The blessing and the curse of FinTech and e-commerce

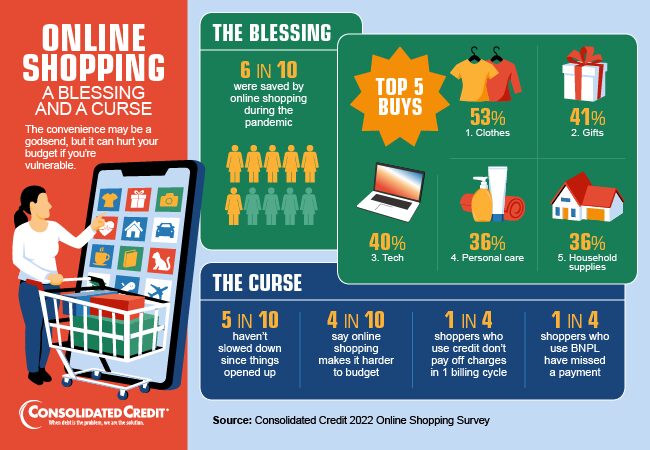

Consolidated Credit polled 940 U.S. adults to ask how their online shopping habits have evolved as a result of the pandemic. The results show shoppers haven’t scaled back even with brick-and-mortar retail fully open everywhere. And unfortunately, the convenience that shopping online offers may be causing some credit challenges.

More online shopping survey results

How often do you shop online?

- Never — 2%

- Rarely – 11%

- A few times a month – 37%

- Once a week – 16%

- A few times a week – 24%

- Almost every day or every day – 10%

Did you start shopping online more as a result of the pandemic?

- Yes – 64%

- No – 36%

Have you cut back now that things are open again?

- Yes – 48%

- No – 52%

What do you typically buy online? (check all that apply)

- Clothes – 53%

- Gifts – 41%

- Tech products – 40%

- Personal care – 36%

- Household supplies – 36%

- Pet supplies – 28%

- Office/work supplies – 28%

- Groceries – 26%

- Tools and parts – 26%

- Experiences – 25%

- Household goods – 26%

- Meals – 18%

Does the convenience of online shopping make it harder to budget?

- Yes – 46%

- No – 54%

Which payment method do you use for online shopping?

- Debit card – 29%

- Credit card – 38%

- Gift card – 6%

- PayPal – 13%

- Apple/Google/Samsung Pay – 3%

- Other – 2%

[Credit Card Users] When using a card for online shopping, do you pay off the charges within one billing cycle?

- Yes –78%

- No – 22%

Have you ever used a Buy Now Pay Later (BNPL) service?

- Yes – 46%

- No – 54%

[BNPL Users] Have you ever missed a BNPL payment?

- Yes – 23%

- No – 77%

What device do you use to shop online?

- Smartphone – 64%

- Computer/laptop – 27%

- Tablet – 10%

How important is free shipping when you shop online?

- I only buy if shipping is free – 45%

- I can pay, but only if it’s a good deal – 45%

- I just buy what I need regardless – 10%