Be aware of these consumer scams as the pandemic continues.

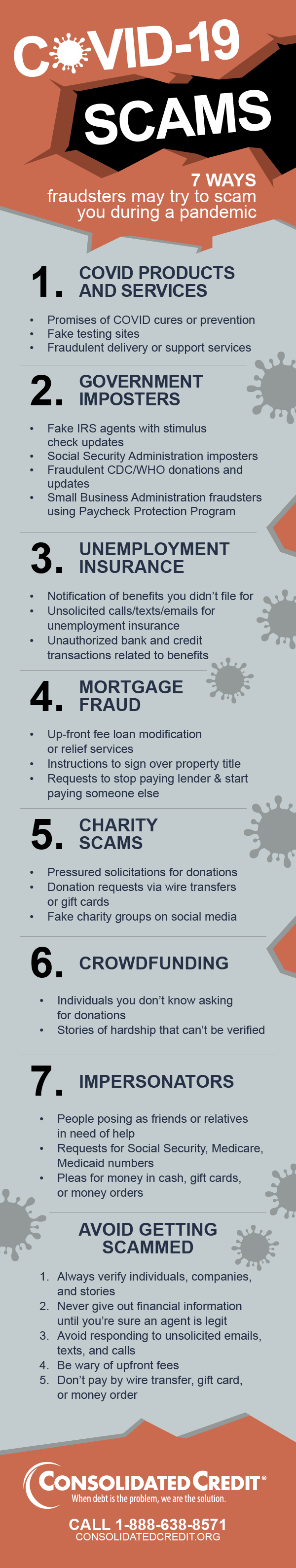

Federal agencies are warning consumers about seven scams that target consumers in the age of COVID-19. These scams prey on people’s anxiety about the virus and resulting financial crisis, as well as their desire to help others. As you manage your health and finances and work to help others, make sure that the people you give your information and donations to are legitimate. Otherwise, you could be at risk of identity theft or give your cash to scammers instead of those in need.

More information on these COVID-19 scams

There is a wide range of scams offering all things COVID-related. You may encounter everything from miracle prevention drugs and cures to cleaning services and air filtration products, to bogus COVID-19 testing sites.

COVID-19 testing site scams are amongst the worst because they can put you at risk of spreading COVID if you are, in fact, positive. If you are getting tested, you can:

- Check with your local police or health department to confirm the site you plan to visit is legitimate.

- Ask for the name of the healthcare provider or testing lab to confirm it’s a legitimate business.

If you encounter a COVID-19 product scam, report it to the Federal Trade Commission (FTC) immediately.

Finally, if you need support services, such as delivery services, grocery or prescription pick up or errand running, always find people through a known app or service. For example, if you need grocery delivery, use a service such as Instacart. Avoid using services like Craig’s List or finding people by printed flyers.

If you’ve been scammed by someone offering these types of services, report it immediately to your local police department.

Imposter scams have been around long before the pandemic, but now they have a COVID-19 spin to them. The most prevalent scam targets people looking for stimulus check payments. While millions of Americans have received their Economic Impact Payment (EIP), millions of others have not. People are also hurting and hopeful that Congress will provide a second round of stimulus.

Thus, scammers prey on that need for cash to steal your identity. They request your Social Security number to process your payment. You give them the number and now they can open loans and credit cards in your name, and even file your taxes to get your refund!

The same thing can happen to small business owners who are looking for information on the Paycheck Protection Program (PPP). The scammer will ask for your Employer Identification Number (EIN) and then can use that number to commit fraud.

To avoid this scam, always make sure you are talking to a legitimate government employee before you give out your Social Security number, EIN, or other information. Never text or email your number and do not enter it on websites you reach through unsolicited emails.

Millions of people are relying on unemployment benefits right now as our job market struggles to recover. Be aware that unemployment benefits always go through your state’s unemployment office. If you are unemployed, this assistance can be vital. You can find the right department through benefits.gov.

If you receive any information about unemployment benefits that you didn’t file for, it could be a sign that your identity has already been stolen. Someone may have used your information to file for benefits in your name.

Contact your state unemployment office immediately. You will also need to contact the IRS and the credit bureaus to inform them that your Social Security number may have been compromised. If someone is getting unemployment with your number, they can also open credit cards and loans in your name, as well as claim your tax refund.

As millions of homeowners struggle to keep up with their mortgage payments, fraudsters are taking advantage. They may promote fraudulent government relief programs or impersonate a lending agent from your mortgage lender or servicer.

Often, these scams charge upfront fees or attempt to get you to sign over the title to your home. Another variation gets you to start sending payments to the fraudulent company. You may think you’re getting a reduced payment when in reality you’re paying a scammer and falling behind on your actual payments!

Never take any action with your mortgage until you verify that you are speaking with someone from your mortgage servicer. Don’t answer calls from unknown numbers or open unsolicited emails regarding your mortgage. The best rule of thumb is that if you did not initiate the contact, proceed with caution.

The last three scams on the COVID-19 scam alert all revolve around preying on people’s desire to help others. If you’re not struggling yourself, then you may be doing everything you can to help people who are.

In most cases, these types of scams won’t put you at risk of identity theft. However, you won’t be helping people who actually need your donations. What’s more, once a scammer has you on the hook, they may continuously pressure you for more money, which can drain your funds.

For charities, always make sure to research the organization carefully before you donate. Donations are best done online on a secure website. Don’t give out your credit or debit card information by text or email, or over the phone unless you initiated contact with the charity. Never give donations by wire transfer or in the form of gift cards. You can verify charities through organizations like CharityWatch and Charity Navigator, or search the IRS database of tax-exempt organizations.

For crowdsourcing, as much as stories on Facebook and social networks may tug at your heartstrings, make sure to verify the identity of the person. It’s too easy for fraudsters to set up crowdsourcing with fake stories or for people to embellish their situation to get money. It’s best to only contribute if you know the person directly, or if someone you know can personally verify that the person and their story are real.

With the last version of a donation scam, the fraudster impersonates someone that you know. A family member or friend needs help, so they reach out to you. Again, never give money by wire transfer or gift card. If you’re giving them cash, do it in person and not by money order.

In a different impersonator scam, a relative may ask for your Medicare or Medicaid numbers. If you give them out, you will likely get billed for medical procedures you did not authorize.

| Type of scam | Who to contact |

|---|---|

| Suspicious products and services | Contact your local police department and your State Attorney General, then submit a complaint with the Consumer Financial Protection Bureau |

| Identity theft | Report the theft to the FTC through IdentityTheft.gov and contact the credit bureaus (Experian, Equifax, TransUnion) |

| Imposter scams and impersonators | File a complaint through the FTC complaint portal |

| Social Security scams | Contact the Social Security Office of the Inspector General |

| Economic Impact Payment (EIP) scams | Content the FBI Internet Crime Complaint Center (IC3) |