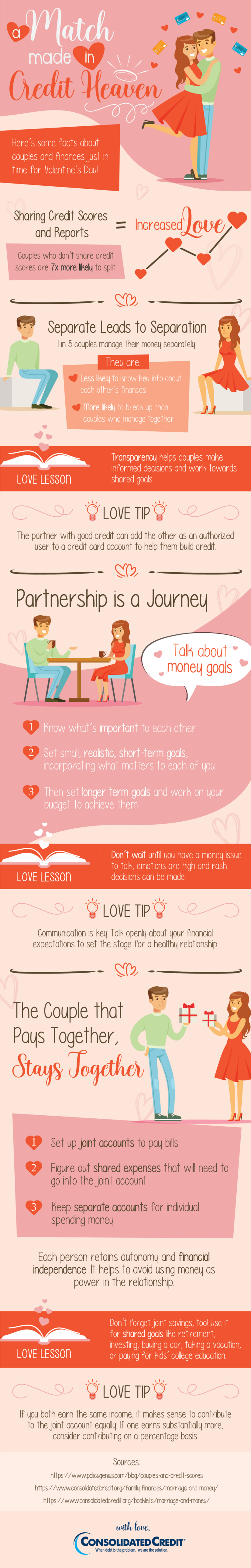

Start strengthening your relationship by talking about that taboo subject: money. This infographic explains how working together financially can help your bond emotionally.

A Match Made in Credit Heaven Sharing Credit Scores & Reports = Increased Love Couples who don’t share credit scores are 7x more likely to split Separate leads to separation 1 in 5 couples manage their money separately They are… • Less likely to know key info about each other’s finances • More likely to break up than couples who manage together Love Lesson: Transparency helps couples make informed decision and work towards shared goals. Love Tip: The partner with good credit can add the other as an authorized user to a credit card account to help them build credit. Partnership is a journey Talk about money goals: 1. Know what’s important to each other 2. Set small realistic, short-term goals, incorporating what matters to each of you 3. Then set longer term goals and work on your budget to achieve them Love Lesson: Don’t wait until you have a money issue to talk, emotions are high and rash decisions can be made. Love Tip: Communication is key. Talk openly about your financial expectations to set the stage for a healthy relationship. The Couple that Pays Together, Stays Together 1. Set up joint accounts to pay bills 2. Figure out shared expenses that will need to go into the joint account 3. Keep separate accounts for individual spending money Each person retains autonomy and financial independence. It helps to avoid using money as power in the relationship. Love Lesson: Don’t forget joint savings, too! Use it for shared goals like retirement, investing, buying a car, taking a vacation, or paying for kids’ college education. Love Tip: If you both earn the same income, it makes sense to contribute to the joint account equally. If one earns substantially more, consider contributing on a percentage basis. Sources: https://www.policygenius.com/blog/couples-and-credit-scores https://www.consolidatedcredit.org/family-finances/marriage-and-money/ https://www.consolidatedcredit.org/library/marriage-and-money/