Find out how Consolidated Credit can help you!

Debt Relief Illinois

See how we’ve helped your Illinoisan neighbors find the relief they need.

Residents in Illinois don’t have the worst credit card debt problems in the nation, but that doesn’t mean credit users don’t face challenges. The average household owes $10,764 in credit card debt, and the total credit card debt in the state adds up to a whopping $48,779,431,952. The credit card delinquency rate, which denotes the rate of people falling behind on required monthly payments, is 9.07.

That means many Illinois credit users need to take action now to avoid serious financial hardship caused by credit card debt. With that in mind, Consolidated Credit’s has launched our Debt Relief Illinois program to help residents to overcome problems with debt. Below you can see how we’ve helped some of your neighbors become debt free. If you’re struggling with debt and looking for a solution, we can help. Call (844) 276-1544 for a free consultation with a certified credit counselor.

How Much Could You Save?

Just tell us how much you owe, in total, and we’ll estimate your new consolidated monthly payment.

Illinois credit card debt statistics

- Household credit card debt: $10,764

- Total credit card debt in the state: $48,779,431,952

- Average number of cards per user: 2.73

- Average credit card debt per user: 6,660

- Credit card delinquency rate: 9.07

- Average credit card late fee: $20

- Credit card fraud reports per capita: 12.44

- Average credit score: 705

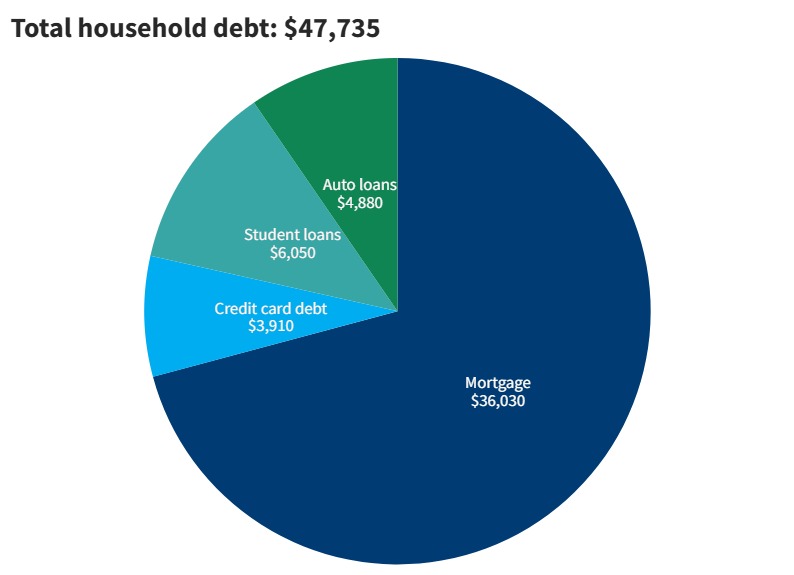

This chart shows a breakdown of average consumer debt in Illinois, based on the latest report of Household Debt report from the Federal Reserve.

Debt relief Illinois: See our program in action!

Don’t spend another sleepless night stressing over your credit card debt. Talk to a certified credit counselor to find relief today