Working to cure the chronic pain caused by unpaid medical bills.

Medical debt is a leading cause of credit problems, but what can be done to cure this chronic financial ailment? Updated for 2019, this infographic explores where America’s medical debt comes from in our current healthcare system and how that impacts families. Read on below to find potential cures if medical debt causes chronic pain for you.

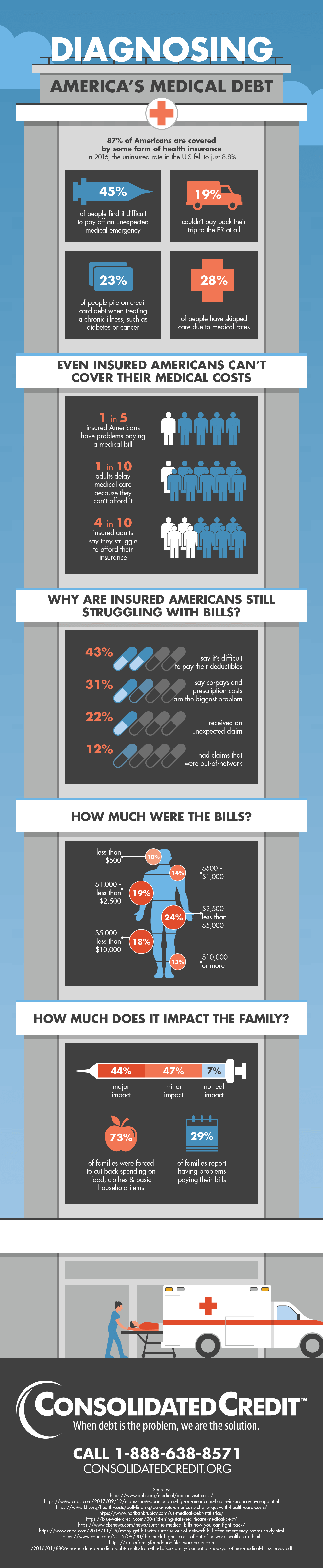

Diagnosing America’s Medical Debt 87% of Americans are covered by some form of health insurance In 2016, the uninsured rate in the U.S feel to just 8.8% 45% of people find it difficult to pay off an unexpected medical emergency 19% couldn’t pay back their trip to the ER at all 23% of people pile on credit card debt when treating a chronic illness, such as diabetes or cancer 28% of people have skipped care due to medical rates Even insured Americans can’t cover their medical costs 1 in 5 insured Americans have problems paying a medical bill 1 in 10 adults delay medical care because they can’t afford it 4 in 10 insured adults say they struggle to afford their insurance Why are Insured Americans Still Struggling with Bills? 43% say it’s difficult to pay their deductibles 31% say co-pays and prescription costs are the biggest problem 22% received an unexpected claim 12% had claims that were out-of-network How much were the bills? 10% – less than $500 14%- $500-1,000 19%- $1,000-less than $2,500 24%- $2,500-less than $5,000 18%- $5,000 – less than $10,000 13%- $10,000 or more How much does it impact the family? 44% major impact 47% minor impact 7% no real impact 73% of families were forced cut back spending on food, clothes & basic household items 29% of families report having problems paying their bills Sources: https://www.debt.org/medical/doctor-visit-costs/ https://www.cnbc.com/2017/09/12/maps-show-obamacares-big-on-americans-health-insurance-coverage.html https://www.kff.org/health-costs/poll-finding/data-note-americans-challenges-with-health-care-costs/ https://www.natlbankruptcy.com/us-medical-debt-statistics/ https://bluewatercredit.com/30-sickening-stats-healthcare-medical-debt/ https://www.cbsnews.com/news/surprise-medical-bills-how-you-can-fight-back/ https://www.cnbc.com/2016/11/16/many-get-hit-with-surprise-out-of-network-bill-after-emergency-rooms-study.html https://www.cnbc.com/2015/09/30/the-much-higher-costs-of-out-of-network-health-care.html https://kaiserfamilyfoundation.files.wordpress.com/2016/01/8806-the-burden-of-medical-debt-results-from-the-kaiser-family-foundation-new-york-times-medical-bills-survey.pdf

Finding relief from medical debt

Medical debt presents some unique challenges when it comes to eliminating it to achieve stability. The first and largest problem comes in how often medical debt ends up in collections without the payee’s knowledge. Insurance gaps often lead to unpaid bills that go unnoticed until the collection calls start.

So by the time you become aware of a medical debt that you owe, you may already be in a bad place. You face credit damage and collection calls for a payment you didn’t even know that you owed. What now?

You have a few options that can be useful as you pay these debts off:

Option 1: Work with original service provider on a repayment plan

If you get a collections notice about a medical debt that you didn’t know you owed, call the original service provider first. Ask if you can work out a repayment plan with them. In exchange, ask that they “re-age” the account to remove it from collections. This will:

- Remove the negative item from your credit report

- Stop calls and potential harassment by the collection agency

- Allow you to repay what you owe directly with the medical service provider

Option 2: Work with the collector on a settlement agreement

If the original service provider is unwilling to work with you, you have the option of working with the collection agency. If you can repay the balance in full, again make sure to ask if they will re-age your account to remove the collection item from your credit report. They will typically only agree to do this if you agree to pay the balance in full.

Otherwise, you should discuss settlement options. A settlement is an agreement to repay a portion of a debt in exchange for discharge of the remaining balance. You can make a settlement with a single lump-sum payment or in a repayment plan. Single-payment settlements usually have higher success rate for two reasons:

- If you can make a payment plan to repay a portion, it follows you can repay the full amount. As a result, the collector may insist that you keep making payments in the same amount until you’re paid in-full.

- A lump-sum gives them the same easy out it gives you. A lump-sum payment is a guaranteed out, where you could disappear again in the middle of your payment plan.

Be aware that any debt settled for less than the full amount generates a negative item in your credit report. This remains seven years from the date of discharge. However, if debts in collections have already severely damaged your credit, this may be an option.

Option 3: Roll medical debts into a debt management program

If you owe other debts such as credit card debt, you may be eligible for a debt management program. In this case, medical debts can be included in your program as long as the collector agrees to the adjusted repayment schedule.

It’s important to note that one of the benefits of debt management program enrollment doesn’t apply to medical debt. When you enroll in a debt management program, your credit counseling agency negotiates with creditors on your behalf. One of the goals is to reduce or eliminate interest charges applied to your debt. This doesn’t apply to medical debts in collections because no interest charges apply.

With that in mind, a debt management program may not be as beneficial if you ONLY have medical debt to consolidate. Ideally, medical debt should be rolled in with high interest rate unsecured debts, such as credit cards.