The emergency forbearance on student loan payments is expected to end in October.

Americans owe more than $1.5 trillion in student loans, most of which are federally-owned. Since the start of the pandemic, the Department of Education set a pause on student loan payments and interest rates. But that pause is set to end on Oct. 1.

Consolidated Credit is here to help borrowers prepare for payments to begin again with its free webinar, Free Yourself from Student Loan Debt. You’ll find out which federal loan repayment is best suited for your budget and circumstances.

Free Yourself from Student Loan Debt

Americans are burdened with over $1 trillion in student loan debt. Although federal student loans are in forbearance until October 1, it’s the right time to develop a plan to pay off your student loans. Get a quick preview of our free webinar that will be held on July 14 so you can learn about repayment plans and forgiveness programs.

Student loan debt can hold you back from your financial goals for years.

This free Consolidated Credit webinar will teach you which federal repayment program might work best for you.

Even if you’re strapped for cash, there are repayment plans that offer affordable payments.

Sign up for free today then join us Wednesday, July 14th

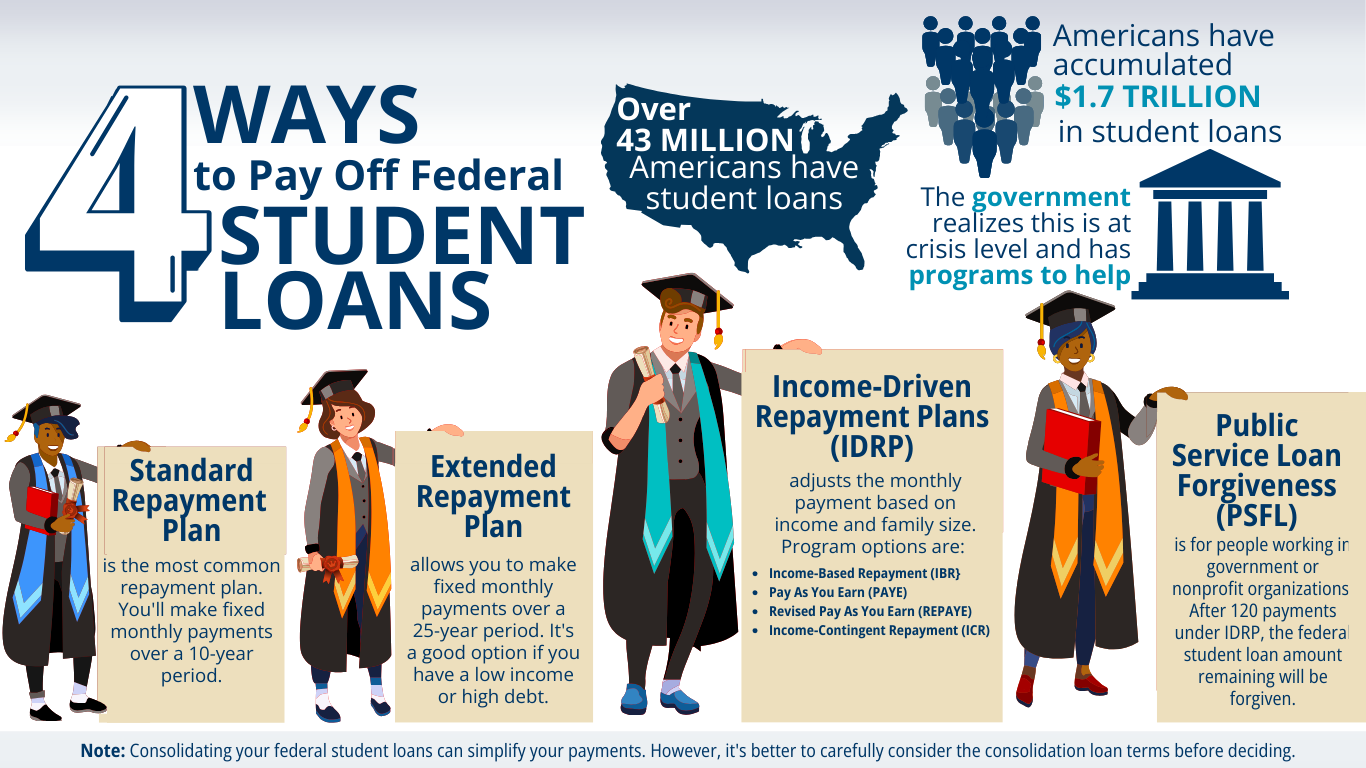

4 Federal Loan Repayment Plans to Consider

In this free webinar, our financial experts will walk you through the pros and cons of each of these plans. This infographic shows an overview of some of the plans you’ll learn about.