America Saves Week Infographic Series: The Science of Saving, Part 1

This week marks the 7th annual America Saves Week in the U.S. – an event started in 2007 by the American Savings Education Council. The idea is simple: Americans aren’t doing enough to plan ahead, so this week provides an opportunity to promote better financial habits. Government agencies, nonprofits and financial institutions across the country are taking the week to provide useful information that helps Americans make a plan for the future.

With that in mind, Consolidated Credit has developed a new infographic series, The Science of Saving, to help consumers learn some of the basics about how, when and where to save. We will run three infographics this week – today, Wednesday, and Friday – that cover a range of topics to help consumers build effective strategies for saving.

Today’s Infographic: The Formula for Saving

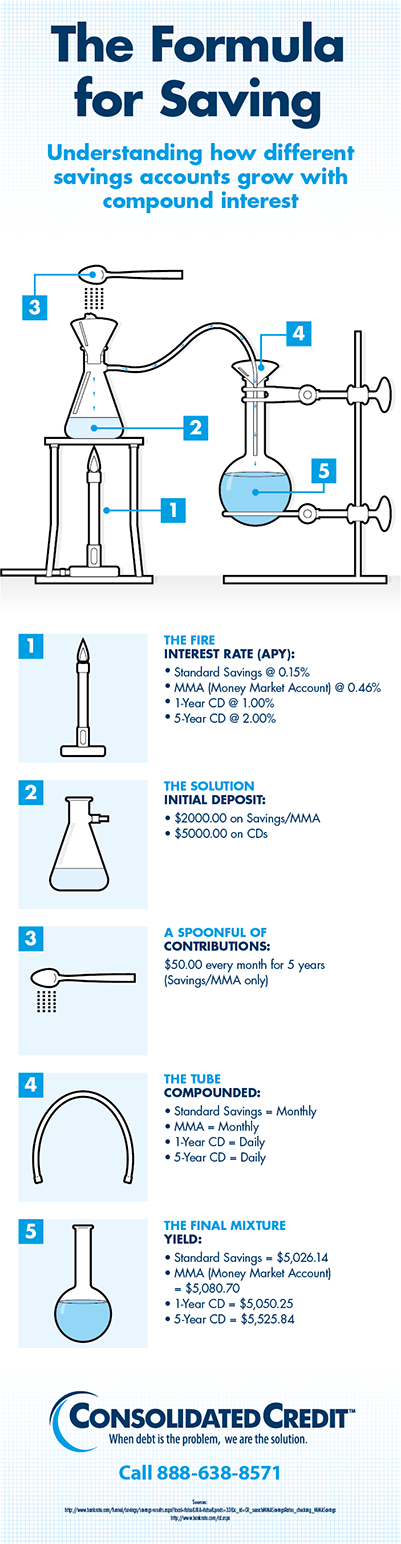

The first infographic looks at the basic formula for saving. From a standard bank savings account, to CDs and special accounts like MMAs, all of these accounts work in the same way.

The money you put in is multiplied by the interest rate (APY – annual percentage yield). Most accounts also compound the interest. Essentially the money you earn as yield gets rolled in with the money you put in.

So if you have an account with $50 in it and it yields $1 after a month, then the next time the yield is calculated, the interest would be multiplied by $51 instead of just $50. Interest can get compounded monthly, weekly or even daily. How often it compounds matters, because the faster it gets added back in, the more money you earn.

What to look for in a saving strategy…

When you set money aside, you want it to grow as quickly as possible. This is why just leaving savings in a standard bank-issued account isn’t the best strategy – the interest isn’t high enough to provide good yield. These accounts are good for things like a rainy day fund, but not for long-term savings.

For the long-term, you need to diversify your assets. Your goal should always be to get your money where it has the highest interest rate with the fastest compounding cycle. So an MMA that compounds daily at 1% APY is better than one that compounds weekly with the same 1% APY.

Of course, higher APY and a faster compound rate may mean either more risk or more requirements to qualify. Things like stocks can have a really good yield, but their value can change overnight and you can lose your investment. Some MMA accounts with higher APY that compounds daily can require an initial deposit, usually between $2,500 and $10,000.

With that in mind, it’s good to have a good mix of different kinds of savings. For example:

- Standard bank account savings for short-term emergencies

- An MMA for mid-term savings

- A few CDs so your money can grow for a set amount of time

- An IRA for long-term retirement planning

Once you have all of the above established you can then look to things like stocks where your money has the potential to grow quickly at the risk of a potential loss. However, it’s important to note that you don’t have to play the stock market to be successful, and even if you do decide to get into stocks, it shouldn’t be the only savings investment in your portfolio.

Of course, a good saving strategy can’t start unless you have the startup capital you need to open the right accounts for your needs. If debt is holding you back from saving effectively, we can help. Call Consolidated Credit or get started online with a request for a Free Debt & Budget Analysis.