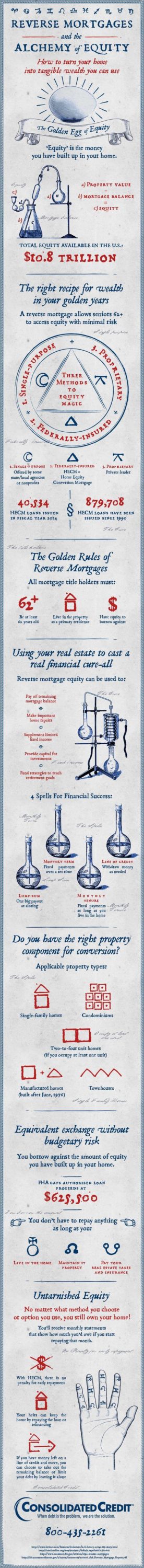

How seniors can turn their homes into tangible wealth.

A home is usually the biggest asset most people have in their financial portfolio, and having equity to borrow against can be a great benefit for homeowners in the right circumstances – especially for seniors.

Put simply, seniors age 62 and up have a unique lending tool they can use to access equity at minimal risk called a reverse mortgage. The challenge is that most people don’t really understand how reverse mortgages work and they often get confused with their riskier cousins, home equity loans. Still, unlike a home equity loan, a reverse mortgage can be an invaluable source of income that doesn’t put homes at risk of foreclosure or force seniors to take on another debt payment on limited fixed income.

With that in mind, Consolidated Credit has put together the following infographic that details everything you need to know about Reverse Mortgages and how they work. If you still have questions or you’d like more information, contact our Housing Department at 1-800-435-2261 to speak with a HUD-approved reverse mortgage counselor today.