Debt Relief Ohio

See how other Ohio residents are meeting challenges with debt head-on.

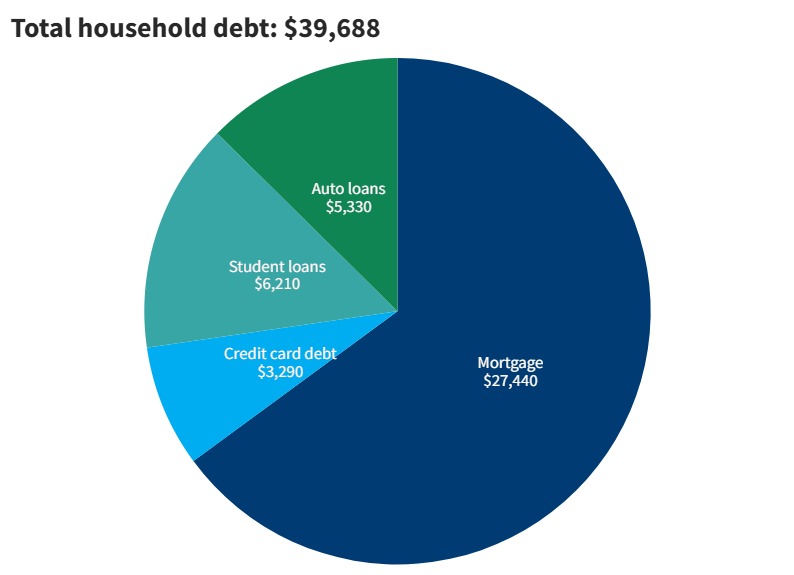

Credit card debt problems aren’t unique to Ohioans, but the financial environment for neighbors is often similar enough that it’s worth taking a look at how debt impacts people where you live. It can also be helpful to look at what they’ve done to regain control and see the success they’ve had to inspire your own journey. The average Ohio household has $9,116 in credit card debt, and the entire state has a total of $39,820,083,569.

That’s why we’ve created this page to help you understand how debt is affecting people in Ohio and what they’ve done to overcome those challenges. If you’re struggling with debt, call us today at (866) 582-6953 to request help now.