Debt Relief Oregon

More than $24.8 million in debt resolved.

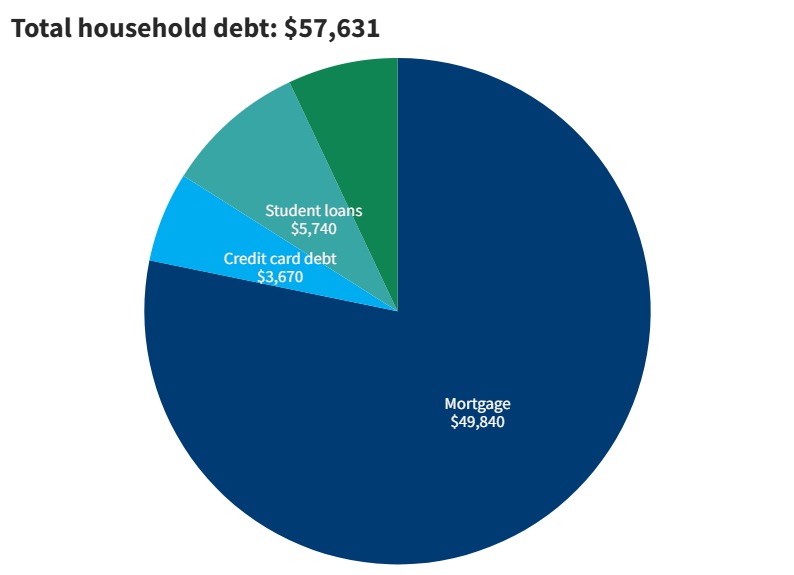

Oregonians have an interesting relationship with personal debt. They have lower student loan balances and fewer underwater mortgages than national averages, but higher delinquency and default rates than people in other parts of the country.

But many residents have found ways to overcome these challenges. In many cases, debt consolidation through a credit counseling agency has provided a means for residents to regain control. The information below can help you understand how debt currently impacts residents and how some have regained stability through credit counseling. If you need help finding a path forward, call us at (833) 868-3776 or fill out an online application to request a free and confidential debt analysis from a certified credit counselor today.