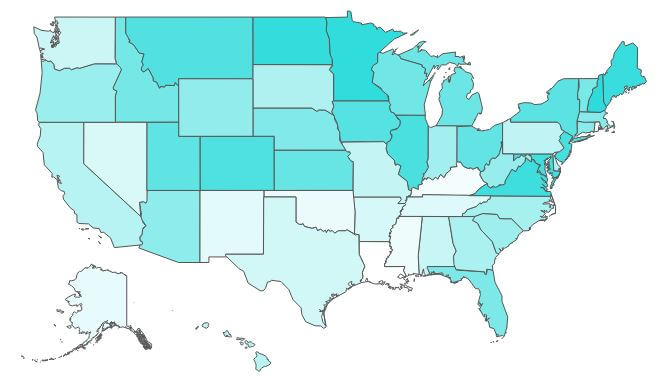

Financial Literacy Month Map reveals the most and least literate consumers.

Please click the map to view the interactive version, brought to you by WalletHub

The interesting study

If you didn’t already know, April is National Financial Literacy Month. To mark the occasion, WalletHub released a new interactive map that reveals the results of their 2017 Financial Literacy Study. They conduct the study each year to identify the least and most financially literate consumers in the U.S.

The big result

Based on three key metrics that evaluate financial literacy, WalletHub named these states as the most financially literate:

- New Hampshire

- Minnesota

- North Dakota

- Maine

- Virginia

On the other end of the spectrum, WalletHub declared these states as the having the lowest financial literacy scores:

- Oklahoma

- Mississippi

- Kentucky

- Rhode Island

- Louisiana

WalletHub also counts the District of Columbia. Technically, Louisiana placed 51st because D.C. ranked 50th.

The fascinating details

The study breaks overall financial literacy down into several categories. Some notable categories include:

States with the highest and lowest number of households with rainy day funds:

| Highest % of Households | Lowest % of Households |

|---|---|

| North Dakota | Tennessee |

| New Hampshire | Mississippi |

| Minnesota | Missouri |

| Hawaii | Oklahoma |

| California | West Virginia |

States with the most and least unbanked consumers:

| Least Unbanked | Most Unbanked |

|---|---|

| Vermont | Oklahoma |

| New Hampshire | Georgia |

| Maine | Alabama |

| Hawaii | Mississippi |

| Wyoming | Louisiana |

States with the most and least sustainable spending habits:

| Most Sustainable | Least Sustainable |

|---|---|

| Massachusetts | District of Columbia |

| Nebraska | Alaska |

| Michigan | Florida |

| North Dakota | Vermont |

| Wyoming | Delaware |

WalletHub also broke the results down by some demographics. Here are the highlights:

- Men scored higher than women (71 vs 66)

- Literacy increased on par with income level:

- People who make less than $25,000 annually scored 57

- Households at the middle-income range ($50-75K) scored 72

- Those at the top (income over $150,000 per year) scored 78

- Married people had the highest scores versus other marital status groups, averaging 74

- Minorities tend to struggle more with financial literacy:

- White, non-Hispanic averaged 72

- Asian / Pacific Islanders scored 63

- Black / African American averaged 59

- Hispanic / Latino scored 58

- Native Americas had the lowest scores at 54

- Literacy scores also go up on par in the following categories:

- Age (older consumers are more savvy than younger)

- Education level (higher education equals more financial literacy)

What you can do

What does “financially literate” mean? Financial literacy refers to the ability to understand basic financial concepts. If you are financially literate, you are effective at managing your money day-to-day; you are also better equipped to address financial challenges.

“Without knowledge, you leave your finances up to guesswork,” says April Lewis-Parks, Director of Education for Consolidated Credit. “That can be a recipe for disaster if you run into any trouble. Improving your financial literacy level makes it easier to achieve and maintain lasting stability. You can address challenges with confidence, instead of facing them with uncertainty. As a result, becoming financially literate decreases stress caused by money concerns.”

Consider your comfort level with various financial topics:

- Do you know the differences between types of bank accounts so you can choose the right accounts for your needs?

- If you ever need debt relief, how familiar are you with different debt solutions, such as consolidation?

- How confident are you about investing? Can you explain the advantages and disadvantages of stocks versus cash equivalents?

- Do you know how your credit score is calculated and how long negative items can remain in your profile?

“Take the month of April to build your knowledge base in any areas where you don’t feel confident,” Lewis-Parks explains. “This is a great month for research, because companies release a range of free resources to boost financial literacy.”

Use these free financial literacy resources!

Consolidated Credit offers the following resources to help you get started:

- Financial Literacy Quiz: 20 questions test your knowledge of basic topics

- 30-Day Literacy Checklist: Not sure where to start? This gives you a new task to do each day that can improve your literacy level

- Join the conversation Facebook: Consolidated Credit’s social media team releases a new tip each day. We also post weekly videos and more great resources. It’s the best place to go to get connected to your finances!