Debt Relief North Dakota

Residents use credit counseling to maintain stability and achieve success.

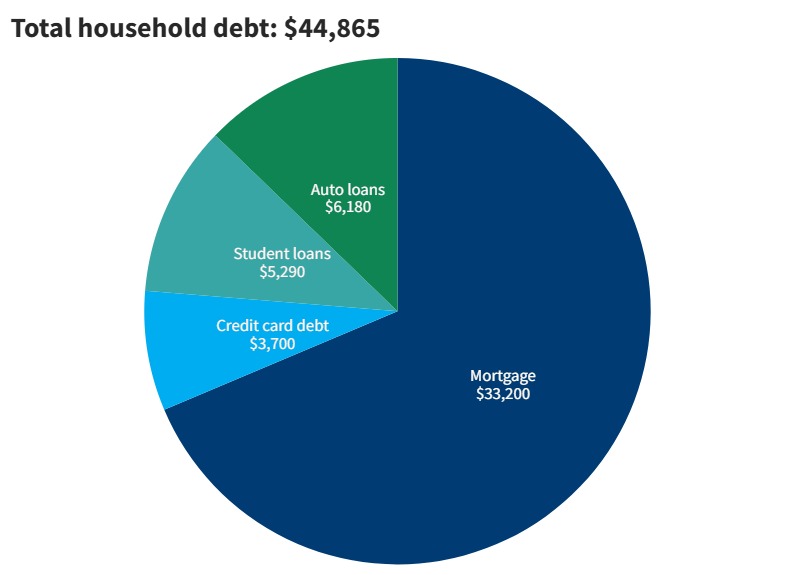

North Dakotans enjoy some of the lowest personal debt levels in the country. That’s not to say North Dakotans don’t face challenges, but they’re highly proactive about finding solutions when issues arise. Still, North Dakota households owe an average of $9,105, and the entire state has a total of $2,657,781,684 in credit card debt.

The information below can help you understand how state residents are currently being impacted by debt, as well as a case study showing how one of your neighbors achieved freedom from debt with the help of credit counseling. If you’re facing your own challenges with debt, call Consolidated Credit today at (866) 406-0921 or complete our online application to request a free debt and budget analysis from a certified credit counselor. You can explore your options and get professional assistance in identifying the right solutions for your situation.