Maryland Debt Relief Guide

A new report titled “States With the Largest and Smallest Credit Card Debt Increases” ranks Maryland No. 16. The average Maryland household owes $12,493, a $318 jump in only three months.

The individual household data shows a microscopic representation of the entire state. In total, Maryland residents owe credit card companies $26,414,219,402.

“The economy in Maryland benefits from its proximity to Washington, DC.” says Gary Herman, President of Consolidated Credit, “But inflation, rising housing costs, and other factors are challenging to your wallet. In a situation like that, you need to keep credit card debt under tight control.”

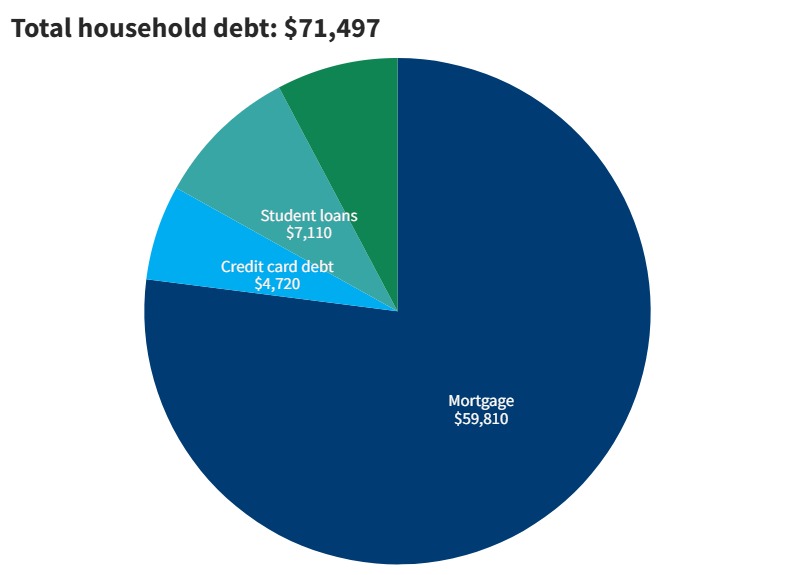

Consumer debt in Maryland

This chart shows a breakdown of average consumer debt in Maryland, based on the latest report of Household Debt report from the Federal Reserve.

In 2023, 9,610 Maryland residents filed for bankruptcy.

Income and employment in Maryland

Maryland has the second-highest median household income of any state or territory, after the District of Columbia.

According to the latest data from the Census, Maryland has an average per capita income of $49,865 and an average median household income of $98,461. The minimum wage of $15 per hour is well above the nationwide minimum wage of $7.25 per hour.

Industry

Maryland is not a right-to-work state. If there is a union at a workplace, the worker must pay union dues regardless of whether they are a union member

Biopharma & Life sciences, Federal Government, Cybersecurity & IT, Manufacturing, and Logistics are some of the key industries in the “Free State.”

The state is a frontrunner in health sciences and is home to the NIH (National Institutes of Health) and the Biological Defence Center located at Fort Detrick. Manufacturing of advanced equipment used in aerospace and medical concerns also provides well-paying jobs.

Additionally, logistics (transporting goods) is a significant industry in Maryland, with hubs for FedEx, Amazon, CSX, and many more. Logistics offers many well-paying entry-level jobs. Maryland’s location is within a one-day shipping window for 1/3 of the country, including Chicago, Boston, and Atlanta.

Finally, while shipbuilding is not what it once was, the marine industry still thrives in Maryland. Companies such as Chesapeake Shipbuilding continue to build riverboats and tugboats, and the Chesapeake Bay Maritime Museum still teaches the art of building wooden boats.

Unemployment

If you are unemployed in Maryland, you can get unemployment coverage for up to 26 weeks. The maximum each week is $430, and the minimum is $50.

