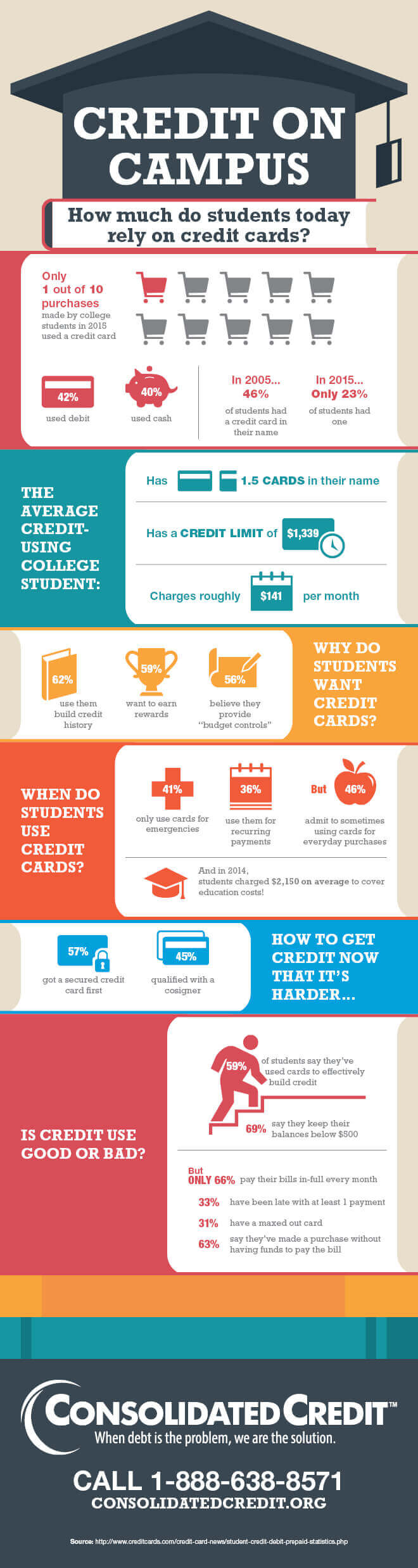

The Credit CARD Act of 2009 restricted on-campus promotions and marketing credit card offers to anyone under the age of 21. Still, credit cards continue to be a prominent financial tool on college campuses. Here’s how campus credit card use is impacting students today…

Why credit card debt is so damaging after graduation

The main challenge with carrying credit card debt balances as you leave school is how much total debt you have after graduation. If you’re like most students, graduation signals the impending start of student loan repayment. Most federal student loans require you to start repaying your debt within 6 months of graduation. If you don’t graduate that clocks starts as soon as you drop below half-time enrollment.

As a result, college grads now generally start their independent financial lives with a high debt burden. You don’t want to compound that challenge by piling on high interest rate credit card debt, too. Doing so has two affects:

- You have to use a higher percentage of your income to cover debt repayment.

- Your debt-to-income ratio increases, making it harder to get approved for new financing.

Essentially, if you graduate with credit card debt in addition to student loans, you’re likely to have an uphill battle. You’ll have less income available to save for things like a down payment on a new car or first home. You may also have a tougher time getting approved for loans because you already have so much debt.

A two-pronged attack with debt consolidation

If you have both credit card debt and student loan debt to eliminate, debt consolidation may be the answer. Consolidation allows you to combine debts into a single monthly payment at a low interest rate. This allows you to get out of debt faster even though you may pay less each month.

The important thing to note is that you typically can’t consolidate credit card debt and student loan debt together. Both can be consolidated, but you must put them into separate programs. So you can consolidate student loan debt with a federal repayment plan; then consolidate the credit card debt with a debt management program.

Consolidating your two main sources of debt separately would provide the following advantages:

- You would only have to worry about 2 payments each month.

- This would likely reduce your total monthly payments each month, leaving more money for living expenses and saving.

- If you reduce your total monthly payments, you improve your debt-to-income ratio; this makes it easier to qualify for new financing.

For more information about credit card consolidation, call Consolidated Credit at (844) 276-1544 to speak with a certified credit counselor today. You can also complete an online application to request a confidential debt and budget analysis at no charge.