Make your wallet and your sweetheart happy with gifts of experience.

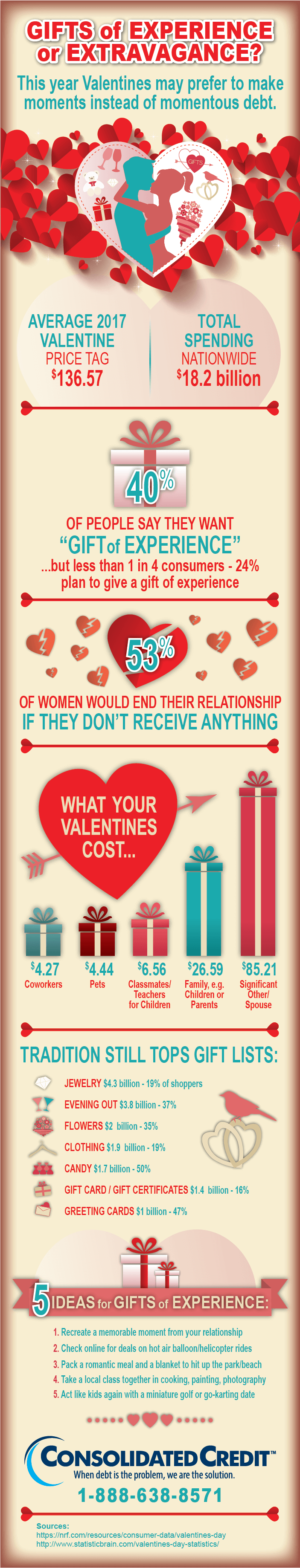

This year, our Valentine’s Day infographic looks at Valentines gifts. Statistics many people actually prefer “gifts of experience” over high-dollar material presents that often turn into high interest rate credit card debt.

Don’t increase your cost with credit card interest charges

A $137.57 price tag for average Valentine’s Day spending may not seem like much. That’s especially true when consider that you may still be paying off winter holiday debt that totaled over $1,000. However, it adds up.

If you charge $137.57 to a credit card at the current average APR of 15.42% and make only minimum payments, it will be 10 months before you eliminate the debt completely. Over that time you’d add another $9.54 in interest charges to the cost of your purchases. So the total price tag ends up being $145.54.

Again, that’s not breaking the bank, but it does cost you more money. That’s roughly $10 you could have spent on something else.

“The best gift you can give your budget is to pay off your credit card balances in-full every month,” says Gary Herman, President of Consolidated Credit. “Credit card interest charges are only applied if you carry a balance over from one billing cycle to the next. So if you pay off your balances every month you can minimize interest charges and save money.”

Smart Saving Tip: Plan ahead for gifts in your budget

The money you save should always be divided and allocated for different goals. In addition to an emergency savings fund and savings for retirement, you should also save for specific needs. If you allocate some of savings and set money aside for gifts, you can avoid credit card debt. By gifts with cash you saved keeps one-off out-of-budget expenses from going on high interest credit cards. It can be a good strategy to maintain a balanced budget.

More helpful resources to spread the financial love

These resources can help you plan, save and budget more effectively:

- Credit card debt payment calculator – find the right repayment strategy to eliminate your debt faster!

- Smart saving guide – learn how to budget so you can save consistently and use cash instead of credit on major purchases

- Video: How to Save Money Everyday – get more helpful tips on how to save money on different everyday expenses so you can improve cash flow and avoid debt