How to Get a Good Credit Score for Free

Improving your FICO credit score can qualify for loans and credit cards at low rates.

A credit score is a three-digit number that tells lenders how likely you are to repay debt and whether you’re a good candidate for new credit. Having a bad credit score can make it difficult to get approved for loans and credit cards. If you are approved despite having bad credit, then you’ll face higher interest rates and strict repayment terms that make borrowing more expensive.

Game of Good Credit

Achieving and maintaining a good credit score and a clean credit profile is a constant game of strategy. By knowing what moves to take to build credit and what moves to avoid so you don’t damage your score, you can develop an effective credit management strategy that helps you hit and keep up the high credit score you really want.

Come on down! You’re the next contestant on the Game of Good Credit!

Achieving good credit is a game of strategy. You have to play tactically if you want to win.

Let’s begin with the basic gameplay of how to go from the starting point to winning the game of good credit so you can maximize your credit score. The overall goal in the game is to move forward from the starting point, taking the right steps to reach your credit goal.

Each step you take can have a positive, negative or neutral effect. You want to make smart moves that boost your score, while avoiding traps that set you back. Positive actions like making payments on time and keeping your credit utilization low help move you forward. And doing things like paying off a credit card in full can give you a big jump up the board. But actions like paying late or allowing an account to go into collections can set you back and put you farther away from your credit score goal.

As you play the Game of Good Credit, keep in mind that even if you have to make a really bad move it doesn’t mean you’ll have bad credit forever. You may just have to start again to begin moving forward toward the score you want. Most negative actions set you back for 7 years. Although some things like Chapter 7 bankruptcy can set you back longer. But if you have a setback, you can start to move forward immediately!

The BEST move you can make is to pay your bills on time – this is the biggest factor in calculating your score. Each time you pay a credit card or loan on time it’s a positive action that lets you move forward. If you’ve had setbacks, start making payments on time to move forward again. But keep in mind that the amount of credit you use affects how quickly you can move up the board.

Credit utilization is the second biggest factor in calculating credit scores – that’s the amount of debt you have relative to your total available credit. The less debt you have, the faster you can advance towards better credit. So by keeping your debt low and making payments on time you can forward to get closer to your credit goal.

Length of credit history is the third biggest factor in your score – creditors believe people who have been playing the game longer are better at it. So don’t close your oldest accounts or let creditors close them due to inactivity, because this can actually set you back. Keep accounts in good standing and you’ll get an extra boost on your way to a winning credit score.

The number of times you apply for new credit within a six month period is a factor in your credit score. If you try to take too many new credit moves at once, you can actually get set back. Only draw a new loan or credit card when you really need it, and don’t apply for credit cards in quick succession. That way getting new credit will be a neutral action that doesn’t set you back.

The type of credit and number of accounts you have also has an impact on your ability to win the game. If you pick up a diverse variety of debts along the way like a mortgage and other loans along with a credit card or two, you’ll have an easier time reaching your goal.

We have a few tips that can help put the big win within reach. Be aware that you can be penalized paying late as well as for moves that you didn’t actually take. This happens when negative items appear in your credit report by mistake – the credit bureaus think you made a bad move when you really didn’t. If this occurs, you have the right to dispute the item to have it removed. If you’re successful with a dispute, you’ll move up the board.

Additionally, players often think asking for help will set them back from reaching a winning credit score. But using services like credit counseling if you’re having trouble can actually help you move forward faster instead of setting you back. Completing a debt management program helps you eliminate credit card debt and may aid in helping you build a positive payment history. It can also help you avoid major setbacks on the board like debt settlement and bankruptcy. So you can get the help you need and still reach your ultimate credit goal, allowing you to win at the game of good credit to improve your financial standing overall.

Make the move to Consolidated Credit and let us help you develop a winning strategy to help you eliminate debt so you can achieve your credit goals.

What is a good credit score? What is a bad credit score?

