Debt Relief in Action: South Carolina

South Carolinians use credit counseling to address challenges with credit card debt.

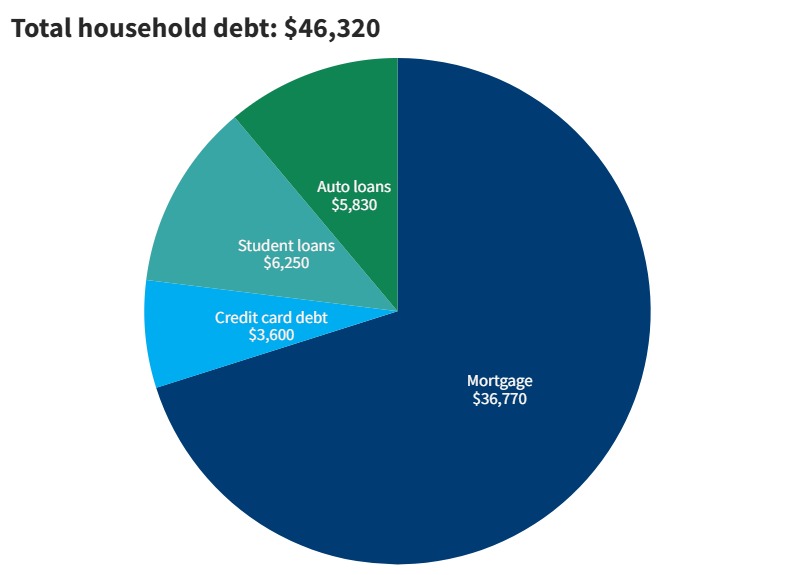

Debt problems aren’t isolated to South Carolina, but residents are definitely having a harder time when it comes to certain types of debt than consumers in other parts of the country – particularly when it comes to credit card debt. The average household owes $10,760.

As a result, many residents of South Carolina have sought solutions that will help them regain control faster than traditional payment means, including credit counseling. The information below can help you understand the state of debt in South Carolina and how some residents have used a debt management program to overcome those challenges. If you’re struggling, call us at (844) 326-7539 or complete an online application to get a free debt and budget analysis from a certified credit counselor.