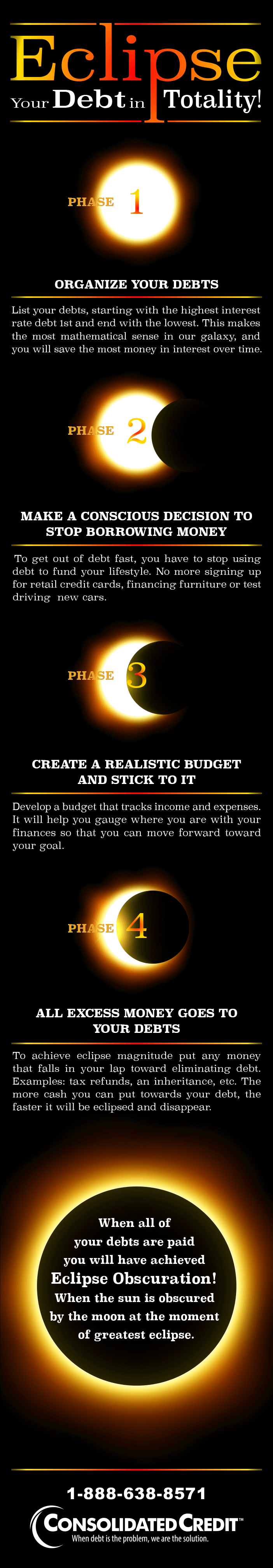

Moving through these four phases of debt elimination provides a way to eclipse your debt in totality!

In celebration of the total solar eclipse in 2017, Consolidated Credit created this infographic. It walks you through the four phases of debt elimination, so you can achieve a total eclipse of your debt.

Eclipse Your Debt in Totality! Phase 1: Organize Your Debts List your debts, starting with the highest interest rate debt first and ending with the lowest. This makes the most mathematical sense in our galaxy, and you will save the most money in interest over time. Phase 2: Make a Conscious Decision to Stop Borrowing Money To get out of debt fast, you have to stop using debt to fund your lifestyle. No more signing up for retail credit cards, financing furniture or test driving brand new cars. Phase 3: Create a Realistic Budget and Stick to It Develop a budget that tracks income and expenses.It will help you gauge where you are with your finances so that you can move forward toward your goal. Phase 4: All Excess Money Goes to Your Debts To achieve eclipse magnitude put any money that falls in your lap toward eliminating debt. Examples: tax refunds, an inheritance, etc. The more cash you can put towards your debt, the faster it will be eclipsed and disappear. When all of your debts are paid you will have achieved Eclipse Obscuration! When the sun is obscured by the moon at the moment of greatest eclipse.

Additional resources for each phase of your journey

Why it’s so critical to organize your debts

Experts recommend that you start with your highest interest rate debts first because they cost you more money over time. Let’s say you have a $1,000 credit card debt on a 2% payment schedule with a minimum payment of $20.

- At 15% APR, $7.50 of your payment goes to pay the principal and $12.50 covers accrued interest charges.

- However, at 20% APR almost all the payment –$16.67 – goes to accrued interest charges; only $3.33 pays off the actual debt you owe.

So, by paying off the high APR debts first, you can:

- Pay off your debt faster, because you pay off principal debts in a more efficient way

- Save money over the course of your elimination plan, because you pay off the high APR debts first.

This credit card debt worksheet can help you map out your plan »

Budgeting doesn’t have to be a pain

Most people would rather dive into a blackhole than sit down to make a budget. However, these days budgeting is not as bad or work-intensive as you may think. New technology makes it easy to build a budget that works to manage your finances without a lot of hassle.

Start by checking with your financial institution. Many banks and credit unions offer free budgeting tools to members through online banking platform. This is the easiest, because the program is already integrated with your main checking and savings accounts.

If you can’t find what you need through your bank, there are third party tools that do the same thing. Go online and search for Personal Financial Management.

Waning debt is worth cutting back

The more money you can put towards debt elimination, the faster you can reach zero. That means it’s in your best interest to cut back as much as possible to maximize your elimination funds. It’s a good idea to review the discretionary expenses in your budget to see what you can live without. Discretionary expenses are all the nice-to-haves in your budget – your wants.

Anything you can cut means a faster path to eclipse your debt. While you may not want to cut everything, at least find something to cut. See if you can limit the number of movie, TV or music streaming services you use. Mow your own lawn or cut back on dining out. Leave yourself some fun, so you don’t exhaust yourself on your budget diet; this can lead to more charging. But do what you can to cut back.

These videos can help you construct a stable budget: