Consumers with high debt-to-income ratios often require professional help to get out of debt because they can’t qualify for do-it-yourself solutions.

FORT LAUDERDALE, Fla., Jan. 20, 2022 /PRNewswire/ — As credit card bills roll in this month, consumers are shocked at just how much they charged over the holiday season. The average person spent a staggering $1,249 on the holidays, according to a report by CNBC, and much of that cost landed on credit cards. Unfortunately, high balances also mean higher payments. So how do consumers who are already dealing with record inflation pay off record holiday credit card debt?

“If your credit card debt has grown out of control, the key to paying this credit card debt off as quickly as possible in this economy may be to consolidate your debt which can reduce your monthly payments as well as your interest rates,” says Gary Herman, President of Consolidated Credit. “Higher prices may be leaving little room in consumers’ budgets to pay off credit card debt. So, people need to find a solution to reduce their payments.”

The good news is that there is a relief option designed to do just that, known as debt consolidation. It rolls credit card balances into one affordable payment. In the right circumstances, it helps someone to pay off debt faster even though they may be paying less each month.

Debt consolidation works by combining several debts and minimizing interest. You lower the high-interest rates, so then payments can go towards paying off the principal debt.

“Consolidated Credit’s certified credit counselors specialize in helping people find the best way to consolidate,” Herman explains, “because there may be more than one way to do it. You can use a balance transfer, a debt consolidation loan, or enroll in a debt management program through a non-profit credit counseling service. They all consolidate debt, and they all work in different situations.”

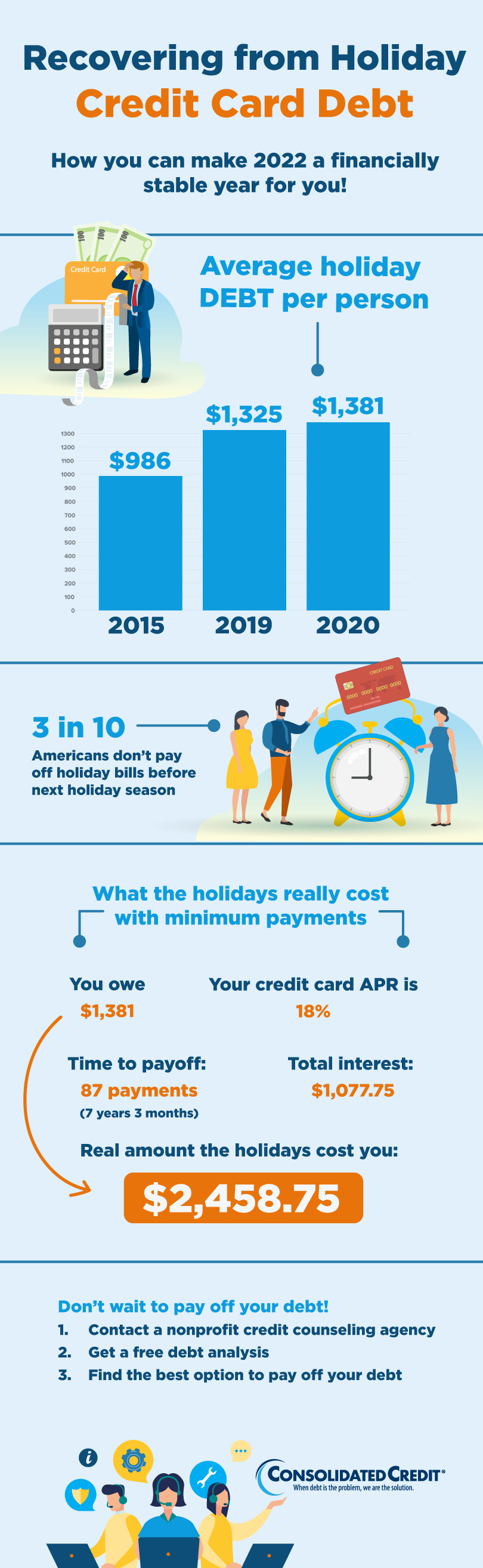

A balance transfer works best for a limited debt amount spread across multiple credit cards. You need good credit to qualify for the longest 0% APR period possible. A debt consolidation loan works for consumers with good credit and has more debt than what can be paid off during a 0% APR promotion period. A debt management program works for people with too much debt to qualify for a loan or a balance transfer. The certified credit counselors at Consolidated Credit can provide a free debt and budget analysis to help consumers find the best way to consolidate. Call 1-800-728-3632 to get started.

About: In 29 years, Consolidated Credit has helped over 10.2 million people overcome debt and financial challenges. Their mission is to assist families throughout the United States to end financial crises and solve money management issues through education and counseling.