There are several different scoring models. The most popular is FICO, which is used by creditors in 90% of lending decisions. The second most popular is VantageScore 3.0, which is the score used by the three credit bureaus. Both scores range from 300 to 850. Higher is always better.

| FICO Range | Score Designation |

|---|---|

| Above 750 | Excellent |

| 700-749 | Good |

| 650-699 | Fair |

| 550-649 | Poor |

| Below 550 | Bad |

| VantageScore 3.0 Range | Score Designation |

|---|---|

| 781-850 | Super Prime |

| 661-780 | Prime |

| 601-660 | Near prime |

| 500-600 | Subprime |

| 300-499 | Deep subprime |

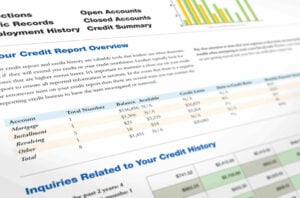

How is credit score calculated?

A person’s credit score is evaluated based on five factors: payment history, credit utilization, average credit age, the different types of credit a person has, and how many recent credit inquiries they’ve made.

Payment history

Payment history is the biggest factor used to calculate credit scores. Whether you make your payments on time (or not) makes up 35% of your score. If you have no missed payments and all your accounts are in good standing, you’ll rank well here. Late or missed payments will hurt your standing in this category.

The payment history factor also looks at account status. Bills in default, collections, or unpaid due to declaring bankruptcy will strongly impact this area.

Credit utilization ratio

Credit utilization ratio measures how much credit you are using compared to your total available credit. This number gives lenders an idea of how heavily you’re relying on credit.

Calculating your credit utilization is easy, it’s current balance ÷ total available credit. Let’s say you have three credit cards, each with a limit of $1,000. Your total available credit line would be $3,000 (3 x $1000). If you had a balance of $1,500 between those cards, that would come out to a credit utilization ratio of 50% ($1,000 ÷ $3,500).

A ratio higher than 30% hurts your credit score, and the lower your credit utilization ratio, the better. There is no credit score penalty for paying off your balances in full! People often think you need to carry credit card debt to have a good credit score. It’s just not true. A net utilization of 0% (if you pay your balances in full every month) is the best ratio to have.

Credit age

Credit age measures the the average length of your total credit history. People who have used credit for longer are presumed to be more experienced and profiecent at managing debt, and therefore are assumed to be more trustworthy. Having older accounts helps here.

This is also why credit experts recommend that you should keep old accounts open. Even if you don’t use an old account regularly, find a way to use it occasionally. This will keep the account active and prevent unintended damage to your credit score.

Types of credit

This is one of the two smallest scoring factors. It looks at the types of debt that you hold. Basically, lenders want to see a good mix of credit cards and loans. You also want to have traditional loans, like mortgages, auto loans, and student debt.

New credit

This factor looks at the number of times you’ve had your credit pulled — your credit score and report has been accessed — within the past six months. Hard credit inquiries are generated whenever a credit check is authorized, such as submitting loan or credit application. Too many inquiries can imply you’re taking on too much debt at once, which doesn’t look good to potential lenders.

Understand How Inquiries Affect Credit Score

Hard inquiries impact credit score when you apply for too many new credit lines at once. Learn which inquiries affect credit score and how to avoid unwanted damage.

Welcome, to the Game of Good Credit. Winning at the Game of Good Credit means taking the right actions to achieve a high score. So, let’s look at how credit inquiries can affect your score.

A credit inquiry happens when you authorize someone to run a credit check. Creditors and lenders run credit checks when you apply for financing. They look at your gameplay history to assess your creditworthiness.

In addition, employers, landlords and even insurance companies can run checks. They review your credit to evaluate risk. Even when you check your credit, it creates an inquiry on your report.

For the most part inquiries have a neutral impact on your credit game – they don’t move you forward or back. You can check your credit as often as you want and it won’t create a negative item or set you back. Employment and insurance related inquiries have a neutral impact, too. And even when a creditor checks your credit to extend a pre-approved offer the effect is neutral. So, while all these inquiries appear on the field, their effects are neutral. That’s why these are referred to as “soft inquiries.”

However, if you apply for a loan or credit card, that creates a “hard inquiry.” One or two hard inquiries within a certain time is fine – the effect on your game is still neutral. But if you have credit applications – one after another – within a six-month period, then it becomes an issue that can set you back from the high score you want.

