Debt Relief Pennsylvania

We help Pennsylvanians like you start their debt relief journeys.

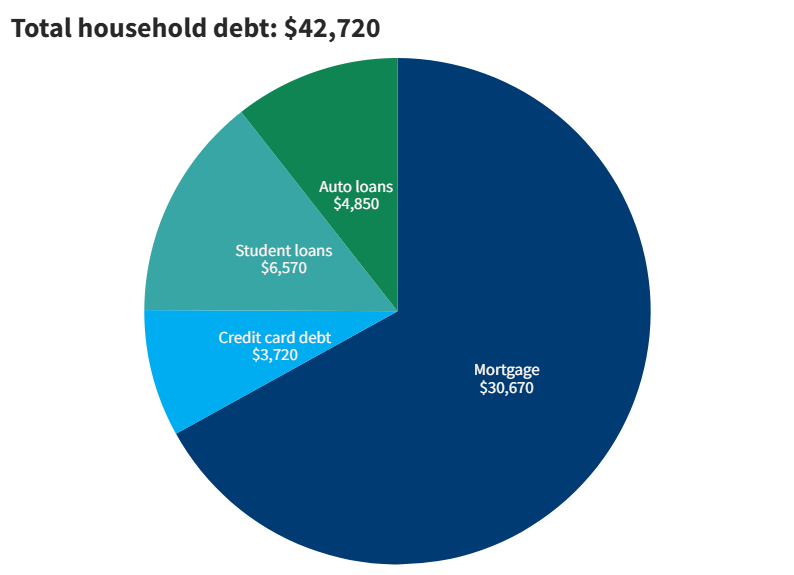

Pennsylvanians don’t have a monopoly on debt problems, but residents do face some unique challenges. For example, Pennsylvanians carry some of the highest student loan debt balances in the nation.

Challenges like this can make it difficult to maintain financial stability, especially if you also happen to be struggling personally with credit card debt. The information below can help you understand your situation. If you’re working to regain control, call us at (844) 325-5549 or complete an online application to request a free confidential debt evaluation from a certified credit counselor.