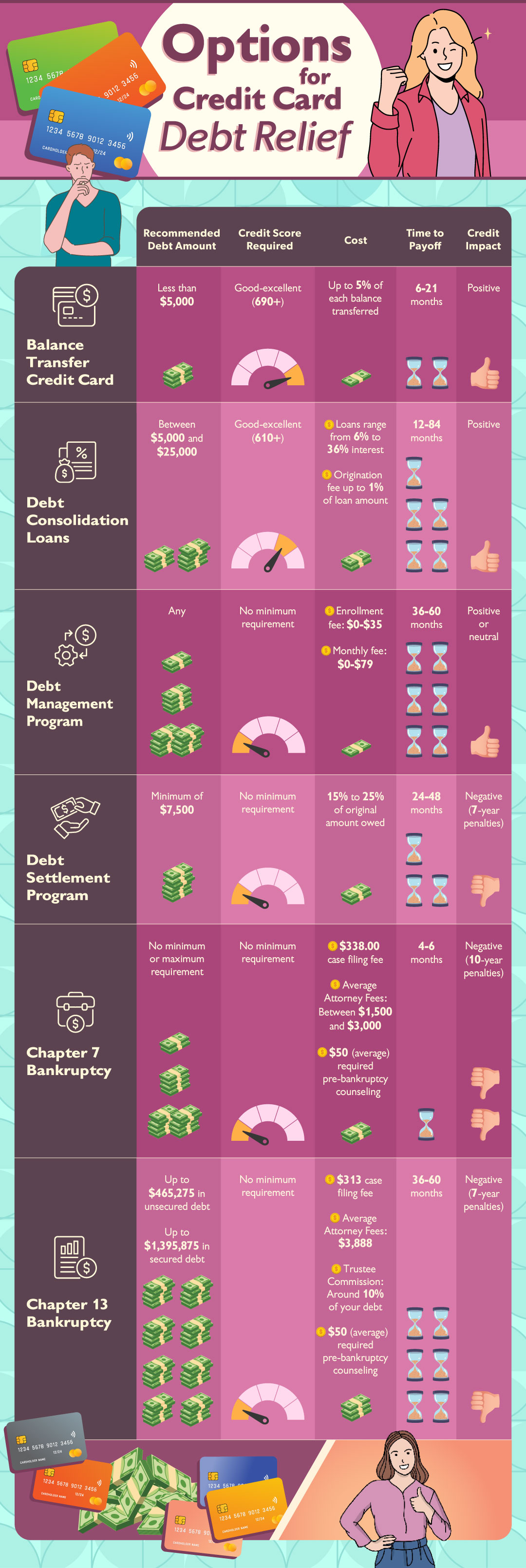

When traditional monthly payments aren’t working to pay off credit card debt, these solutions can provide relief. The best one to choose depends on your financial situation. This infographic helps you understand how the most common debt relief options compare based on five key factors.

Still not sure which debt solution is right for you? Talk to a certified credit counselor for a free debt and budget evaluation.