It’s never too early to get ready for tax filing season! Join us February 9 to learn of a few tax hacks that will help you plan ahead.

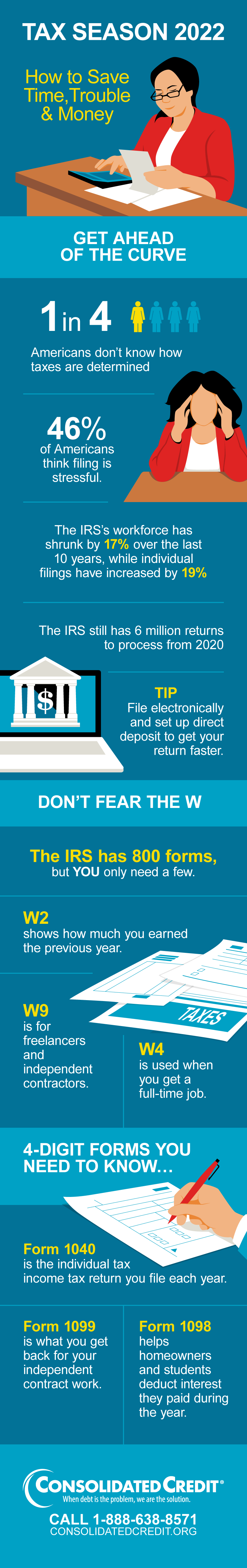

2021 was one of the most, if not the most, challenging years for both taxpayers and tax professionals due to delays in tax return processing. Between increased filings to claim stimulus payments and millions of people needing to file amended returns for unemployment issues, it was no surprise the IRS faced processing delays. In fact, the IRS currently has a backlog of 6 million unprocessed tax returns and another 2.3 million amended returns to get through.

As a result, taxpayers could be facing more delays in 2022. That’s why it’s more important than ever to file as soon as possible be prepared with the correct paperwork. Consolidated Credit is here to help with a free Tax Hacks webinar on Wednesday, February 7.

Filing Income Taxes – Sneak Peek of New Free Webinar

Tax season 2022 is officially open! You can now file your 2021 annual income tax returns anytime between now and April 18, 2022. But the IRS is encouraging people to file early this year or refunds could be delayed! Consolidated Credit is here to help with a free webinar on February 9. Watch this video to get a sneak peek of what we’ll cover!

The 2022 tax season is officially open. Get ahead of the game by filing early. The IRS is warning there may be delays this year; saying you should file online and set up direct deposit if you want to get your refund as soon as possible. And Consolidated Credit is here to help with a free webinar where you can learn how to file your income tax properly to keep the IRS at bay.

You’ll learn about IRS forms that you need to know, how to get the most out of your tax refund, and how long you have to pay off a balance with the IRS.

Sign up free today and join us Wednesday, February 9th, 2022.

Tax season has officially started, so you don’t have to wait until the deadline to file. But if you’re going to file, then you need to get organized and make sure you have all the forms you need.

Tax tips to make 2022 easy for you

File early

Tax season officially started on Monday, January 24, 2022. So, you can file anywhere between now and April 18, 2022. It would be in your best interest to file as early as possible. Because the sooner you file, the sooner you’ll have your tax refund in hand.

File electronically

Paper is the IRS’ kryptonite. So even they’re encouraging people to file electronically to expedite processing. If you file by mail, just expect it will take longer for the IRS to process your return and longer to get your refund.

Make use of the IRS Free File

You may think the IRS is out to get you, but they just want to help make things easier for both you and them. Take the IRS Free File system for example. You can use Free File so long as your Adjusted Gross Income (AGI) in 2021 was $73,000 or less. But that’s not all. There are actually a few different online tax services that use Free File, so take advantage of them and save a little more.

File even if you can’t pay

Make sure you file even if you cannot afford to pay the taxes you may owe. Why? Because the penalties for not filing are much worse than for filing and not paying everything off immediately.

Save all your records

Any and all documents or letters you’ve received from the IRS should be kept in safe place. Be aware that the IRS will only contact you through mail. So, if you get any emails or calls from the IRS, it’s most likely a scam.

However, if you owe the IRS money, you may be contacted by third-party debt collectors who are collecting back taxes on behalf of the IRS. If you get a call from a debt collector for back taxes, ask them for an IRS authentication. That way you can verify if the collectors work for a legitimate company or not.

Find your refund

Within 24 hours of e-filing your tax returns, you’ll be able to track your return either on the IRS website or through the IRS app.