Don’t pay for a credit repair service when you can dispute errors in your report for free on your own.

Important Note: Debt elimination should always come before credit repair. If you’re currently in the process of paying off debt, it’s recommended that you complete your elimination plan first. Then you can review your credit to make sure your profile reflects your debt free status.

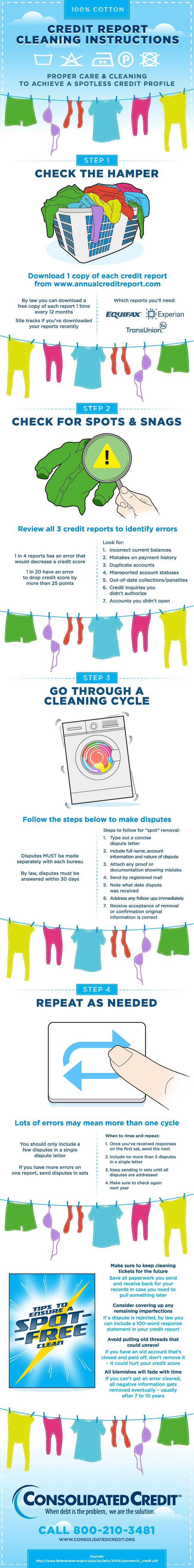

Credit Report Cleaning Instructions Proper care and cleaning to achieve a spotless credit profile. Step 1: Check the hamper Download 1 copy of each credit report from annualcreditreport.com By law, you can download a free copy of each report 1 time every 12 months. Site tracks if you’ve downloaded your reports recently. Which reports you’ll need: Equifax, Experian, TransUnion Step 2: Check for spots and snags Review all 3 credit reports to identify errors 1 in 4 reports has an error that would decrease a credit score 1 in 20 have an error to drop credit score by more than 25 points Look for: 1. Incorrect current balances 2. Mistakes on payment history 3. Duplicate accounts 4. Misreported account statuses 5. Out-of-date collections/penalties 6. Credit inquiries you didn’t authorize 7. Accounts you didn’t open Step 3: Go through a cleaning cycle Follow the steps below to make disputes. Disputes MUST be made separately with each bureau By law, dispute must be answered within 30 days. Steps to follow for “spot” removal 1. Type out a concise dispute letter 2. Include full name, account information and nature of dispute 3. Attach any proof or documentation showing mistake 4. Send by registered mail 5. Note what date dispute was received 6. Address any follow ups immediately 7. Receive acceptance of remove or confirmation original information is correct Step 4: Repeat as needed Lots of errors may mean more than one cycle You should only include a few disputes in a single dispute letter If you have more errors on one report, send disputes in sets When to rinse and repeat: 1. Once you’ve received response on the first set, send the next 2. Include no more than 5 disputes in a single letter 3. Keep sending in sets until all disputes are addressed 4. Make sure to check again next year Tips to Ensure a Spot-Free Clean Make sure to cleaning tickets for the future: Save all paperwork you send and receive back for your records in case you need to pull something later. Consider covering up any remaining imperfections: If a dispute is rejected, by law you can include a 100-word response statement in your credit report. Avoid pulling old threads that could unravel: If you have an old account that’s closed and paid off, don’t remove it – it could hurt your credit score. All blemishes will fade in time: If you can’t get an error cleared, all negative information gets removed eventually – usually after 7 to 10 years Source: https://www.federalreserve.org/pubs/biulletin/2004/summer04_credit.pdf

Routine Credit Repair is Crucial for Creditworthiness!

Lenders and creditors judge you based on the information contained in your credit report. Negative information can make you seem like a high-risk borrower. That can lead to rejected loan applications, higher interest rates and less flexible lending terms. So, it’s critical to repair your credit regularly to keep your credit profile as clean as possible.

Tip No. 1: Review your reports at least once per year

The Fair Credit Reporting Act (FCRA) is the federal law that protects your right to maintain a clean and error-free credit report. It requires that all credit bureaus must provide a free copy of your credit report upon request for free. You can do this once every twelve months with each bureau.

The bureaus created a web portal that allows you to download all three reports from one place. It’s annualcreditreport.com.

When you go to the portal, you have the option of download just one report, two or your reports from all three bureaus. So, how many reports should you download?

