Whether it’s a student loan or financing for furniture, you can have a credit score with no credit card.

I’ve always steered clear of credit cards after watching my parents struggle all my life. Up until now, that’s worked for me. But now I want to buy a house and I’m worried the lack of credit will mean I can’t get approved. Since I’ve never had a credit card, do I even have a credit score to assess? If not, what can I do?

Chantelle R. in Baton Rouge, LA

What Makes Up Your Credit Score If You Have No Credit Cards?

Consolidated Credit’s Financial Education Director April Lewis-Parks explains how credit scoring models apply when a consumer doesn’t use credit cards. Learn what impacts your credit score besides the plastic in your wallet.

Hi, I’m April Lewis-Parks, Director of Education at Consolidated Credit. And we have a consumer question today, and it is, “Can I have a credit score without having a credit card?”

And the answer is yes. If you have any type of financing whatsoever ever extended to you, you probably have a credit score. But that doesn’t mean a credit card. If you have a car loan, a mortgage, student loans you certainly have a credit score. And there’s probably three, because there are three credit reports and then there’s FICO.

So you should always check your credit score even if you don’t have any credit cards.

Other ways to generate a credit score without a credit card

As Education Director April Lewis-Parks explained in the video, having a credit score without a credit card is possible. Any of the following actions or events would create a credit history that translates into your score:

- You took out student loans to get through college, even federal student loans that didn’t require a credit check

- If you’ve ever financed a car with an auto loan

- Personal loans through a traditional bank also count

- Financing furniture or electronic purchases on store credit

- You received a court judgment that requires payments, such as alimony or child support

- If you’ve had any type of account – including service contracts for smartphones – go into collections

Basically, any loan, civil court judgment, or collection account creates a credit history. This is the basis of the information used to build your credit report. Then, your credit score is calculated based on the information in that report.

Steps to take if you have limited credit history

It’s important to note that simply having a credit score isn’t a sign you can get approved. Bad credit can is just as hard to overcome as no credit. Either may present challenges on major financing approvals, like what you get when you apply for a mortgage.

With that in mind, if you have only ever had one loan and had trouble with repayment, or you’ve had several service accounts slip into collections, then your credit score may be problematic for future loan and credit approvals. What limited credit history you have to generate a score would be negative.

In this case – or even in the case that you’ve never had any credit at all and really have no credit score – you should take the following steps:

Step 1: Know where you stand

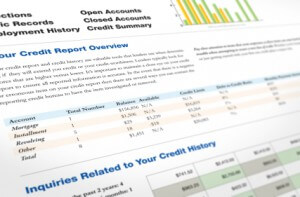

Go to annualcreditreport.com to download a free copy of your credit report. You will be able to get a copy of each report you have from TransUnion, Experian, and Equifax. Those are the three main credit bureaus and they each maintain their own version of your credit profile. This website allows you to download your reports for free, without strings attached. Currently, you can download your free credit reports every week.

This allows you to check your credit to see where you stand. You may believe you have no credit score when, in fact, you have generated a history at some point. So check the government-authorized report download website to make sure you really don’t have a report.

Step 2: Start small to build credit

Smaller financing will be easier to get approved for. This includes opening a secured credit card or applying for a small traditional loan. Both of these will give you a small credit line to repay so you can build a positive credit history.

In most cases, a secured credit card will be the easiest to get approved for, even with no credit history. You simply need a small cash deposit to open a credit line of equal value. If you deposit $200, then you have a credit line of $200. Just ensure you’re applying for a secure credit card, not a prepaid one. The former allows you to build credit; the latter functions more like a debit card and doesn’t build credit history.

If you have an aversion to credit cards, try a small personal loan. Make sure to go for a traditional loan, where you apply and they review your credit. No credit check loans, such as payday loans, typically have high interest rates and finance charges. They’re expensive and, in many cases, bad for your finances.

Step 3: Build your credit history for 6 months

Whatever type of credit you choose, pay it off responsibly for at least six months. Make sure to make all of your payments on time. If you have a secured credit card, try to pay off the balance in full every month.

After roughly six months to a year, you should have enough credit history to qualify for other financing. If you want to apply for large-scale financing such as a mortgage, you may wish to consult with a credit counselor or housing counselor. These experts can help analyze your credit and make recommendations to help you get the approval you want.

Additional Resources

If you need help building credit, Consolidated Credit offers the following free resources: