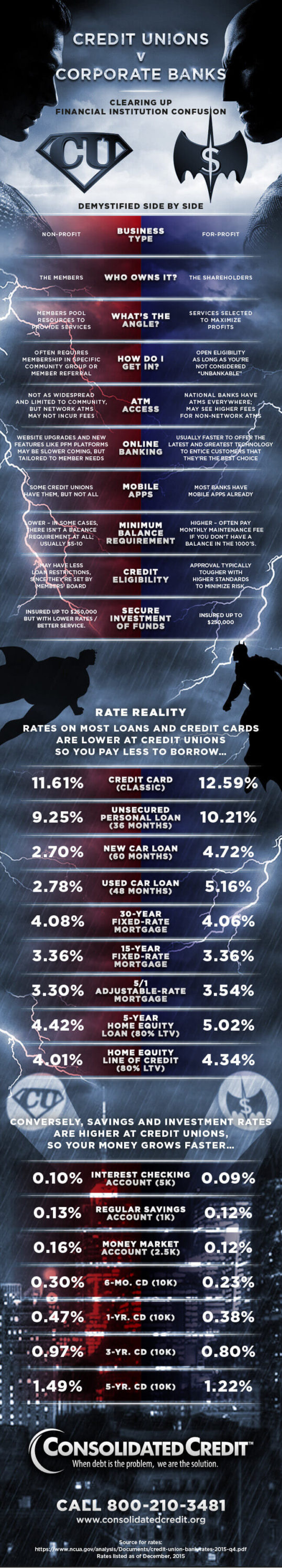

Which one is the right place for your money and your business?

From maintaining accounts that keep your money safe and help it grow to providing loans and credit cards at the best rates and terms, where you bank matters. This infographic explains the key differences between credit unions and banks so you can decide what’s right for you.

Be strategic about selecting financial institutions

A key point to keep in mind is that you don’t have to choose just one financial institution for all your business. You can maintain your main bank account at one institution, a savings or Money Market Account (MMA) at another, and get your loans with whoever offers the best interest rates and terms.

In fact, going through one financial institution to do absolutely everything with your money could be hurting your bottom line. Particularly when it comes to opening accounts that help your money grow AND getting loans and lines of credit that have a cost you have to pay via interest charges, you want to shop around.

Never just go to your main bank and open whatever you need without shopping around to compare terms with other financial institutions first. Otherwise, you could be losing money on loans with higher interest charges, as well as leaving money on the table by choosing savings and investment accounts with lower returns.

This means you need to be strategic about which financial institutions you choose to support you in each financial action that you want to take. Compare rates and terms between different products before you formally apply for a loan or a new credit card. You should also check APY (annual percentage yield) and how often interest compounds on savings and investment tools. Go with the institution that’s going to be best for your money, because blind loyalty to an institution can really cost you.

Other factors may come into play, too. For instance, some reward credit cards may offer additional cash-back bonuses if you put the cash you earn into an account with the same financial institution. In this case, it might be in your best interest to have a savings account or MMA with that institution to earn extra cash back. Your money will grow faster simply because you’re being strategic about how you bank.