- If this is the first time you’ve reviewed your credit, download all three. There’s no guarantee that they say the same thing, so you want to make sure all your reports are error-free.

- If this is your annual review and you plan to apply for credit this year, just download one. This will allow you to see what your profile says, so you can take steps to address and mistakes. It also gives you time to build credit before your financing application. Then, just prior to applying, you can download the other two to ensure your reports are all error-free.

- If you just completed a debt elimination plan, download all three. You want to make sure that your reports show that your debts are paid and your accounts are in good standing.

Routine Credit Repair is Crucial for Creditworthiness!

Lenders and creditors judge you based on the information contained in your credit report. Negative information can make you seem like a high-risk borrower. That can lead to rejected loan applications, higher interest rates and less flexible lending terms. So, it’s critical to repair your credit regularly to keep your credit profile as clean as possible.

Tip No. 1: Review your reports at least once per year

The Fair Credit Reporting Act (FCRA) is the federal law that protects your right to maintain a clean and error-free credit report. It requires that all credit bureaus must provide a free copy of your credit report upon request for free. You can do this once every twelve months with each bureau.

The bureaus created a web portal that allows you to download all three reports from one place. It’s annualcreditreport.com.

When you go to the portal, you have the option of downloading just one report, two or your reports from all three bureaus. So, how many reports should you download?

- If this is the first time you’ve reviewed your credit, download all three. There’s no guarantee that they say the same thing, so you want to make sure all your reports are error-free.

- If this is your annual review and you plan to apply for credit this year, just download one. This will allow you to see what your profile says, so you can take steps to address and mistakes. It also gives you time to build credit before your financing application. Then, just prior to applying, you can download the other two to ensure your reports are all error-free.

- If you just completed a debt elimination plan, download all three. You want to make sure that your reports show that your debts are paid and your accounts are in good standing.

Need to craft a debt elimination strategy before you work on your credit? Talk to a certified credit counselor now!

Tip No. 2: Know when negative items should expire

One of the trickiest (and most important) errors that you need to correct is when negative items should drop off your report. Negative items don’t stick around forever. Eventually, they naturally expire and disappear from your report; that’s supposed to happen without requiring any specific action on your part. However, sometimes penalties linger even after the expiration date.

Most penalties drop off after seven years from the date the negative history occurred. For instance, a missed payment drops off seven years after you missed the payment. So, if you incurred a missed payment in May 2011, then by June 2018 it should no longer appear in your report.

Negative Items in Your Credit Report

Learn when negative items will fall off naturally from your credit report, so you can plan strategically when you want to review your reports.

Welcome back, contestants, to the Game of Good Credit!

Do you have the right strategy to win? The game of good credit is easy to win with the right moves. And winning means you achieve a good credit score that helps you get approved with low rates. But some actions you take can set you back.

By law, filing for bankruptcy hits you with a penalty that sets you back 10 years from the date of filing. Except if you file for Chapter 13 – the bureaus stop the penalty after 7 years. This minimizes the setback so it’s easier to recover.

Things that happen outside your credit file can also affect your game – civil suits, court judgments and records of arrest can come up. These public records remain for 7 years from the date of entry OR as long as the current governing statute of limitations allows – whichever is longer.

Unpaid taxes can also set you back. A paid tax lien sets you back seven years from the date the lien was paid. On the other hand, if you leave a lien unpaid it can stop you in your tracks and remain indefinitely until you pay it off. That is, except in Experian’s game where the penalty for unpaid tax liens ends after 15 years.

Every time you pay on time it creates a positive space that stays on your credit forever and pushes you ahead. But each time you pay more than 30 days late, it sets you back 7 years from the date the payment was missed. And the longer a debt goes unpaid, the more it sets you back. If you let it go unpaid too long, the creditor writes off the account and changes the status to charge-off. Charge offs also set you back 7 years.

There is one exception to that rule… If you default on a federal student loan and then bring it current, any negative actions from the late payments disappear. But for all other debts, charge-offs are usually sold to collections, which creates ANOTHER trouble space that causes issues for 7 years. So, letting a debt slip into default is almost a double or triple whammy to your game.

