Free weekly reports can help you maintain credit health during COVID.

The three major credit bureaus in the U.S. have collectively agreed to offer free weekly credit reports to consumers. Experian, Equifax, and TransUnion will all provide weekly reports through annualcreditreport.com at no charge through April 2021. The goal is to make it easier for Americans to manage their credit during the pandemic and resulting recession.

In the past, the Fair Credit Reporting Act (FCRA) mandated that people could check their credit for free once per year. You could download a copy of each credit bureau’s report through annualcreditreport.com every twelve months.

The dramatic increase in free credit reports attests to just how unique the situation with the U.S. economy is during this pandemic. There is a range of potential reporting issues that could result in credit damage.

Good reasons to regularly check your credit

If you enrolled in a debt management program to pay off credit card debt, those payments should be noted, too. Since your creditors agree to accept payments through a credit counseling agency, payments will be made on time for each account.

If a credit card company or lender offered forbearance or deferment, it should not affect your credit. Any payments they permitted you to miss should not be noted as missed payments. Your account should still be current with no negative notations in the account’s history.

If you see a missed payment or a delinquent status, contact the creditor immediately. Under the CARES Act updates to the FCRA, creditors are required by law not to report missed payments during COVID forbearance periods.

If you enrolled in a debt management program to pay off credit card debt, those payments should be noted, too. Since your creditors agree to accept payments through a credit counseling agency, payments will be made on time for each account.

What’s more, most creditors will bring delinquent accounts current once you make three consecutive payments through the program. Monitoring your credit as you pay off your debt will ensure everything is being reported correctly.

If you use a personal loan to consolidate credit card debt, then you will see a few updates on your credit report. First, you should see a new inquiry on your credit report for the loan application. Then the loan itself will appear as a new account on your report. Finally, the balances on the cards that you pay off should drop to zero.

Interest rates are at historic lows, meaning that it may be a good time to make a major purchase. If you have good credit and stable income, getting a new car or buying a home can be extremely cost-effective. You may enjoy interest rates of three percent or even lower, and car dealerships are offering 0% APR for up to 72 months.

If you decide to buy a car or home now to take advantage, you can apply for multiple loans to get specific rates and terms. All inquiries made within 14-45 days should be grouped as one inquiry. You should check your reports to ensure your credit isn’t dinged for multiple inquiries instead.

This only applies to mortgage and auto loan applications. Any other loan applications will remain as individual inquiries. Too many inquiries can potentially hurt your credit score.

If you have faced unemployment or loss of income, you may be juggling bills. Even after you recover from a slowdown in your income, you may still be working to catch up. Keeping an eye on your credit report may help you spot a collection account that fell through the cracks.

Also, be aware that any medical collections that may appear on your report can be removed if they should have been paid by insurance.

The pandemic has resulted in more time spent online and an increased need for online shopping. All that time online means people are at a much higher risk of identity theft.

If someone gets their hands on your personal information, they may open accounts in your name. One of the best ways to catch this type of ID theft is to monitor your credit reports for accounts you do not recognize. If you see an account you did not authorize, it may be a sign that your information has been compromised.

What negative information can appear on your credit report?

In addition to finding mistakes and ensuring payments are reported correctly, you also need to be on the lookout for negative items that have been legitimately incurred during this crisis.

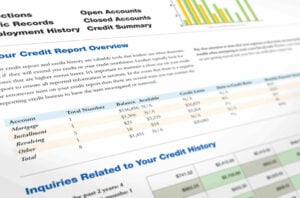

This table shows some of the items you may incur during a period of economic hardship and how long they can remain on your credit report.

| Item | Reporting timeframe |

|---|---|

| Missed loan and credit card payments | 7 years from the date the payment was first reported as missed |

| Collection accounts | 7 years from the date you missed the first payment on the original account |

| Missed child support payments | 7 years from the date the account originally became delinquent |

| Debt settlement | 7 years from the date of final discharge |

| Chapter 13 bankruptcy | 7 years from the filing date |

| Chapter 7 bankruptcy | 10 years from the filing date |

| Foreclosure | 7 years from the date the mortgage originally became delinquent |

| Repossession | 7 years from the date the auto loan originally became delinquent |

Will an eviction appear on a consumer credit report?

The hold on eviction and foreclosure actions is set to end on August 31. If that moratorium date is not extended again by the federal government, then many families could be facing eviction notices.

An eviction, itself, will not appear on a consumer credit report. The only way the information would appear on your report is if the landlord sent an unpaid rent amount to a collection agency. Then the collection account would appear on your credit report.

Just be aware that even though the eviction will not appear on your credit report, it may still appear on a tenant screening report.

Talk to a certified credit counselor to find solutions for the financial challenges you’re facing.