Tips to help you come in under-budget for the holidays this year.

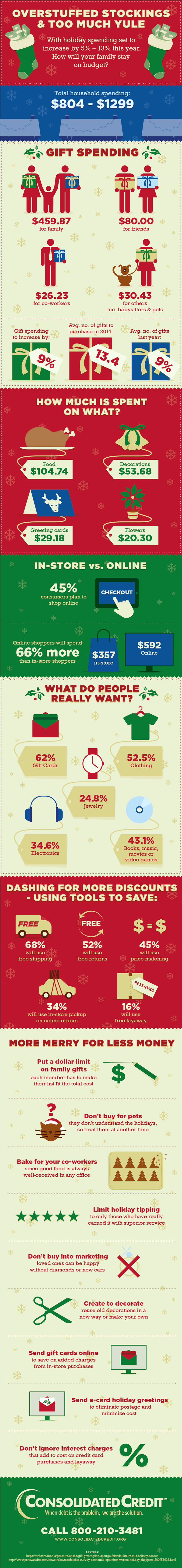

While Black Friday sales were down 11 percent from last year, most analysts still expect the average consumer will wind up spending more than they did in 2013. In fact, the average family can expect to spend about 5-13 percent more this year than they did last, once all is said and done.

All of these added costs right at the end of the year have a way of throwing your budget off. In the end, many consumers rely on credit cards to get through the holidays. As a result, the holidays cost even more with interest added before the debt can be paid off. It’s a bad way to start the New Year, because you’re already behind with debt.

With that in mind, Consolidated Credit has put together the infographic below to help you understand where you have the most risk of overspending for the holidays. We also offer some tips you can follow to get through the holidays without amassing more debt. If you have questions or you’re already in the hole and need help, call us at (844) 276-1544 to speak with a certified credit counselor or complete an online application form.