Debt Relief in Action: Rhode Island

Finding debt relief in spite of high debt levels across the board.

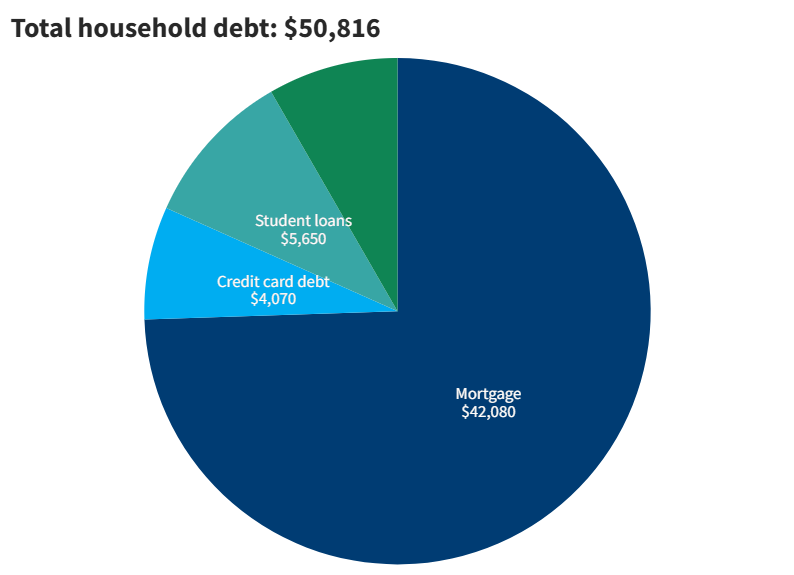

Rhode Island may be the smallest state in the union, but it’s a big player when it comes to personal debt. Residents rank high amongst the states with the most credit card debt. Borrowers also have notably higher student debt levels than what we see in other parts of the country. Even credit card and mortgage delinquency rates are higher than national averages.

In spite of these challenges, residents are finding ways to achieve the stability that fosters financial success. Many have used credit counseling services to explore and identify the right combination of solutions they need to regain their financial control. If you’re facing challenges with debt that you can’t overcome on your own, we can help. Call Consolidated Credit at (888) 293-0376 or send in an online application to request a free debt analysis from a certified credit counselor.