Debt Relief New Hampshire

Residents overcome challenges with debt to achieve financial stability.

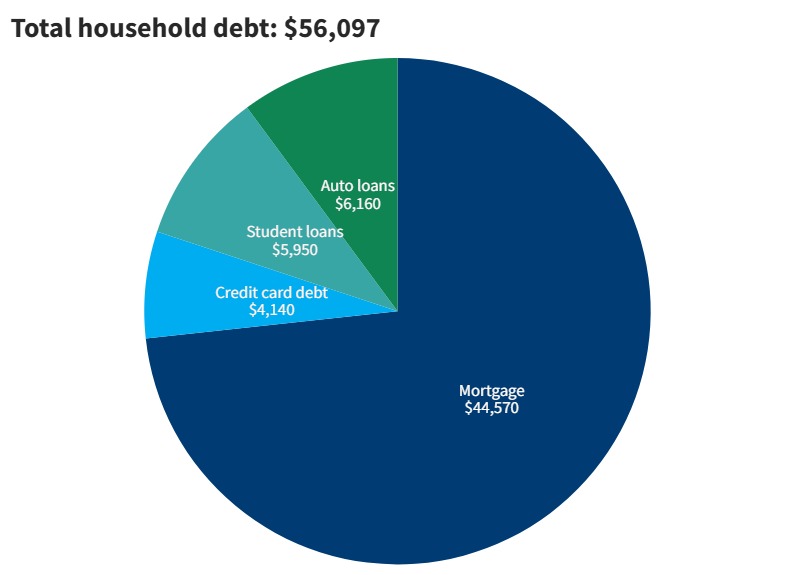

New Hampshire is no stranger to debt. The latest available data says that the average New Hampshire household has $11,108 in credit card debt. Citizens in this state collectively owe $5,522,703,700, an increase of $154,130,783 from the beginning of the year.

Thankfully, New Hampshire residents have found ways to achieve and maintain financial stability in spite of these challenges. Many borrowers have turned to debt consolidation to reduce credit card debt. If you’re in debt and exploring options to regain control of your own financial life, we can help. Call Consolidated Credit at (844) 276-1544 or fill out an online application to request a free, confidential debt analysis from a certified credit counselor.