How to transition your finances from the classroom to the boardroom.

As graduation season kicks into high gear, outgoing college seniors throughout the U.S. are getting ready to take the plunge into the real world. As these young professionals move towards true financial independence, there are a few critical tasks that should be completed quickly to transition effectively and efficiently.

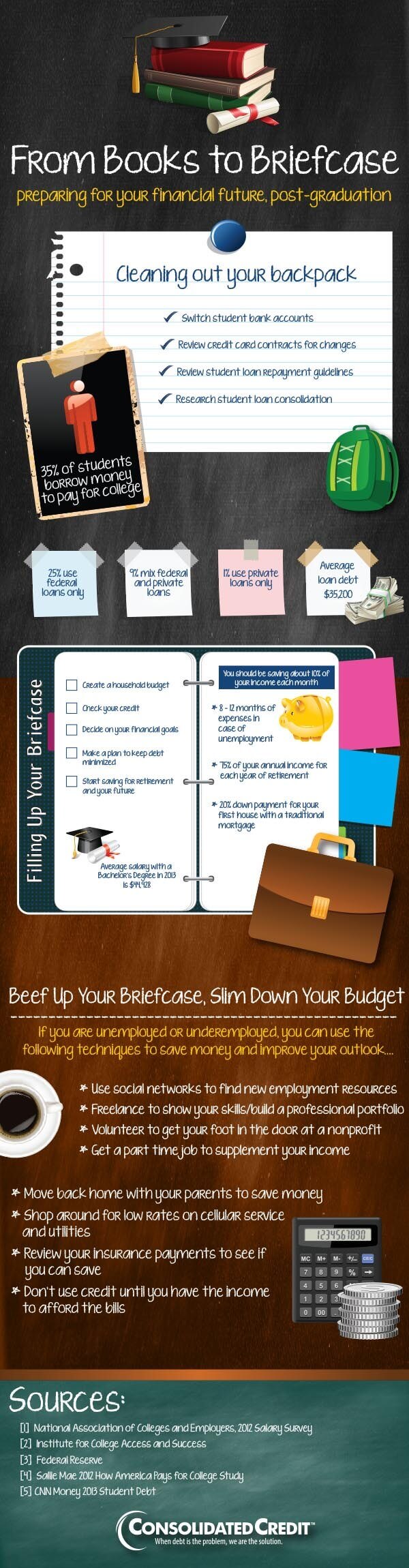

Dealing with debt post-graduation

One of the biggest financial challenges that a young professional will face right out of school is how to handle the burden of debt repayment. This includes not only student loan debt, but credit card debt taken on during college.

Often, college students show little concern for financial issues, including credit score. As a result, they may get credit cards or store cards, run up charges and not really pay attention to the bills. Payments are made late or accounts are overdrawn without much thought for the consequences.

Then when those students graduate, they are suddenly faced with financial challenges caused by bad credit, such as problems renting property and challenges getting approved for financing on things like car loans and a first mortgage. What’s more, high debt payments can quickly drain entry-level incomes, making it difficult to eliminate the debt and get ahead.

So what should you do?

Credit card debt. If you charged up credit cards during your school years and now you have accounts at their credit limits and even possibly some in collections, you need to handle those debts quickly to stop any potential damage to your credit score. A debt management program may allow you to consolidate credit cards, store cards, gas cards and even in some cases accounts in collections. Getting your debt under control now will make the next few years a lot easier on your finances.

Student loan debt. If you don’t have a job yet, explore options for federal loan deferment. Most student loans have payments that start 6 months after you graduate. Using deferment may delay the start of those payments. If you have a job, bite the bullet and find a way to pay off those debts as fast as you feasibly can without hurting your budget. You may have to pinch pennies and tighten your belt now, but you’ll avoid getting rejected for loans and being held back by lingering student loan debt. If necessary, you may want to look into options for student loan debt consolidation.