Ana Maria Ceballos

Community and Business Relationship Manager

Adept at formulating, implementing, and evaluating cross-functional decisions related to workforce management, Ana Maria Ceballos enables each organization she works with the ability to achieve set objectives and reach them efficiently. She is an expert at creating and implementing process road maps and optimizing work efficiency and business performance.

Ana obtained her M.B.A in Business Administration & Management from Nova Southeastern University after obtaining her bachelor’s degree from Universidad Pontificia Bolivariana in Colombia, her native country.

In the United States, Ana would join The Hispanic Unity of Florida, working as a team leader in the VITA and Small Business Services department. In that position, she helped to improve customer service satisfaction and data management by 50% and increased earned income tax credits by 49%.

After 5 years in that role, Ms. Ceballos became Program Coordinator of the same department. There, she oversaw and enabled the delivery of VITA services to over 25,000 low-to-moderate income individuals and had a role in over $29 million in refunds to the Broward County community.

Her continued excellence would see Ana promoted to Senior Program Manger in the Income Supports & Small Business Services department in 2018. There she assessed the needs and eligibility for public benefits, in addition to providing access to healthcare by leading high performing of navigators. Ana also managed all aspects of the recruiting process including screening, interviewing, and selecting over 30+ candidates each tax season.

Joining Consolidated Credit in September 2022 as a Community and Business Relationship Manager, Ana’s focus has been on the KOFE platform, and how it can help companies, their employees, and clients.

The 2026 Budget Blueprint: Systems That Actually Work

A practical guide to choosing a budgeting style that fits your personality and financial habits.

2026 Money Confidence Roadmap: January Reset

Why many money goals fade early in the year and how clarity helps people stick with them.

Set the Right Plan to Pay Off Holiday Debt

How to start the New Year on the right financial foot. It’s all too easy to overspend during the holidays.…

Your 2026 Debt Reset: The Smartest Ways to Start the Year Strong

With record-high credit card balances, here’s how Americans can lower interest, pay down debt faster, and rebuild confidence in the…

Understanding Financial Scams: How to Protect Yourself During the Holidays

The holiday season is a time for cheer and giving, but it’s also a peak season for financial scams. A…

Ready for a Financial Reset This New Year? Start Here

The start of a new year is the perfect moment to reset your habits, rethink your priorities, and build the…

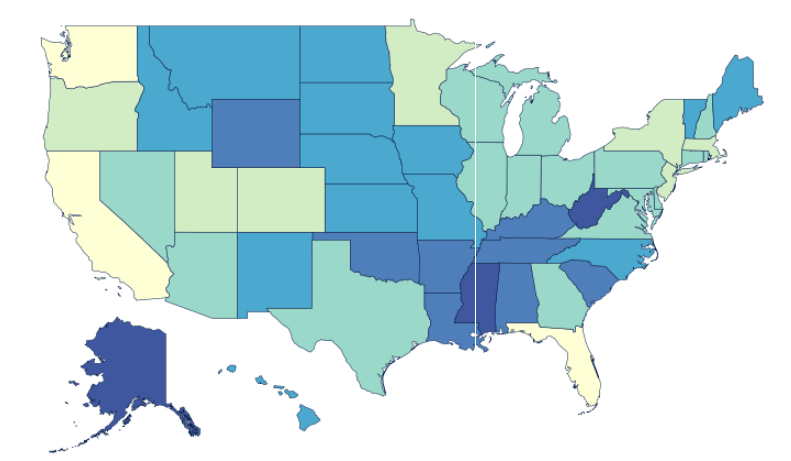

A Snapshot of Credit Card Debt by State – Updated With the Latest Data

Alaska leads the nation in average credit-card debt, and new Experian data shows balances rising in nearly every state. Experian…

Who Is the ‘Typical’ Consolidated Credit Client?

After decades, that’s hard to say. But their results are the same: They get out of debt.

Understanding Buy Now, Pay Later Plans: Pros and Cons

As the holiday season approaches, you might be hearing more about “Buy Now, Pay Later,” or BNPL. This payment method…

Avoiding Fraud During Holiday Shopping: Online Safety Tips

The holiday season is about to ramp up with black-friday and cyber monday about a month away. Holiday shopping online…

Holiday Spending Stress

Most Americans will add debt and stress to their gift lists this year.

Halloween Spending Statistics

Anticipation is high for the spookiest night of the year. About 73% of Americans say they plan to celebrate Halloween…