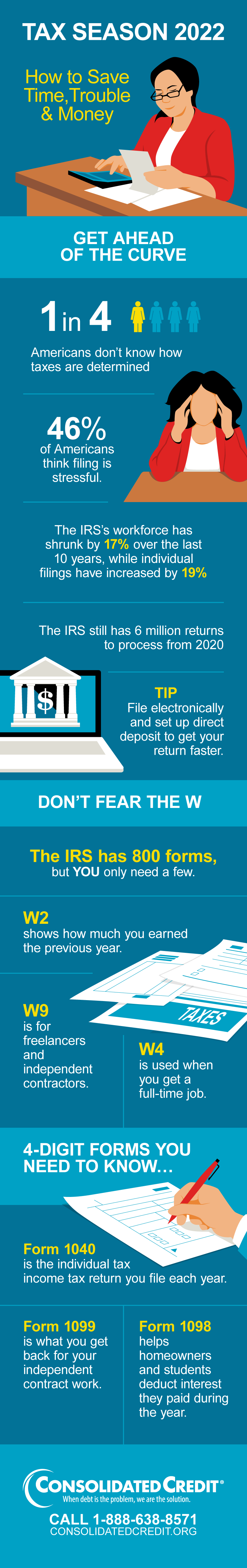

Tax season is coming ‘round again! You know what that means—it’s time to gather up those tax documents so you can file as soon as possible in 2022. Since the IRS still has a backlog of tax returns from last year, it’s your best interest to try and file right away. Tax season officially opened on January 24, so you can file as soon as you’re ready. But you may still be wondering what documents you need and what all the W’s mean. That’s why Consolidated Credit has crafted this infographic to help make it easier on your eyes and mind.

If you still have questions that were left unanswered, sign up for our free Income Tax Hacks: How to Save Time, Trouble & Money webinar on February 09, 2022 at 1:00 pm.