If you apply for a mortgage or car loan and shop around, each lender runs a credit check when you request a quote. HOWEVER, in this case you don’t get penalized for comparison shopping. All the inquiries get grouped together so the effect is neutral. Just keep in mind that the same thing doesn’t happen with credit cards or other types of loans.

For more information on winning the game of good credit, visit ConsolidatedCredit.org

How to Improve Your Credit Score for Free

Raising your credit score doesn’t require expensive third-party services. In fact, you don’t even need to pay someone at all. Follow these steps (and stick with them), and you’ll be able to build and repair credit yourself.

- Review your credit report to see how many negative items appear that could hurt your score. If you see any negative items that are mistakes, go through credit repair to dispute them. Winning disputes can immediately improve your credit by removing negative items, like missed payments.

- Keep all your accounts open, active and in good standing. This means making all your debt payments on time, making at least one purchase on each credit card every six months, and preventing bills or medical expenses slip into collections.

- Keep credit card balances to a minimum. Never run them up to the limit and try to use no more than 30% of your available credit.

- Only apply for new loans or credit cards when you have a strategic need for them. Try to avoid applying for more than one new account every six months.

Follow these steps diligently and your score will steadily increase. No fancy tricks, no expensive credit monitoring services needed. Just good, old-fashioned legwork.

Infographic

Credit Score Idol

Do you have what it takes to be a credit score superstar? Learn about the five credit score factors that determine credit score and how it’s calculated….

Read moreIf maxed out credit cards are hurting your credit score, we can help. Talk to a certified credit counselor to discuss options for debt consolidation.

How long does it take to raise your credit score?

If you’re starting from a bad score, it usually takes about six months to one year to build credit to a fair score. The length of time depends on your past credit profile. Negative items like bankruptcy or foreclosures are harder to offset with positive actions. Still, even with one of these remarkably bad items, you can still build credit effectively within 24 months.

Going from bad to excellent may take as little as three to five years. So, even if you have a score that’s less than 500 now, with a little work you could achieve a 700 credit score or higher in about 36-60 months. And it’s worth the effort! A better credit score can save hundreds and even thousands of dollars when paying off loans and credit card balances.

Make the Most of Your Credit Score

CreditHaving a good credit score is essential. It makes it easy to get approved for new credit and allows you to borrow money with the best rates and terms. This guide will teach you how credit scores are calculated, what counts as a good score, and what you can do to ensure you maintain the highest score possible.

Open Booklet Download BookletConsolidated Credit has answered several Ask the Expert questions related to credit scoring. Here are some of the top questions we’ve received:

Ask the Expert: Do Credit Scores Merge After Marriage?

What Happens to Your Credit When You Get Married?

Consolidated Credit’s Financial Education Director explains what happens to your credit when you get married. When two people come together, does one person’s bad credit score drag down the other? Watch this video to learn how marriage affects your credit…Read full article >>

[April Lewis-Parks, Consolidated Credit Director of Education] Do credit scores merge after marriage?

[On-screen text] Consolidated Credit Ask the Expert

[Lewis-Parks] When people get married, each person maintains their own individual credit score. So, one score doesn’t impact the other score unless you have joints accounts. Any debt you have before marriage remains separate, unless you add your partner as a cosigner. And debts incurred after you’re married that you hold jointly can affect both spouses’ credit scores.

Common examples of these are mortgages and auto loans. Any missed payments on jointly held debt will damage both spouses’ credit.

[On-screen text] Subscribe to out newsletter for updates & news. Consolidated Credit: When debt is the problem, we are the solution. 1-800-995-0737

Ask the Expert: “Can I have a Credit Score with No Credit Card?”

Can You Have a Credit Score without a Credit Card?

It’s possible to have a credit score without a credit card. This Ask the Expert video explains what types of credit help you build credit history and how to achieve good credit without cards…Read full article >>

Hi, I’m April Lewis-Parks, Director of Education at Consolidated Credit. And we have a consumer question today, and it is, “Can I have a credit score without having a credit card?”

And the answer is yes. If you have any type of financing whatsoever ever extended to you, you probably have a credit score. But that doesn’t mean a credit card. If you have a car loan, a mortgage, student loans you certainly have a credit score. And there’s probably three, because there’s three credit reports and then there’s FICO.

So you should always check your credit score even if you don’t have any credit cards.