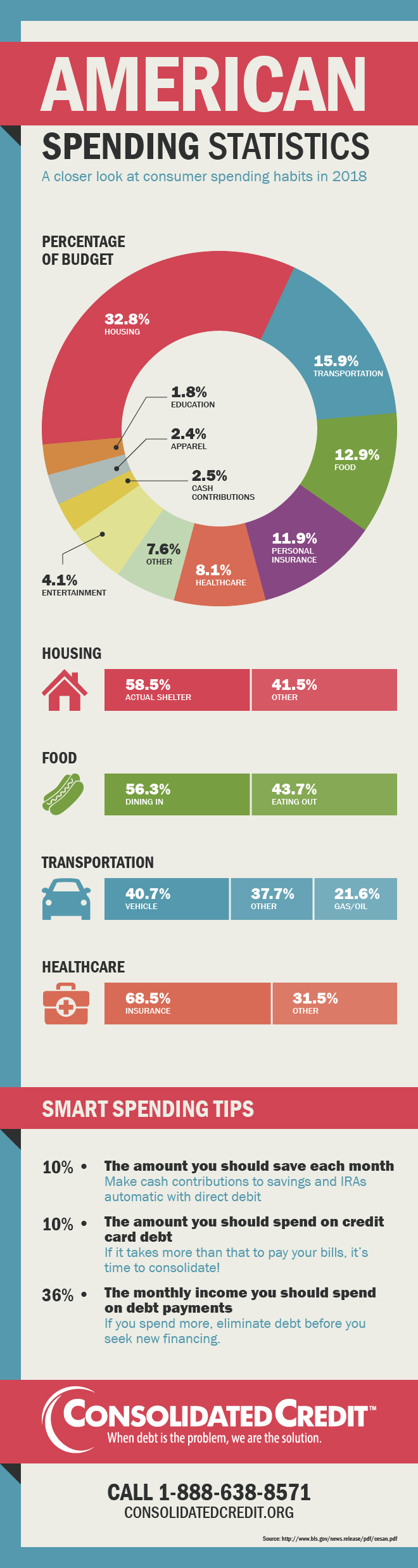

Breaking down how the average American household spends their money.

This infographic takes American household budgeting statistics from the latest Bureau of Labor Statistics (BLS) 2018 report. See how your spending stacks up versus other Americans.

Your primary goal: positive cash flow

Cash flow is the measure of how much cash you have available in your budget at any given time. It weighs income versus expenses.

- Positive cash flow means that you consistently spend less than you earn, meaning you have money left over each month once all your bills and expenses are paid.

- Negative cash flow means you spend more than you earn, leaving you to juggle bills, miss payments and choose between expenses to see what you can afford this month.

The more cash flow you have available at any given time, the less you’re walking the line of living paycheck to paycheck. Cash flow is also important because this represents the amount of money you have available to save to help reach your financial goals.

Ideally, you should permanently allocate a portion of cash flow to become “monthly savings” so you have savings planned into your budget. This helps you avoid savings becoming an afterthought that’s often missed at the end of every month. You can make this even easier by setting up a recurring account transfer between your checking and savings accounts or simply asking your HR department to divert part of your direct deposit to your savings account.

How to balance debt repayment versus savings

Often people put off saving because they say they’re focusing on eliminating debt. However, in a balanced financial life, you should really be doing both.

- Debt elimination should be a priority, particularly when it comes to high-interest credit card debt because it costs you money every month you carry a balance over to the next.

- Savings also needs to be a priority or else you won’t have any emergency savings fund on hand to cover unexpected expenses… or those unexpected expenses will simply turn into more credit card debt

Essentially, covering the minimum required payments on your credit cards should already be allocated within your budget. Then your free cash flow should be split between saving and debt elimination, so a portion gets saved in your emergency fund, while the remainder is used to make larger payments on one credit card debt at a time until all of your debts have been eliminated.

Once you have your emergency fund built up – ideally it should equal out to roughly 3-6 months of budgeted expenses – then you can put more of your attention on debt elimination until you have your credit card debt at zero.

This is a good strategy, because after your emergency fund you should start investing in order to help you money grow so you can reach long-term financial goals. The return on most investments is usually lower than the interest rate applied to a credit card debt. So while a long-term CD may earn 2% APY (annual percentage yield), your credit card may have 21% APR (annual percentage rate).

This is how you can strategically prioritize debt repayment versus savings. Just keep in mind that first you need to establish an emergency fund because otherwise every little extra expense will just lead to more high-interest debt.