Making sure you get the most bang for your refund bucks.

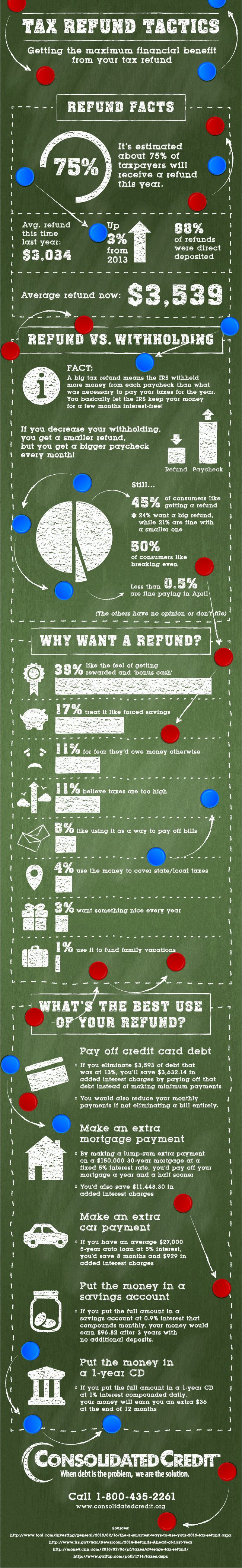

It’s tax time once again and for most of us – roughly 3 out of every 4 Americans – that means it’s also time to decide what to do with the refund you should be receiving once you file. According to IRS data, the current average refund is $3,539. That’s up about 3 percent from the refunds received by the same time last year.

Still, while it can be tempting to splurge and use your refund on something fun, there are usually better things that you can be doing with your money. Deciding on the best use of your funds is really a matter of looking at your current debts and saving assets to determine where you’ll get the maximum benefit from the money you receive. And that comes down to one thing: interest.

When it comes to debt, paying off over $3,000 could eliminate several credit card bills from your plate or pay off a significant chunk of your auto loan or mortgage. On the other hand, putting the money into a savings option with good interest earned will help your money grow. The infographic below helps you understand your refund and how best to use it, with some helpful examples of different options you can reference.

If you have questions about how to use your refund to your best advantage or you’d like to apply the refund you receive to your debt management program, we’re here to help. Call Consolidated Credit today at (844) 276-1544 to speak with a certified credit counselor.