Debt Relief Nevada

Overcoming personal challenges with debt through credit counseling.

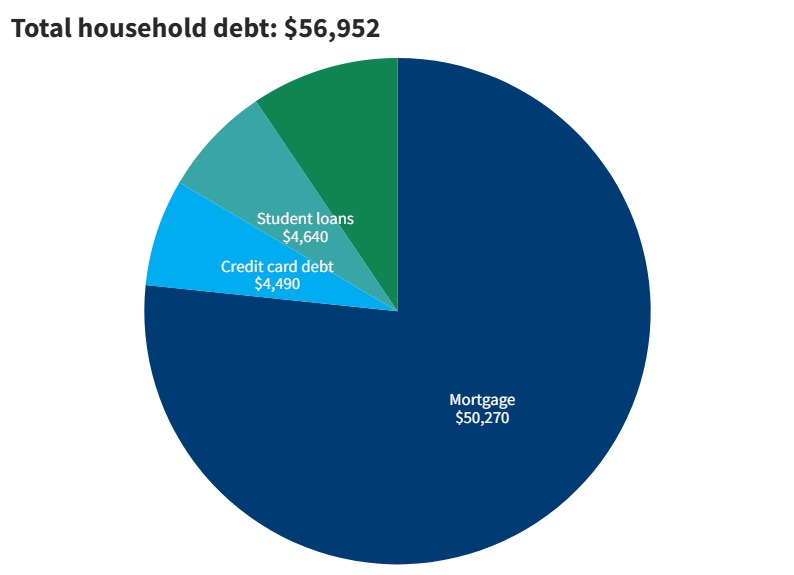

Borrowers aren’t exactly having an easy time with debt no matter they live in the U.S. but borrowers from Nevada are definitely faced with an uphill battle. Nearly one in four homes is underwater because the value of the home doesn’t even match the remaining balance on the mortgage. Five out of every 100 borrowers have at least one account that’s past due, while almost half have at least one debt in collections.

Luckily, there are solutions that can often help struggling borrowers find relief and regain control. If you’re facing challenges with debt that you can’t overcome on your own, give us a call at (844) 276-1544 or complete an online application to request a free debt analysis from a certified credit counselor.