However, don’t believe a collector if they say they have ways of ruining your credit game forever. That’s just not true. Nothing you do can get you kicked out of the credit game forever. Any penalty you encounter will only set you back. But you can offset these setbacks by taking positive actions that help you move forward. So even if your period of financial distress puts you back at Square One, you can start again and get right back in the game.

For more information on winning the Game of Good Credit, visit ConsolidatedCredit.org

Tip No. 3: Be brief and concise with dispute letters

An incorrectly worded dispute can lead to a rejection, so you need to be careful about how you frame disputes. Keep letters brief and concise. Provide your name and relevant account numbers at the top of the letter. Then explain concisely what the issue is with the item. Don’t give backstory on what happened, how you felt or how the creditor treated you during a customer service complaint.

Remember, the credit bureaus only want the facts. Can the information be verified or not?

Consolidated Credit offers a free downloadable guide to credit repair that includes a sample dispute letter. It also has a selection of helpful worksheets for making disputes.

Repair Your Credit

CreditMistakes in your credit report can drag down your score, making it harder to qualify for financing at low-interest rates. But you have a right to review your reports each year and dispute information that you believe is incorrect. This process is known as credit repair. Learn how it works and how to repair your credit for free on your own.

Open Booklet Download BookletFree Credit Repair vs. Paid Credit Repair Services

As we say, the credit repair process is something you can do entirely on your own for free. There is no need to pay a professional credit repair service to dispute errors on your behalf. If you have limited income or a tight budget, you should go through the process yourself to avoid any additional costs.

That being said, you can hire a company to repair your credit for you as long as they have a state-licensed attorney on staff who is authorized to make disputes on your behalf. The Credit Repair Organizations Act (CROA) states that you can grant a state-licensed of attorney Power of Attorney to make disputes on your behalf.

This can save you time and help ensure your disputes are successful. Credit repair attorneys have experience making disputes, so they know how to word them to get results. This can also be beneficial if you have a large number of disputes to make.

If you decide to use a paid service, make sure to follow these tips:

Tip No. 1: Be cautious with national credit repair services

CROA specifically states that the only individual authorized to make disputes on your behalf is a state-licensed attorney. That means a national credit repair company would need to employ attorneys licensed in each state in order to operate within the letter of the law.

This means it’s usually better to look for local credit repair services, instead of national ones. If you decide to use a national service, make sure they expressly state that they have a network of licensed attorneys on staff. If they don’t, then the service may not be legit.

Tip No. 2: Be very wary of big claims without guarantees

The primary goal of the repair process is not to improve your credit score. The goal of repair is to clean up your credit report. So, any improvement to your score is more of a happy side effect than a direct aim.

This means you should be careful of credit repair services that claim to improve your score by a certain amount. Saying that their service will improve your score by 100 points isn’t something they can promise. It depends on where your score starts and how many negative items remain after any discrepancies are removed.

Any direct claim about your credit score should raise red flags. If a company makes such a claim, then it should provide a money-back guarantee. Make sure you have this guarantee in writing.

It’s worth noting that a company cannot even guarantee that it will get negative items removed. If you legitimately incurred a negative item and the information be verified, then it generally can’t be removed. You can only remove mistakes and errors that are not verifiable.

So, if you missed six months of payments, there is no legal credit repair service that can remove the information. It’s legitimate, so you must wait for the penalties to expire. In the meantime, you can take steps to build credit to offset any damage to your score.

Tip. No 3: Never violate the law on someone instructions

Credit repair services that don’t have state-licensed attorneys on staff aren’t operating according to the law. But there are other services that are much worse. They’re scams and if you follow their advice, you could be criminally prosecuted.

These scam services prey on your desire to fix your credit score quickly. They claim to have a magic bullet solution that can immediately get around any negative items you’ve incurred. You simply need to start a new credit profile. To do this, you use a fake Social Security Number or use an Employer Identification Number (EIN).

Both of these practices amount to credit fraud, which is a felony offence. You can face significant fines and even jail time if you follow this advice. And tracking down the companies responsible for getting you into trouble can be almost impossible. They regularly close shop and open business under a new name.

If you get this advice from a repair service, do not sign up for anything! End the conversation and contact the Consumer Financial Protection Bureau (CFPB) and Fair Trade Commission (FTC).

Have a question about credit repair or your credit score? Ask Consolidated Credit’s certified experts!