Debt

This Fourth of July weekend, celebrate freedom from debt. This strategies and tips will help you lower your debt burden.

Read full article

Consolidating Debt: How to Simplify Your Payments This Year

Mid-year can be a good time to pause and look at your financial picture. If you’re like many people, you might find yourself juggling several different credit card debts. Each… Read full article

Revolver vs. Transactor: What Kind of Credit User are You?

We compare the credit habits of revolver vs transactor cardholders so you can see the difference and choose the right credit management strategy for you.

Read full article

The Student Loan Crisis Is Worse than You Think

Federal student loans payments resume this October. The result will likely hurt individual borrowers and the greater economy as a whole.

Read full article

Understanding Common Credit Card Fees

Rules and regulations concerning common credit card fees are constantly changing. Stay up-to-date on the latest fee news and choose your cards wisely.

Read full article

U.S. Consumer Debt Breaks Records in the Pandemic Aftermath

Consumer debt has risen to record levels, fueled by mortgages and credit cards. One of those is good debt, the other isn’t. Here’s what to do about it.

Read full article

Survey: Consolidated Credit Clients are Financially Surviving the Pandemic

A survey finds that Consolidated Credit clients are more likely to be in a better financial position and more optimistic about 2021 money prospects.

Read full article

Americans May Face a Crisis with Past Due Debt

Experts predict that credit card defaults and delinquencies will increase in 2021 once stimulus runs out. Here’s how to get ahead of past-due debt.

Read full article

Americans Adjust Their Credit Habits as a Result of the Pandemic

Even as Americans focus on paying down revolving debt, millions are relying on credit cards to address income challenges during the pandemic.

Read full article

Experts Respond: How Should People Handle Debt after a Loss of Income?

As millions of Americans try to deal with income losses amidst coronavirus shutdowns, we asked 21 experts for their tips on how people should handle debt.

Read full article

Consolidated Credit Establishes COVID-19 Financial Help Hotline

Consolidated Credit has established a free COVID-19 debt hotline for consumers facing challenges during the shutdown. Call for 800-745-2513 for support.

Read full article

Overspending for Credit Card Rewards You Never Use

Studies show that consumers use charge more to earn credit card rewards, but often never do anything with them. Find tips for refining your credit strategy.

Read full article

Student Loan Reform: Repaying Student Loans May Get Easier in 2020

Get the latest updates on student loan reform proposals currently being debated on Capitol Hill. Will these provide student debt relief for millions of Americans?

Read full article

Hindsight is 2020: How to learn from money mistakes

Even experts make money mistakes. Learn from our panel about money missteps and how you can learn from them and move forward.

Read full article

Veterans to Qualify Automatically for Permanent Disability Student Loan Forgiveness

Veterans will now qualify automatically for permanent disability student loan forgiveness, as well as tax exemption on the discharged debt. Learn more here.

Read full article

What Happens When the Fed Lowers Interest Rates?

When the Fed lower interest rates, it affects your ability to save and pay off debt. Learn what to do following the latest Federal Reserve announcement.

Read full article

Is Your Debt-to-Income Ratio Telling You It’s Time to Get Debt Help?

Debt-to-income ratio is a tool that lenders use to assess your debt, but it can also clue you into knowing when it’s time to get debt help. Learn how here.

Read full article

Consumer Credit Card Debt Breaks Records… Again.

It’s official. Consumers ended 2018 with a record $870 billion in credit card debt. If you have high balances to pay, Consolidated Credit has some advice.

Read full article

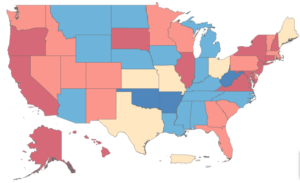

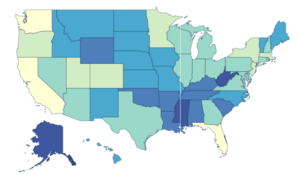

A Snapshot of Credit Card Debt by State in 2019

Total debt and the number of delinquent accounts are both climbing. We look at average credit card debt by state and offer tips to eliminate debt.

Read full article

5 Good Reasons to Call Your Credit Card Company

A credit card company wants your business, so they’re usually willing to give you certain money-saving perks for sticking with them. Learn how you can turn customer loyalty into more credit card rewards, cut annual fees and lower interest rates.

Read full article

What to Do If You Receive an Unexpected Emergency Room Bill

If you go to an in-network ER, but you get treated by an out-of-network ER doctor, it can lead to major unexpected emergency room bills for you to cover.

Read full article

Two Major Creditors Scale Back on Customer Credit Card Limits

Credit card companies set credit card limits based on your score, but your credit limit may also change for other reasons. Here’s what you need to know.

Read full article

Going into Debt After a Cancer Diagnosis

If you went into debt after a cancer diagnosis, you’re not alone. Learn about debt relief options so you can regain control and focus on your health.

Read full article

Millennials’ Biggest Source of Debt Might Surprise You

You might think that most Millennials struggle the most with student loans, but a new study reveals that their biggest source of debt is credit cards.

Read full article

Managing debt is an essential skill for financial stability. But with record-levels of consumer debt in the U.S. many households struggle to stay ahead of their obligations. Consolidated Credit’s certified team of experts specializes in understanding today’s financial landscape so we can help people navigate it effectively.

Managing debt is an essential skill for financial stability. But with record-levels of consumer debt in the U.S. many households struggle to stay ahead of their obligations. Consolidated Credit’s certified team of experts specializes in understanding today’s financial landscape so we can help people navigate it effectively.