Apply for unemployment benefits in Maryland »

Banking and taxes in Maryland

Maryland residents have an adjustable income tax of 2-5.75% and a sales tax of 6%. Maryland residents enjoy an extended tax holiday that lasts an entire week! The weeklong holiday extends from the Second Sunday in August until the following Saturday. Tax-free items include school uniforms, backpacks used for school, baby supplies, and other practical items.

According to Bank on Maryland, 22% of residents are unbanked or underbanked, and contribute to the 50 million people who are underbanked in the United States.

Maryland was one of the first states to tax Software-as-a-service (SaaS). An example of a SaaS is Microsoft Office 365, where you don’t buy the product but pay a monthly subscription fee.

Maryland housing market

Throughout 2024 the housing market in Maryland has remained competitive. While prices have continued to rise, fewer units are selling. This may indicate a peak in the housing market for the state

But Maryland is a tale of many states, the affluent eastern half, Baltimore, and the rural west.

The rural west is losing population and hoping to become a part of West Virginia.[5] However, it does have more affordable properties.

Baltimore sees a lot of demand, and areas of the city are undergoing renovation. Many homes that were boarded up are being purchased and restored, which has led to some neighborhoods being revitalized. New residents may help repopulate the city, lower the high poverty rate, and provide needed jobs to inner-city areas.

Because of its proximity, easy access to Washington, DC, and relatively lower pricing, many government workers from the District of Columbia live in Baltimore.

Consolidated Credit Helps Maryland Residents Reduce Their Total Credit Card Payments by Up to 50%

Retirement in Maryland

Maryland is a challenging place to retire. While Maryland has fantastic cultural offerings and a rich and tolerant history, taxes and living costs are high. You are taxed on your IRA distributions in Maryland, but 401(k) distributions are exempt. Social Security income is not taxed. A public pension is partially taxed, but a private pension is fully taxed. Maryland is also the only state with both an estate and an inheritance tax.

The average annual cost of living after retirement for Maryland residents is $64,707. Most elderly households rely on Social Security for at least 90% of their income. The average age for retirement is 65.

Average Maryland insurance premiums

Maryland is a great state for all types of insurance, which is priced at the national average or below it.

The average driver has a full coverage premium of $2,609 per year in Maryland, on par with the nationwide average.

Homeowners insurance rates are below the national average. The average Maryland homeowner’s insurance premium is $1,537 per year.

The average cost of health insurance in Maryland is $7,007 per person.

Helpful resources for Maryland residents facing hardship

Food insecurity

| Region | Food Bank | Phone Number | Address |

|---|---|---|---|

| Baltimore | Maryland Food Bank | 410.737.8282 | 2200 Halethorpe Farms Road, Baltimore, MD 21227 |

| Baltimore | Community Assistance Network, Inc. – Food Distribution Center | 410.285.4674 | 7900 E. Baltimore Street Baltimore, MD 21224 |

| Capital Region | Manna Food Center | 301.424.1130 | Gaithersburg 2 Teachers Way Gaithersburg, MD 20877 Germantown 20021 Aircraft Drive Germantown, MD 20874 Silver Spring 12301 Old Columbia Pike Silver Spring, MD 20904 |

| Capital Region | The Bowie Interfaith Pantry and Emergency Aid Fund | 301.262.6765 | 2614 Kenhill Drive, Suite 134 Bowie, MD 20715 |

| Capital Region | Laurel Church of Christ Pantry – Food Distribution Center | 301.490.0777 | Laurel Church of Christ 7111 Cherry Lane Laurel, MD 20707 |

| Capital Region | Fort Washington Food Pantry – Food Distribution Center | 301.248.4290 | 9801 Livingston Road Fort Washington MD 20744 |

| Central Region | Howard County Food Bank | 410.313.6185 | 9385 Gerwig Lane, Suite J Columbia, MD 21046 |

| Central Region | Elkridge Food Pantry | 443.492.9209 | 5646 Furnace Avenue Elkridge, MD 21075 |

| Central Region | Thurmont Food Bank | 240.288.1865 | 10 Frederick Road Thurmont, MD 21788 |

| Southern Region | ICAC-Oxon Hill Food Pantry | 301.899.8358 | Saviour’s Lutheran Church 4915 Saint Barnabas Road, Temple Hills, MD |

| Southern Region | Anne Arundel County Food Bank | 410.923.4255 | 120 Marbury Drive Crownsville, MD 21032 |

| Western Region | City of Frederick Maryland Food Bank | 301.600.3972 | 14 E All Saints Street Frederick, MD 21701 |

