Credit on Campus

Even with a cosigner, generating credit card debt during college is a risky proposition.

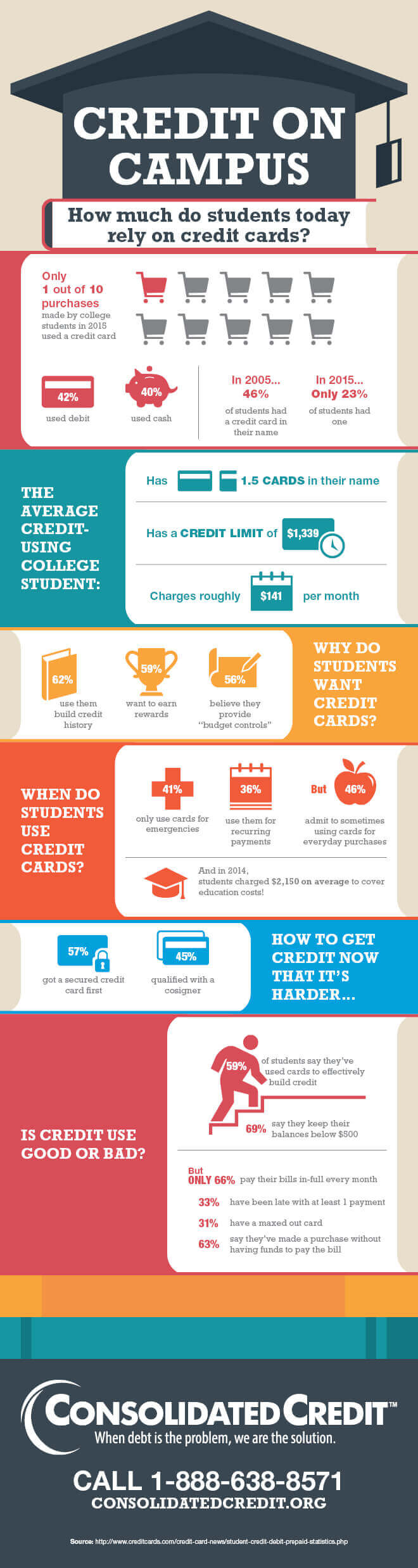

The Credit CARD Act of 2009 significantly restricted card use by students and promotional card offers by issuers directly on college campuses. This has greatly reduced the issue of students graduating with unmanageable credit card debt… which is good, considering the increasing challenges they face with student loans.

How does the Credit CARD Act protect students?

There were two main provisions of the CARD Act that aimed to stop rampant credit card debt problems amongst students:

- Anyone under the age of 21 who wants a credit card must have a cosigner.

- Creditors are prohibited to offering “tangible items” to incentivize college students to apply for cards.

If you attended college after 2009, you were saved the experience of signing up for a credit card just so you could get a free cooler or some other swag. That may sound silly, but college breezeways were filled with credit card company reps offering tons of freebies in exchange for signups. The result was students graduating burdened by credit card debt.

The Credit CARD Act also provides some additional protections for young borrowers:

- Credit limit increases for students (and anyone under 21) must be approved by a parent

- Creditors cannot send prescreened credit offers to anyone under 21

- The cosigner for an account must be a parent, legal guardian, spouse or other individual with a proven means to repay the debt; they must also provide written authorization