Massachusetts Debt Relief Guide

The latest available data says that the average Massachusetts household has $11,219 in credit card debt. Citizens in this state collectively owe $28,046,691,178, an increase of $782,743,148 from the beginning of the year.

“While the story for Massachusetts technology workers is great, others are still suffering in the economy,” says Gary Herman, President of Consolidated Credit, “and unfortunately, the recovery is moving at a slow pace. That makes it more crucial than ever that people focus on paying down debt and shoring up their savings to better deal with the down economy and the ongoing potential for unemployment.”

Tony, Consolidated Credit DMP Alumnus From Boston, Massachusetts

I think my story can sort of help other people.

To be in debt is a huge deal. No savings. No way to help. And that just happens sometimes.

Consolidated Credit has given me the opportunity to do new things.

I’m able to just be at peace.

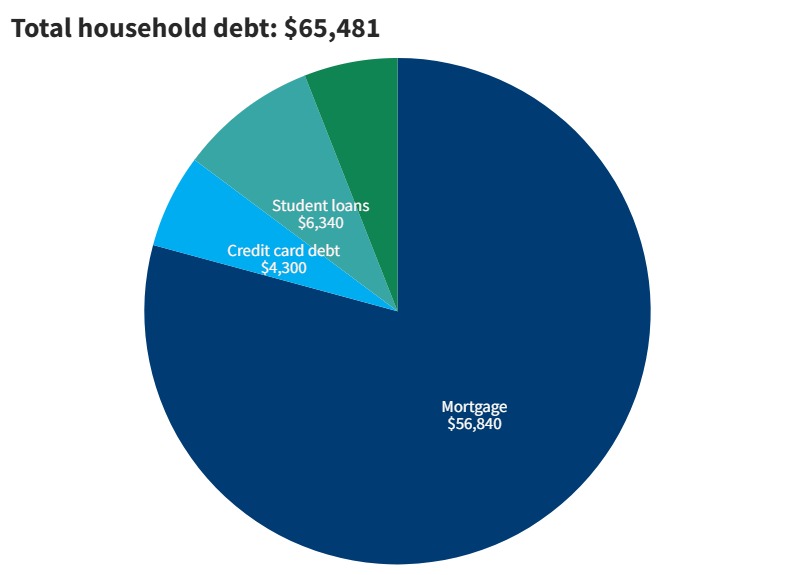

Consumer debt in Massachusetts

This chart shows a breakdown of average consumer debt in Massachusetts, based on the latest Household Debt report from the Federal Reserve.

In 2023, 3,869 Massachusetts residents filed for bankruptcy.

Income and employment in Massachusetts

The per capita (average per person) income in Massachusetts is $53,513. That’s a good deal higher than the national average of $41,261 and is a slight compensation for the higher cost of living in Massachusetts. The high cost of living in Massachusetts has led to many residents owing more than they make.

Massachusetts is not a right-to-work state, so workers can choose to join a union or not. The state has a very competitive job market. Unemployment currently sits at 3.8% percent. There currently are no federal unemployment benefits or programs. However, unemployment benefits in Massachusetts are very generous and can reach up to $1,033 per week for a single person.

That means if you are unemployed and living in Massachusetts, even with a higher unemployment benefit, the chances are that you are struggling financially. If you’re in this situation, take steps to prioritize your bills and keep debt minimized.

Apply for unemployment benefits in Massachusetts»

To file a claim by telephone number: (877) 626-6800

For help finding a job, visit a Massachusetts Job Centers

Banking and taxes in Massachusetts

Massachusetts has a graduated state individual income tax, and the rates range from 5% to 9%. Everyone who earns more than $8,000 annually must file taxes. There is also a sales tax of 6.25%. There is one sales tax holiday weekend each year in Massachusetts. On that weekend, there is no sales tax for select items up to $2,500, except for clothing which has a limit of $175.

Massachusetts residents are also more likely to bank than the average American. According to the FDIC, 95.9% of households have a checking or savings account.

Massachusetts housing market

Massachusetts has always had a highly competitive housing market, particularly in highly populated areas like Boston. This year has seen an increase in average home prices, but the market for renting has currently cooled down.

Because of this tight market, there are frequently bidding wars for the remaining homes left on the market. Not only are prices rising, but investors are driving up prices and competing against regular buyers. Many investors pay in cash, allow them to buy quickly and buy over market value. In contrast, potential buyers typically have to wait for mortgage financing. That’s edging out first-time homebuyers and leaving them with few options.

Massachusetts does have an exceptional homestead exemption, with an automatic $125,000 exemption even if you don’t file. That exemption goes up to $500,000 when you file. If you are over age 62 or are legally disabled, your exemption goes up to $1,000,000. You can even homestead properties that are in a trust. (People typically put a home in a trust to avoid the probate process after they die.) These large homestead exemption amounts make homeownership a highly attractive option for residents who can afford to buy.

- 61.9% of Massachusetts residents are homeowners

- Median monthly owner costs including mortgage: $2,553

- Median gross rent payment: $1,588

Massachusetts does have an emergency assistance program if you are facing difficulties making rental payments or mortgage payments. There are also programs for first-time homebuyers sponsored by the State of Massachusetts.

