Here in Florida, hurricane season is upon us. Isaias barely missed us and Laura recently battered Louisiana. More storms are brewing in the Atlantic as you read this.

But that’s not all. There are other natural disasters, such as earthquakes, tornadoes, and blizzards, that could all affect your finances in the coming months and years no matter where you live.

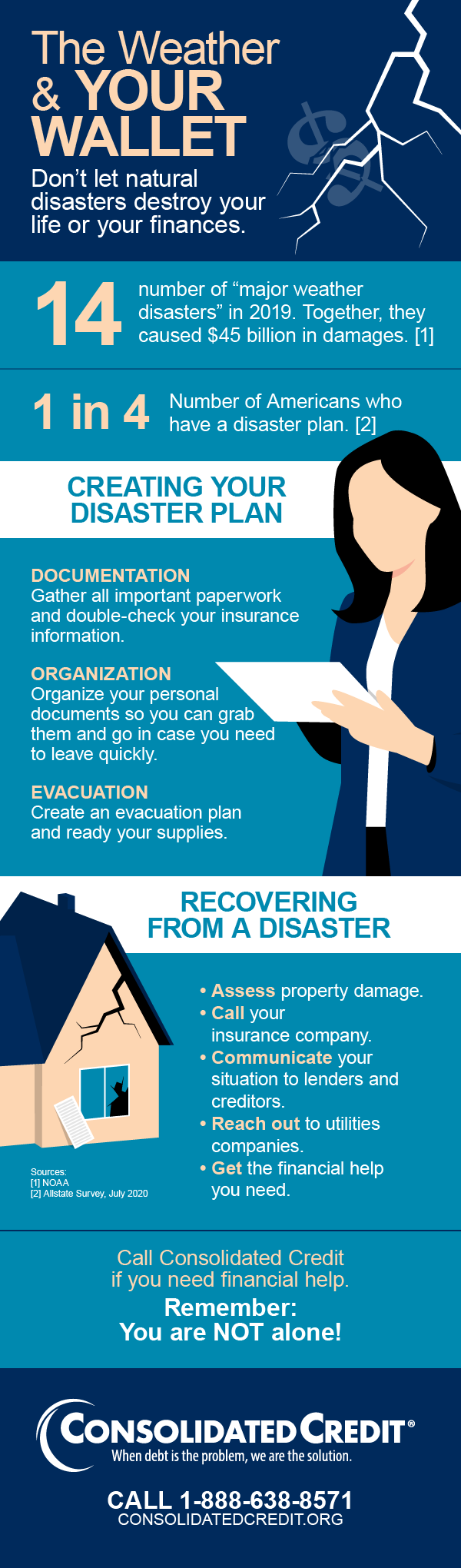

According to a July 2020 Allstate survey, 70% of Americans say they’re “concerned about weather-related disasters” – but only 1 in 4 Americans have a disaster plan.

That’s why our upcoming webinar highlights methods of preparing for natural disasters so you and your finances can stay safe.

Sign Up for a Free Disaster Planning Webinar

Natural disasters are hitting the U.S. hard this year and there’s still a few months to go in hurricane and fire seasons. Learn how this free webinar can help you prepare for the worst and weather the storm. Join us September 9 at 1:00 pm (EST) for this free webinar to make sure you’re prepared.

While natural disasters happen year-round, September is National Preparedness Month for a reason. It’s in the middle of hurricane season, and when NASA satellites have determined a lot of other natural disasters happen. How do you protect yourself from nature’s wrath? And how do you quickly recover if you’re caught in the path? We’ll show you how with our latest webinar. It’s free. Sign up now.

Do you have an evacuation plan for your money?

It’s essential to know where you’ll evacuate in an emergency, but your money also needs a plan.

Emergency savings

We always recommend keeping 2-3 months of living expenses in an emergency savings account at all times. If you find it difficult to save that much, start with a $1,000 goal.

Also, keep your emergency savings in an easily accessible account. Don’t invest it — it will be harder to get when you need it and you could end up losing it.

Keep in mind that you should have enough money to buy supplies before an event and to recover after the event.

Take out cash

If a natural disaster occurs, stores and gas stations may not be able to process credit cards. Withdraw some cash from your bank account to cover food and gas for at least a few days.

Contact creditors

You may be unable to make payments on your car, home, or other loans after a disaster. Be transparent with your lenders. The same goes for credit card companies. Many will make exceptions for those suffering after a catastrophic event.

The sooner you plan, the better

Putting off disaster prep can lead to a financial disaster later. This webinar will help you get started. Join us on September 9th at 1 p.m. to learn more about planning for weather woes.