Veterans

As of 2023, Maryland is home to 348,459 Veterans. These resources are available to help Veterans that are facing unemployment, homelessness, and other hardships.

Maryland Department of Veterans Affairs

National crisis hotline: (800) 273-8255

Maryland Veterans Support Line: 877-770-4801

Headquarters:

16 Francis St #4

Annapolis, MD 21401

410 260 3838

Find a Veteran service office in your area »

Helpful employment resources for Veterans:

- CareerOneStop

- VeteranRecruiting.com

- Helmets to Hardhats

- Hiring Our Heroes

- My Next Move

- Warriors to Work

How Consolidated Credit helps Maryland residents find debt relief

In 2024, Consolidated Credit provided free credit counseling services to 3,958 residents of Maryland. Of those, 208 went on to consolidate their debt with our help through a debt management program (the average amount of debt enrolled was $13,511). The others received a free debt analysis and complementary budget evaluation, and they were directed to the right solution for their situation to get out of debt as quickly as possible.

We’d also like to congratulate the 196 Maryland residents that got debt-free last year with the help of Consolidated Credit!

Relief options to consider if you’re in debt in Maryland

A debt consolidation loan is an unsecured personal loan that you get to pay off credit cards and other existing debts. You need good credit to qualify for the lowest interest rate possible. That low rate helps lower your total payments so you can get out of debt faster, even though you may pay less each month. So, this is a good solution for Maryland residents with a high credit score.

A home equity loan or home equity loan of credit (HELOC) is a debt solution that’s only available to Maryland homeowners. If you have equity available in your home, you can borrow against that equity and use the funds to pay off your debt. However, this can be a risky option for paying off credit card debt if you are living paycheck-to-paycheck. Home equity lending products put Maryland residents at risk of foreclosure if they can’t make the payments. If you are considering borrowing against your home, call 1-800-435-2261 to speak with a HUD-certified housing counselor to make sure this is a safe option for you.

Nonprofit credit counseling services like those provided by Consolidated Credit help Maryland residents identify the best solution for getting out of debt. This is a free service. Maryland residents can get a confidential debt and budget evaluation from a certified credit counselor. Then the counselor will explain options that are available to each person and recommend the best course of action based on an individual’s needs and goals.

If a Maryland consumer cannot get out of debt effectively on their own but has the ability to repay everything they owe to avoid bankruptcy, a debt management program is often the best solution. You enroll in the program through a credit counseling organization. They help you find a monthly payment you can afford and then work with your creditors to reduce or eliminate interest. Qualifying Maryland residents can get out of debt in 36-60 payments.

Debt settlement allows Maryland residents to get out of debt for a percentage of what they owe. You can settle debt on your own and negotiate with individual creditors and collectors or enroll in a debt settlement program to get professional help. This does cause credit damage. Each debt settled will be noted on your credit report for seven years from the date the account first became delinquent. However, it can be a viable debt relief option for avoiding bankruptcy when you are completely overwhelmed with debt.

If you’re curious how we can help you, below you will find a few case studies from clients that we’ve helped in Maryland. If you’re facing challenges with debt, call us at (844) 276-1544 to receive a free debt and budget evaluation from a certified credit counselor.

Ready to solve your problems with debt? Talk to a certified credit counselor for free to find the best way to get out of debt for you.

Want to know if Consolidated Credit can help you, too? Get a free, confidential debt and budget analysis now.