Consolidated Credit Helps Massachusetts Residents Reduce Their Total Credit Card Payments by Up to 50%

Retirement in Massachusetts

Massachusetts can be a fantastic place to retire. Healthcare facilities in the state are top-rated, and access to high-ranked higher education can keep your mind going. If you are a fan of history, you might just be in paradise. Picturesque cities and towns with a history dating back to the 1600s make for great day trips. You can also choose between small towns and big cities, beachfront living, or mountain views. The greater Boston area is one of the most walkable cities in the United States, and you may not even need a car. If you’re a sports fan, the Red Socks and New England Patriots are popular teams, and the Fenway Park baseball stadium is a national treasure. Public transportation is excellent, and travel to outside locations is effortless.

CNBC reported in 2024 that the average Massachusetts resident would need about $83,501 annually to retire. A 20% comfort buffer ($16,700) is recommended. That means the target for a comfortable retirement in Massachusetts would be about $100,201 a year.

Average Massachusetts insurance premiums

Massachusetts residents face some high rates when it comes to protecting their homes, vehicles, and health with insurance. Massachusetts is a no-fault state for auto insurance. The average driver has an auto insurance premium of $1,828 per year.

Homeowners insurance rates are lower than the national average of $2,304. The average Massachusetts homeowner’s insurance premium is $1,660 per year.

Massachusetts’s annual health insurance premium is $8,068, which is $1,087 higher than the national average. Massachusetts has an excellent health care system with near-universal coverage and an extremely low uninsured rate of 1.7%.

Helpful resources for Massachusetts residents facing hardship

Food insecurity

| City/Region | Food Bank | Phone Number | Address |

|---|---|---|---|

| Central Massachusetts | The Greater Boston Food Bank | (617) 427-5200 | 70 South Bay Ave, Boston, MA 02118 |

| Central Massachusetts | Worcester County Food Bank, Inc. | (508) 842-3663 | 474 Boston Turnpike, Shrewsbury, MA 01545 |

| New Hampshire | New Hampshire Food Bank | (251) 653-1617 | 700 East Industrial Park Drive, Manchester, NH 03109 |

| Western Massachusetts | The Food Bank of Western Massachusetts | (413) 247-9738 | 97 North Hatfield Road, Hatfield, MA 01038 |

Veterans

According to the Census Bureau, 243,000 veterans live in Massachusetts. These resources are available to help Veterans that are facing unemployment, homelessness, and other hardships.

Massachusetts Department of Veterans’ Affairs

National crisis hotline: (800) 273-8255

Massachusetts Veterans Support Line: (844) 693-5838

Headquarters:

600 Washington Street, 7th Floor

Boston, MA 02111

(617) 210-5480

Find a Veteran service office in your area »

Helpful employment resources for Veterans:

- CareerOneStop

- VeteranRecruiting.com

- Helmets to Hardhats

- Hiring Our Heroes

- My Next Move

- Warriors to Work

How Consolidated Credit helps Massachusetts residents find debt relief

In 2024, Consolidated Credit provided free credit counseling to 3,329 Massachusetts residents. Of those, 204 went on to consolidate their debt with our help through a debt management program (the average amount of debt enrolled was $9,622). The others received a free debt analysis and complementary budget evaluation, and they were directed to the right solution for their situation to get out of debt as quickly as possible.

We’d also like to congratulate the 252 Massachusetts residents who got debt-free last year with the help of Consolidated Credit!

Tony from Boston is one of them. He graduated from a debt management program and is now living debt-free. Consolidated Credit caught up with Tony after he completed his DMP. Here’s what he had to say about the program:

A debt consolidation loan is an unsecured personal loan that you get to pay off credit cards and other existing debts. You need good credit to qualify for the lowest interest rate possible. That low rate helps lower your total payments so you can get out of debt faster, even though you may pay less each month. So, this is a good solution for Massachusetts residents with a high credit score.

A home equity loan or home equity loan of credit (HELOC) is a debt solution that’s only available to Massachusetts homeowners. If you have equity available in your home, you can borrow against that equity and use the funds to pay off your debt. However, this can be a risky option for paying off credit card debt if you are living paycheck-to-paycheck. Home equity lending products put consumers at risk of foreclosure if they can’t make the payments. If you are considering borrowing against your home, call 1-800-435-2261 to speak with a HUD-certified housing counselor to make sure this is a safe option for you.

Nonprofit credit counseling services like those provided by Consolidated Credit help consumers identify the best solution for getting out of debt. This is a free service. Massachusetts residents can get a confidential debt and budget evaluation from a certified credit counselor. Then the counselor will explain options that are available to each person and recommend the best course of action based on an individual’s needs and goals.

If a Massachusetts consumer cannot get out of debt effectively on their own but has the ability to repay everything they owe to avoid bankruptcy, a debt management program is often the best solution. You enroll in the program through a credit counseling organization. They help you find a monthly payment you can afford and then work with your creditors to reduce or eliminate interest. Qualifying residents can get out of debt in 36-60 payments.

Debt settlement allows Massachusetts residents to get out of debt for a percentage of what they owe. You can settle debt on your own and negotiate with individual creditors and collectors or enroll in a debt settlement program to get professional help. This does cause credit damage. Each debt settled will be noted on your credit report for seven years from the date the account first became delinquent. However, it can be a viable debt relief option for avoiding bankruptcy when you are completely overwhelmed with debt.

If you’re curious how we can help you, below you will find a few case studies from clients that we’ve helped in Massachusetts residents. If you’re facing challenges with debt, call us at (844) 276-1544 to receive a free debt and budget evaluation from a certified credit counselor.

Massachusetts residents trust us with their debt. Contact us today and we can help you find the right solution for your debt!