Foreclosure Prevention Counseling

Consolidated Credit is approved by the U.S. Department of Housing and Urban Development (HUD) to help you achieve sustainable homeownership. Our HUD-certified housing counselors are experts in foreclosure prevention and can discuss all available options for dealing with a delinquent home loan. Work with a counselor today to create a personalized action plan to prevent foreclosure.

What is foreclosure prevention counseling?

Foreclosure prevention counseling is a HUD-certified service that helps homeowners struggling to afford their mortgage payments. Foreclosure counselors can help homeowners explain options to understand homeowner’s rights and resources to avoid foreclosure (or what to expect of the process) and minimize damage to credit caused by missed mortgage payments.

If you need assistance in preventing foreclosure, Consolidated Credit’s certified housing counselors have the experience to help you develop a unique personal plan of action for you and can assist Spanish and Creole speakers. Call us today at 1-800-435-2261 to speak with a certified housing counselor or request a consultation online now. Foreclosure prevention counseling is free and confidential.

7 Options to avoid foreclosure

There are many options available for homeowners who are struggling with their mortgage payments and may face foreclosure. The following provides an overview of each of the options you may be able to use:

Refinancing allows you to secure a new mortgage loan with new terms, including a new interest rate and/or monthly payment schedule. This completely replaces your current mortgage and may help make mortgage payments more manageable within your budget. Even if your home value has decreased so your home is worth less than what you owe on your mortgage, you may be able to refinance your loan.

- Makes your monthly mortgage payment more affordable by lowering your interest rate and/or adjusting the terms of your loan

- Will not have any negative impact on your credit score

- Allows you to stay in your home and avoid foreclosure

A repayment plan is a personal agreement between you and your mortgage lender. It allows you to pay the past due amounts on your mortgage payments over a specified time period in order to bring your mortgage up to date. Mortgage lenders are often willing to work with homeowners to make special payment arrangements in order to avoid the expense and potential losses that would be caused by foreclosure.

- Allows you to catch up on past due payments over an extended period of time

- May be less damaging to your credit scores than foreclosure

- Helps you stay in your home and avoid foreclosure

Forbearance is an offer by your mortgage lender to temporarily reduce or suspend your monthly mortgage payments for a specified period of time. This can give you’re the breathing room you need in your budget to regain your financial control before your regular monthly payment schedule is reinstated. You can get back on the road to financial stability without losing your home to foreclosure.

- Gives you time to improve your financial situation so you can get back on your feet

- May be less damaging to your credit scores than foreclosure

- Helps you stay in your home and avoid foreclosure

Mortgage modification is an agreement between you and your mortgage lender to change the original terms of mortgage, such as the payment amount, the length of your loan or amortization schedule, and more. Modification options are often available to homeowners who face a situation where their home is worth significantly less than the value of the original mortgage, as many homeowners experienced in the real estate market collapse.

Mortgage modification benefits:

- May reduce your monthly mortgage payment so they are more affordable for your budget

- May be less damaging to your credit scores than foreclosure

- Helps you stay in your home and avoid foreclosure

A short sale is where you sell your home for less than the balance remaining on your mortgage. Whereas in a normal sale, the sale price will be more than what’s still owed on the mortgage, a short sale leaves a balance owed with your mortgage lender. However, if your mortgage company agrees to a short sale, you may be able to sell your home and pay off your mortgage balance with the proceeds. It’s important to note your lender may require you to cover any remaining balance owed once the short sale is complete in what’s known as a deficiency judgment.

Short sale benefits:

- Eliminate or reduce your mortgage debt

- Relocation assistance may be available

- May provide faster credit score recovery so you can get another mortgage faster than if you went through foreclosure

A deed-for-lease is a program that allows you to temporarily lease your home. First you transfer ownership of your home to the mortgage lender (called a Deed-in-Lieu of Foreclosure, see below) in exchange for a release from your mortgage loan and monthly payments. Then you can rent the property back at an affordable rate and remain in the home as a tenant. While you don’t maintain ownership of the asset, you can at least stay in your home.

Deed-for-lease benefits:

- Allows you to stay in your home so there is no need to move or relocate to a different city or neighborhood

- May provide faster credit score recovery so you can get another mortgage faster than if you went through foreclosure

- Relocation assistance may be available at the end of your lease

- Allows you to avoid foreclosure

With a deed-in-lieu of foreclosure (DIL), you transfer the ownership of your property to your mortgage lender in exchange for a release from your mortgage and monthly loan payments. Effectively, you return the deed to the mortgage company so they can sell the property to recoup their losses. It’s important to note that in some cases, the lender may pursue a deficiency judgment against you if the sale price of the home is less than the remaining balance owed on your mortgage.

DIL benefits:

- Eliminate or reduce your mortgage debt

- Relocation assistance may be available

- May provide faster credit score recovery so you can get another mortgage faster than if you went through foreclosure

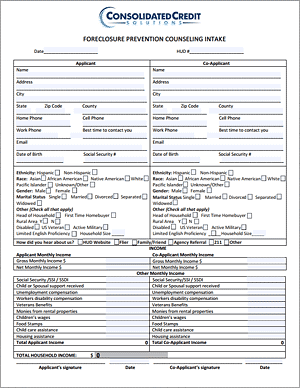

Foreclosure Prevention Counseling Intake Form

Get started with online foreclosure prevention counseling application.