Is the new student loan debt a really better bet for borrowers?

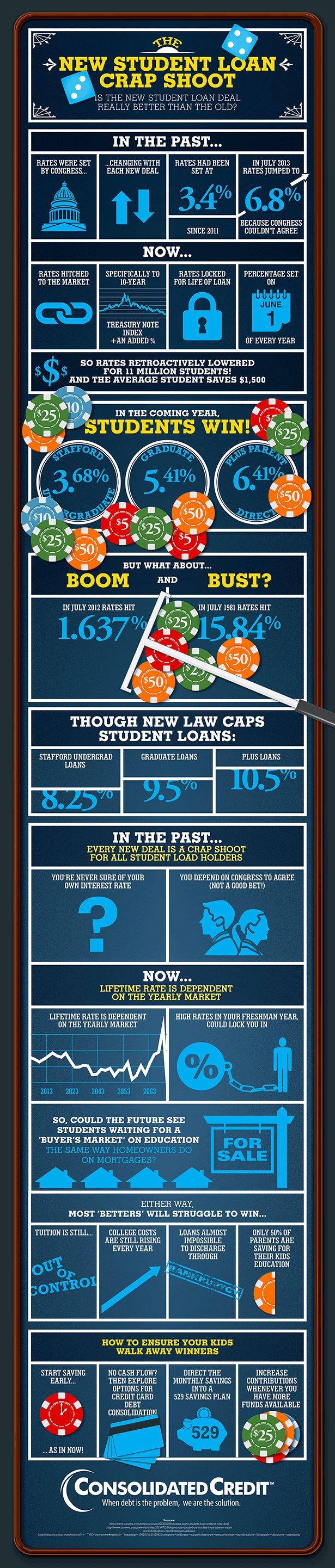

On August 8, 2013 President Obama signed a new student loan debt into law. The new regulations automatically cut most borrowers’ federal student loan interest rates by almost half, but with new rates tied to the T-note index, there’s a chance future borrowers could face higher rates. Here’s what you need to know about the new student loan debt and how it impacts your rates.

What to do if interest rates aren’t the real issue

Even if the new student loan deal works out perfectly and everyone benefits from lower rates both now and in the future, this still hasn’t really solved the actual problem. Tuition costs continue to rise and the cost of attending even an in-state public school can lead young Americans to borrow excessively.

As a result, students are leaving school with high student loan balances to pay off. Even with a low interest rate making it more affordable to pay off the debt long-term, it does nothing to fix the burden of the actual debt itself. The average student loan debt in the U.S. is now high enough that it would cover the cost of a new mid-sized sedan or the down payment on a first home. The fact that this money has to go to student debt, instead of being used to establish a borrower’s financial life following school is a big problem.

Also consider that much of the student debt in the country is not held by people who graduated from a 4-year university of master’s degree program. Often these debts are held either by those who attended a for-profit technical or trade college. The job opportunities available upon completion of these programs often don’t cover the debt you incurred to attend school.

Additionally, in many cases, the borrower doesn’t even graduate. They get locked into loans and receive bad advice for for-profit financial aid offices who really just want to turn a profit for that school. Then after getting into the program, they drop out or worse, the school closes and those borrowers are stuck.

And sadly student loan debt is not easy to get rid of by any other means other than paying it off. Student loans – even loans from private financial institutions can’t be discharged by bankruptcy. Think about that, you could have a car loan, a personal loan and a private student loan that all come from the same financial institution. If you declare bankruptcy, the personal loan may be discharged and the car liquidated to take care of the auto loan, but the student loan will remain with you no matter what.

This is why it’s critical for parents to take steps to help their children Afford College. Otherwise, they may start life in a financially weaker position because they’re burdened with student loan debt right out of school.