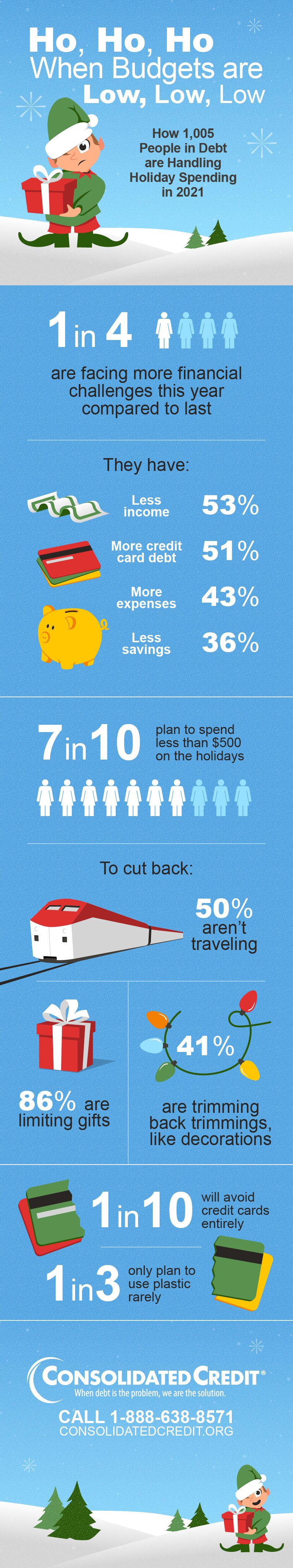

The holiday shopping season is always the most expensive time of year for most families. But between rising prices and shipping delays, the costs are even higher this year. We asked over 1,000 people who are facing challenges with debt how they plan to get through the holiday season. Here’s what they had to say…

Ho, Ho, Ho When Budgets are Low, Low, Low How 1,005 People in Debt are Handling Holiday Spending in 2021 1 in 4 are facing more financial challenges this year compared to last They have: • Less income – 53% • More credit card debt – 51% • More expenses – 43% • Less savings – 36% 7 in 10 plan to spend less than $500 on the holidays To cut back: • 86% are limiting gifts • 50% aren’t traveling • 41% are trimming back trimmings, like decorations 1 in 10 will avoid credit cards entirely 1 in 3 only plan to use plastic rarely