I was interested in your program. I was wondering what kinds of debts you deal with. I have collections, credit cards, and some loans. Do you work with all of these? Is there any type of debt you don’t work with?

Ashley M from Marshall, WI

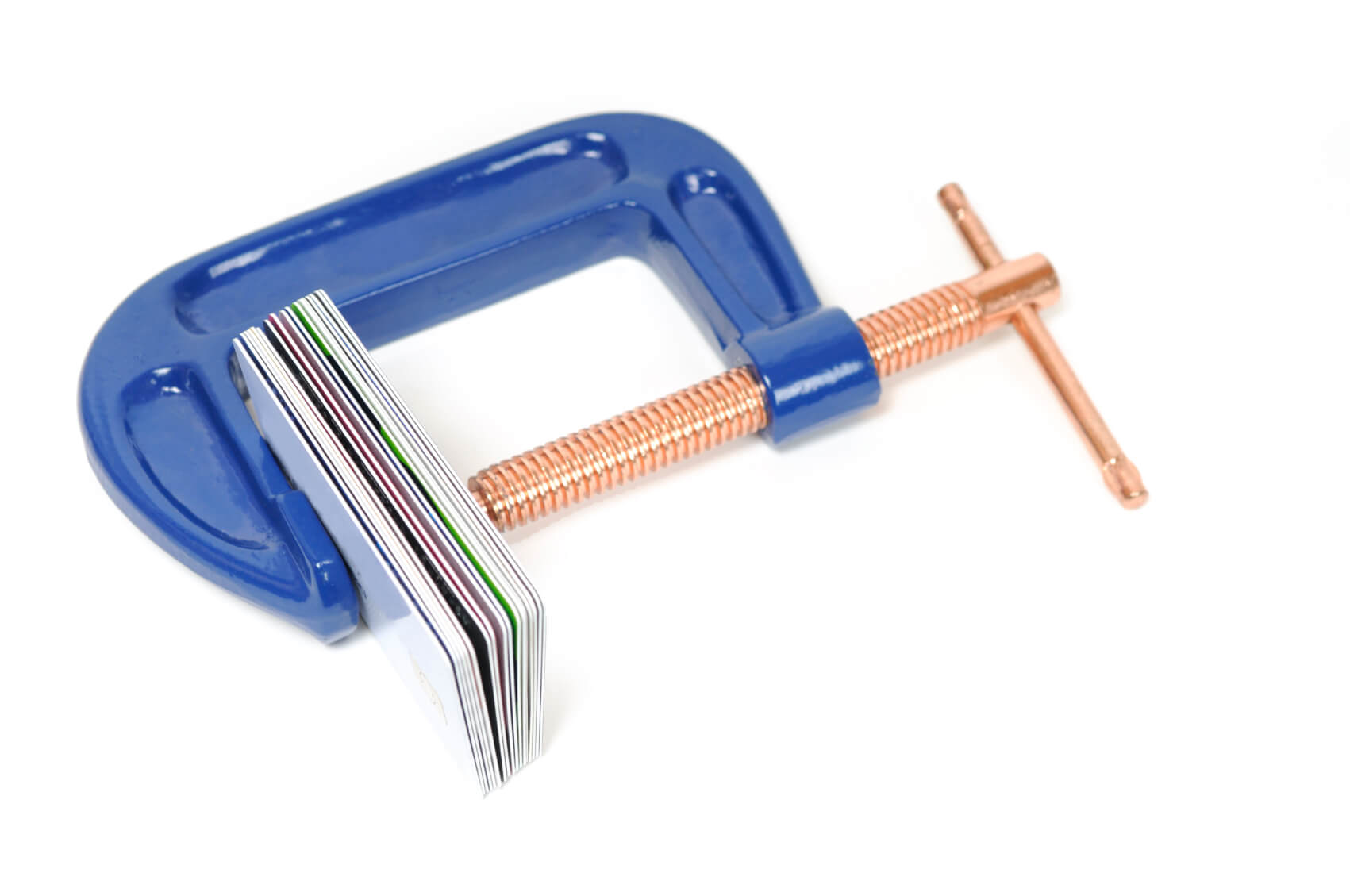

Credit counseling may be able to help you with more than just credit card debt.

What Types of Debt Can’t be Consolidated?

A debt management program allows you to consolidate unsecured debts into a single monthly payment at the lowest interest rate possible, but it can’t work for just any type of debt. Consolidated Credit president Gary Herman explains what types of debt can be included when you enroll.

Debt is essentially split into two groups when it comes to what can and can’t be consolidated using a debt management program – secured and unsecured.

Secured debts mean that you’re getting something in exchange for what you’re paying. So you get a house for a mortgage and a car for your auto loan. By contrast, unsecured debt doesn’t have anything that can be taken away if you don’t pay. You borrow the money without collateral – so your credit card company extends a credit line in good faith based on your credit score. If you fail to pay back what you borrowed, the creditor can’t just come and take any of your property to pay back your debt. Instead, they must sue you in civil court.

In most cases, any type of debt that doesn’t have collateral can usually be consolidated. Even if you haven’t kept up with the payments and the account has been charged off by the original creditor and sent to collections, we may be able to work with the debt collector to have the account included in your debt management program.

This basically means credit cards, store cards, gas cards and unsecured personal loans can all be consolidated. Additionally, unpaid medical debts and even some payday loans can be included, too. Keep in mind that part of the enrollment process for a debt management program involves the credit counseling team calling each creditor to get them to agree to your enrollment and accepting reduced payments at a lower interest rate.

For most major creditors and lending institutions, credit counseling agencies have established relationships with those companies. As a result, they know it’s in their best interest to agree to payment schedules arranged through these agencies because they understand they’re going to get their money back instead of facing the risk that the debt will be written off if the borrower declares bankruptcy.

With debt collectors, things are a little different because that particular collector may not have a standing relationship with every credit counseling agency. Getting their signoff requires some negotiation, which is part of the service that certified credit counselors provide. They negotiate on your behalf to ensure companies agree to your enrollment so you can get started on the program and work your way out of debt.

When things like utility bills can and can’t be included

If you have a bill, like a utility bill, that is past-due but you’re still using the service, that bill cannot be included. However, if the utility company froze your account or you moved and the account was sent to a debt collector, then you may be able to include it.

If you have this type of debt, let your credit counselor know during your free consultation. The counseling team will contact the debt collector to see if they would be willing to accept payments through a debt management program. In many cases, collectors will agree to this arrangement, because it means they will get paid.

What about student loans?

Student loans are unsecured debt. However, while these loans can be consolidated, they cannot be consolidated on a debt management program. Instead, you have to use specialized student loan consolidation programs that are specifically designed to address challenges with student loan debt.

Talk to a certified credit counselor to see if a debt management program is the best choice to pay off your debt.