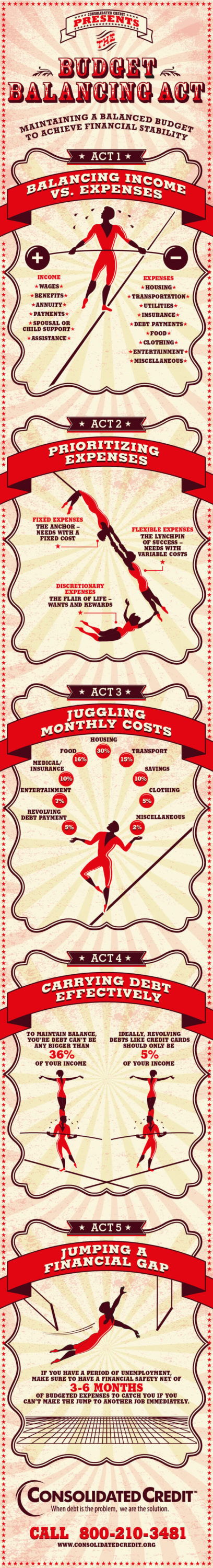

How to maintain a balanced budget in order to overcome challenges.

While it may not be the most exciting aspect of personal finance, maintaining an accurate household budget is the foundation of financial success in your personal life. Without a balanced budget, it can be almost impossible to juggle your bills while staying ahead of regular expenses and unexpected emergency costs that always seem to come up.

On the other hand, having a budget allows you to set practical limits on spending so you can maintain financial stability, avoid problems with debt and reach your financial goals. So is a budget really all that important in your financial life? Absolutely!

That’s why Consolidated Credit has put together the following infographic to help you understand how a budget works and how you keep all of the obligations and expenses you face any given month in check with the income you’re earning. Use the information below to help you make a budget that works for your family. If you need help or debt is keeping you from finding the balance you need, we can help. Call Consolidated Credit today at (844) 276-1544 or complete our online application to speak with a certified credit counselor.