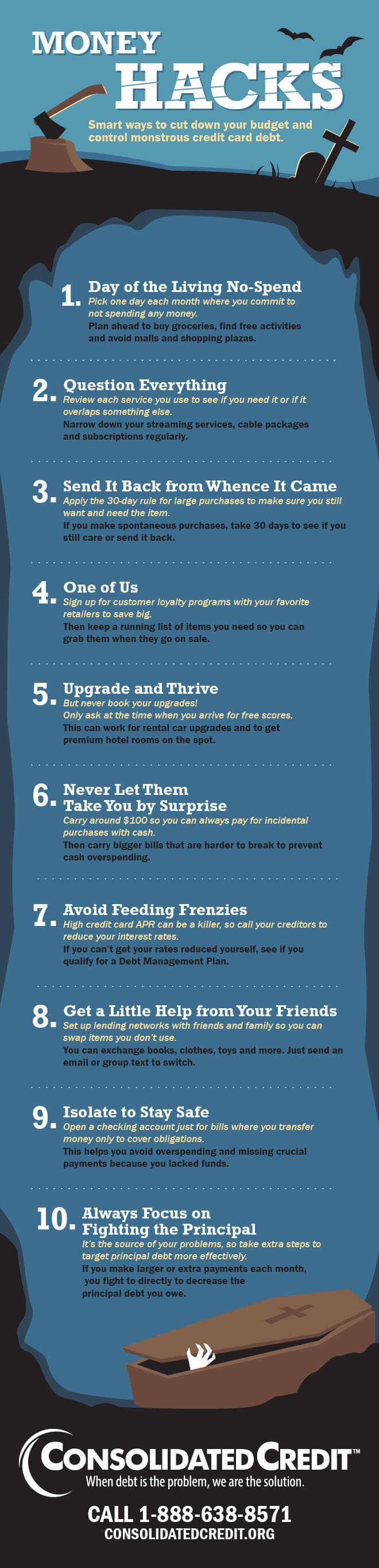

Don’t let monstrous debt take control of your budget and lead you into peril.

These days, the average household carries a frighteningly high amount of credit card debt – more than $16,000 per household. Use Consolidated Credit’s special Halloween infographic to find simple hacks that help you avoid big problems with debt. Below the infographic, you can find more tips to get ahead.

Money Hacks: Smart ways to cut down your budget and control monstrous credit card debt. 1. Day of the Living No-Spend: Pick one day each month where you commit to not spending any money. Plan ahead to buy groceries, find free activities and avoid malls and shopping plazas 2. Question Everything: Review each service you use to see if you need it or if it overlaps something else. Narrow down your streaming services, cable packages and subscriptions regularly 3. Send It Back from Whence It Came: Apply the 30-day rule for large purchases to make sure you still want and need the item. If you make spontaneous purchases, take 30 days to see if you still care or send it back. 4. One of Us: Sign up for customer loyalty programs with your favorite retailers to save big. Then keep a running list of items you need so you can grab them when they go on sale 5. Upgrade and Thrive: But never book your upgrades! Only ask at the time when you arrive for free scores. This can work for rental car upgrades and to get premium hotel rooms on the spot. 6. Never Let Them Take You by Surprise: Carry around $100 so you can always pay for incidental purchases with cash. Then carry bigger bills that are harder to break to prevent cash overspending 7. Avoid Feeding Frenzies: High credit card APR can be a killer, so call your creditors to reduce your interest rates. If you can’t get your rates reduced yourself, see if you qualify for a Debt Management Plan 8. Get a Little Help from Your Friends: Set up lending networks with friends and family so you can swap items you don’t use. You can exchange books, clothes, toys and more. Just send an email or group text to switch. 9. Isolate to Stay Safe: Open a checking account just for bills where you transfer money only to cover obligations. This helps you avoid overspending and missing crucial payments because you lacked funds. 10. Always Focus on Fighting the Principal: It’s the source of your problems, so take extra steps to target principal debt more effectively. If you make larger or extra payments each month, you fight to directly to decrease the principal debt you owe

More tips to help you stop monstrous debt in its tracks

#1: Budgeting is the best way to ward off debt

Creating a household budget gives you a few weapons you can use to ward off debt. First, it allows you to control your spending, so you don’t spend more than you make. This prevents you from relying on credit cards to cover shortfalls in your budget. Using credit cards for everyday expenses is a fast way to wind up in debt.

A budget also allows to you to save money consistently, creating an emergency fund to cover unexpected expenses. This way, if you have an out-of-pocket medical expense or an emergency car repair, you don’t have to use credit. You can dip into your fund, pay in cash and won’t have to worry about high-interest debt to repay.

#2: Put protections in place so you sense debt problems early

There are a few key ratios that you can use to monitor your financial health. When they hit a certain range, it gives you an early warning sign of financial hardship. So, you can use these ratios to keep ahead of potential trouble.

- Income-to-expense ratio: Divide your total monthly income by total monthly expenses. To maintain financial stability your ratio should be more than 1.25; if your ratio is less than 0.75, it’s a sign of financial hardship.

- Debt-to-income ratio: Divide your total monthly debt payments by your total income and multiply by 100. If your ratio is less than 36% then you are financially stable; anything over 41% means you will get rejected for new credit applications.

- Credit card debt ratio: Credit card debt payments should take up no more than ten percent of your income each month. Multiply your monthly income by 0.1 to determine the maximum amount you should pay. If your minimum payments ever go above that amount, it’s time to consolidate!

#3: Don’t take help from strangers

When you run into trouble with debt, it can lead to feelings of desperation. You’d take almost any help just to be rid of your problems. But this can lead to situations where you get scammed by people who prey on consumers in financial distress.

Never trust an offer of debt help unless you either know where it’s coming from or you thoroughly vet the source. If you don’t recognize a company that’s offering you a solution, look them up through the Better Business Bureau. You only want to work with companies that have an A rating or better. Check out reviews on independent, third-party review websites.

This will help ensure that you only get legitimate help from trustworthy professionals, instead of getting pulled in by a scammer out to make a quick buck.