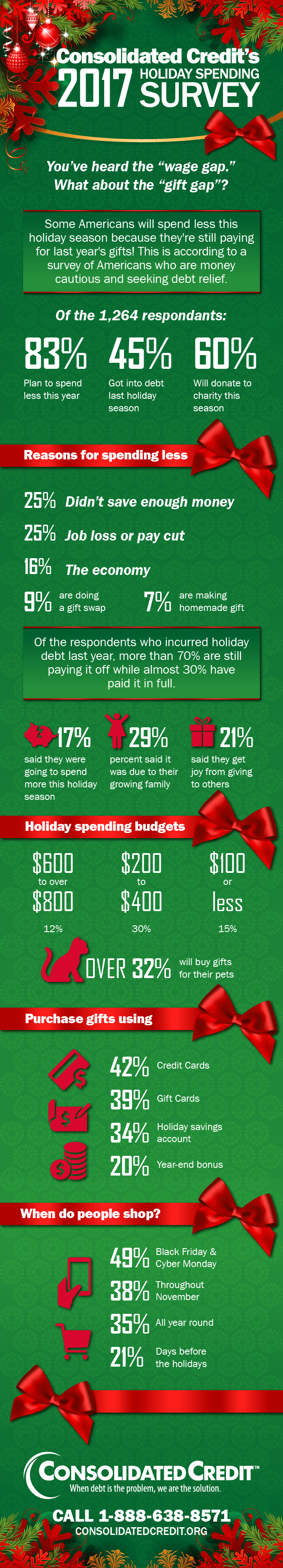

How Americans holding credit card debt plan to get through the holidays without amassing more debt..

Each year, Consolidated Credit asks clients and other people that have reached out to us for debt help to tell us about their holiday spending plans. In 2017, we received 1,264 responses. Here are the results…

Consolidated Credit’s 2017 Holiday Spending Survey You’ve heard of the “wage gap.” What about the “gift gap”? Some Americans will spend less this holiday season because they’re still paying for last year’s gift, according to a survey of Americans who are money cautious and seeking debt relief • Of the 1,241 respondent almost 83% reported that they plan to spend less this year • Over 45% said they got into debt last holiday season • Close to 60% will donate to charity this season Reasons for spending less: • 24.83% have less income due to a job loss or pay cut • 24.83% didn’t save enough money this year to spend more • 16.26% the economy • 8.57% are doing a gift swap • 7.11% are making homemade gifts Of the respondents who incurred holiday debt last year, more than 70% are still paying it off while almost 30% have paid it in full. • 17% said they were going to spend more this holiday season o 28.57% percent said it was due to their growing family o 21.18% said they get joy from giving to others Holiday spending budgets: • $600 to over $800 – 12% • $200 – $400 – 30% • $100 or less – 15% Over 32% will buy gifts for their pets Purchase gifts using: • Credit Cards 42.08% • Gift Cards 38.67% • Holiday savings account 34.38% • Year-end bonus 20.42% People do their holiday shopping: • 49.07% Black Friday & Cyber Monday • 38.01% Throughout November • 34.54% All year round • 20.95% Days before the holidays