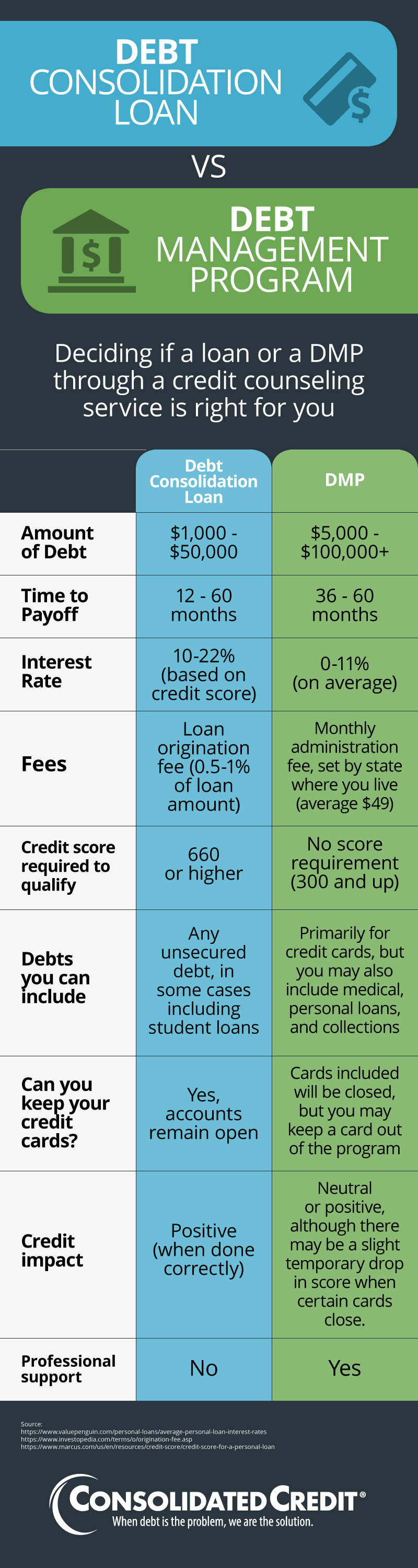

Debt Consolidation Loans vs Debt Management through Credit Counseling

Both options consolidate debt. The best choice depends on your situation.

When high-interest rates make it impossible to pay off debt efficiently, debt consolidation offers a faster, easier way out. You combine multiple bills into one affordable monthly payment at the lowest interest rate possible. Thus, you can get out of debt faster because you’re not wasting money covering interest charges every month.

But there’s more than one way to consolidate. So, which method is the right one for you?

The most popular option doesn’t work for most people

Debt consolidation loans are, by far, the most popular and well-known way to consolidate debt. You take out a low-interest rate personal loan and use the funds to pay off your credit cards and other debts.

On the surface, it sounds like the perfect solution. You can get out of debt on your own, keep your credit cards, and save a bunch of money. When it works, it’s ideal.

However, the reality is that it doesn’t work for most people. There are two reasons why…