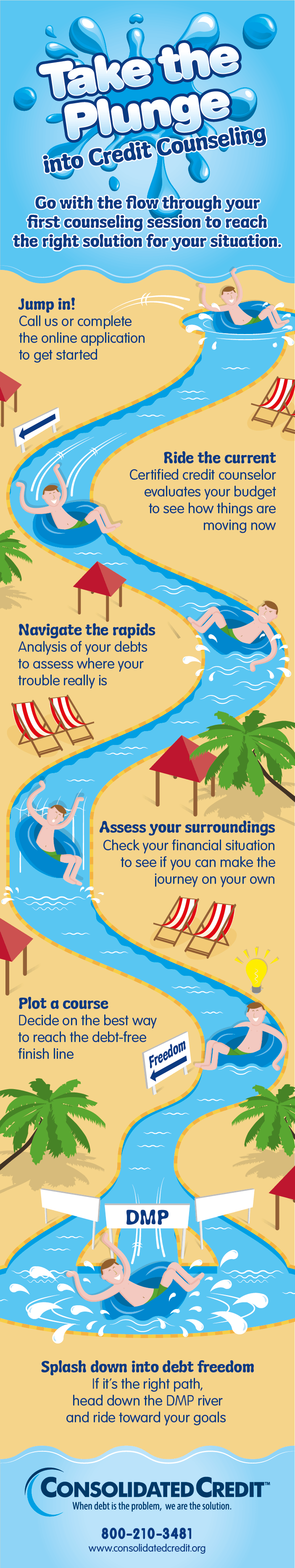

Learn what to expect so you can go with the flow and find the right debt solution for your needs.

It’s usually not an easy decision when you realize you need help with debt. Understandably, most people prefer to deal with financial issues on their own – it’s hard to trust someone else with your money and it can be difficult to admit that things have gone off the deep-end.

On the other hand, professional help is often exactly what most people need to find the right solution to debt problems. A professional point of view can provide perspective and help you identify solutions you make not even know exist. That’s exactly what certified credit counselors are trained to do: assess your situation to help you find the best way forward.

With that in mind, we’ve put together the following infographic that explains the credit counseling process so you can know what to expect when you call us for help. If you’re ready to get started, call us at (844) 276-1544 to speak to a certified credit counselor or ask for help online with a request for a Free Debt & Budget Analysis.