Strategies to overcome your 4 biggest sources of debt.

Achieving freedom from debt is possible, but you need a strategic plan to eliminate these four sources of household debt. Consolidated Credit helps you understand the hurdles and how you can get over them.

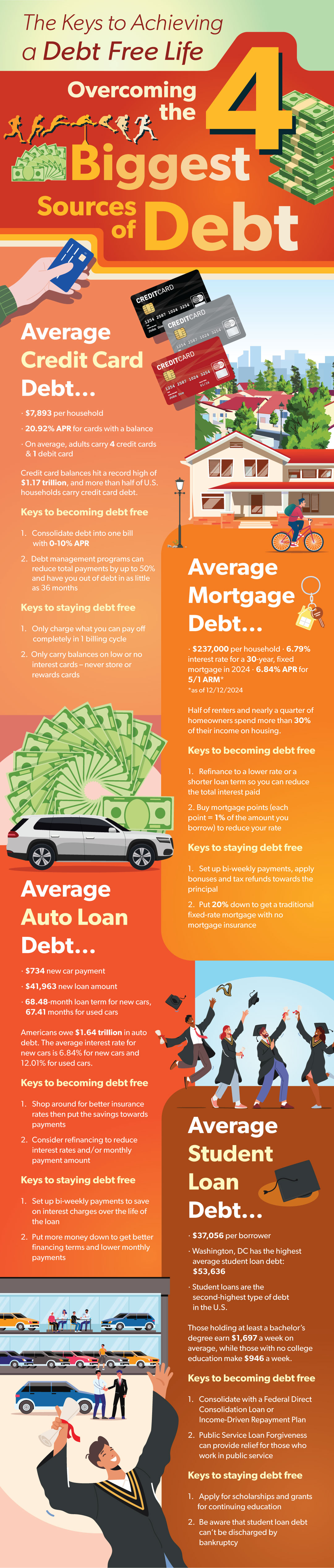

Keys to achieving a debt-free life: Overcoming the 4 biggest sources of debt infographic.

Don’t be satisfied with standard payment schedules

The real key to achieving freedom from debt is to be proactive. Sticking to the assigned payment schedules on your loans – and especially on high-interest credit cards – is an easy way to ensure you’ll be in debt for the rest of your life.

Instead, you need to review your budget and make plans to tackle your debts one at a time. Extra money should be devoted to making larger debt payments and extra payments. Make sure there’s no penalty for early repayment on loans and if there aren’t those can be paid off quickly, too.

Credit card debts and student loans are often easier to eliminate because both have options for debt consolidation. You can use a credit card debt consolidation strategy to make a plan that pays off your credit card debt efficiently. In many cases the right option for credit card consolidation lowers your monthly payments at the same time it lowers the interest rate applied to your debt. As a result, you can get out of debt faster even though you may be paying less each month.

Student loan consolidation programs can do anything from making payments more affordable for your budget to creating a payment schedule that speeds up over time as you advance in your career so you can pay off your loans quickly. In many cases, you can even consolidate and then make larger payments if you have the means.

Once you have the two sources of debt that tend to cause the most problems eliminated, you can move on to other debts like your car and home. For these, often the best way to eliminate the debt is to set up a bi-weekly payment schedule. The payments are typically half of what you’re paying each month. However, on a bi-weekly schedule you make two extra payments each year so you accelerate the debt elimination.

If you decide not to restructure your debt payments, simply consider paying off what you owe in large chunks. When you have extra money, make a larger monthly payment or an extra payment. Remember, as you pay off your mortgage, the interest rate may reduce gradually as you eliminate the debt, so your monthly payments will decrease as you get closer to zero. Still, pay what you can afford so you can eliminate the debt fast.